AUC Score :

Short-term Tactic1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Deductive Inference (ML)

Hypothesis Testing : Chi-Square

Surveillance : Major exchange and OTC

1Short-term revised.

2Time series is updated based on short-term trends.

Key Points

CPI is expected to continue its growth trajectory, driven by robust infrastructure spending and an increasing demand for its asphalt paving and construction services. Potential risks include rising material costs, particularly for asphalt and aggregate, which could pressure profit margins, and labor shortages in the construction sector that may hinder project completion timelines and increase wage expenses. Furthermore, a slowdown in residential or commercial construction in key markets, though less directly impactful than infrastructure, could represent a secondary risk. However, CPI's established market position and its focus on essential infrastructure projects provide a strong foundation for sustained performance.About Construction Partners

This exclusive content is only available to premium users.

ML Model Testing

n:Time series to forecast

p:Price signals of Construction Partners stock

j:Nash equilibria (Neural Network)

k:Dominated move of Construction Partners stock holders

a:Best response for Construction Partners target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

Construction Partners Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

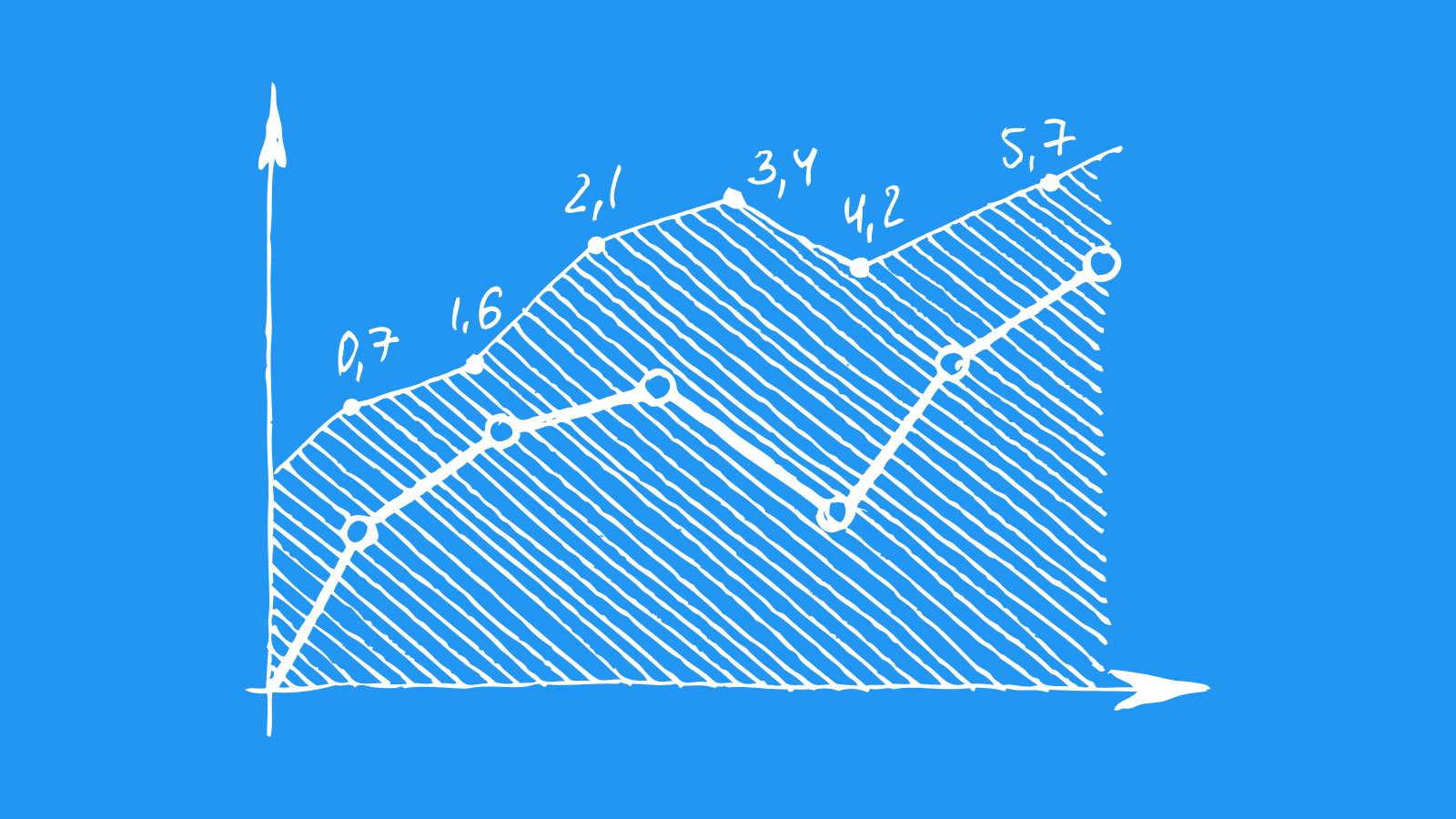

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | B2 | B1 |

| Income Statement | B2 | B2 |

| Balance Sheet | Caa2 | Baa2 |

| Leverage Ratios | Caa2 | Baa2 |

| Cash Flow | Baa2 | C |

| Rates of Return and Profitability | B3 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Breiman L, Friedman J, Stone CJ, Olshen RA. 1984. Classification and Regression Trees. Boca Raton, FL: CRC Press

- Armstrong, J. S. M. C. Grohman (1972), "A comparative study of methods for long-range market forecasting," Management Science, 19, 211–221.

- L. Prashanth and M. Ghavamzadeh. Actor-critic algorithms for risk-sensitive MDPs. In Proceedings of Advances in Neural Information Processing Systems 26, pages 252–260, 2013.

- V. Borkar. Q-learning for risk-sensitive control. Mathematics of Operations Research, 27:294–311, 2002.

- Byron, R. P. O. Ashenfelter (1995), "Predicting the quality of an unborn grange," Economic Record, 71, 40–53.

- Ruiz FJ, Athey S, Blei DM. 2017. SHOPPER: a probabilistic model of consumer choice with substitutes and complements. arXiv:1711.03560 [stat.ML]

- B. Derfer, N. Goodyear, K. Hung, C. Matthews, G. Paoni, K. Rollins, R. Rose, M. Seaman, and J. Wiles. Online marketing platform, August 17 2007. US Patent App. 11/893,765