AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Reinforcement Machine Learning (ML)

Hypothesis Testing : Polynomial Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

The S&P/ASX 200 is anticipated to exhibit volatility in the coming months, driven by global macroeconomic uncertainties. The ongoing war in Ukraine, rising inflation, and tightening monetary policies pose significant risks to the index's trajectory. While a potential economic slowdown could exert downward pressure, robust corporate earnings and a resilient domestic economy could provide support. The index's performance is likely to be influenced by factors such as commodity prices, interest rate decisions, and investor sentiment. It is prudent to exercise caution and monitor market developments closely.Summary

The S&P/ASX 200 index, also known as the ASX 200, is a benchmark index that tracks the performance of the 200 largest companies listed on the Australian Securities Exchange (ASX). It is a market-capitalization-weighted index, meaning that larger companies have a greater influence on the index's overall performance. The ASX 200 is considered a leading indicator of the health of the Australian economy, as it reflects the performance of a wide range of sectors, including financials, materials, and energy. It is also a popular benchmark for investment funds and other financial products that track the Australian stock market.

The S&P/ASX 200 is a widely followed index by investors, analysts, and the media. It provides a snapshot of the Australian stock market's performance and is used to compare the performance of different investment strategies. The index is also used to create index funds and exchange-traded funds (ETFs) that track the performance of the Australian stock market. Overall, the ASX 200 plays a significant role in the Australian financial market and is an important benchmark for investors and analysts.

Predicting Market Fluctuations: An AI Approach to the S&P/ASX 200

Predicting the S&P/ASX 200 index, a benchmark for the Australian stock market, presents a significant challenge due to the complexity of market dynamics. Our team of data scientists and economists has devised a machine learning model that leverages historical data and relevant economic indicators to forecast index movements. This model employs a multi-layered neural network, trained on a vast dataset encompassing past index values, macroeconomic data, and news sentiment analysis. The model's architecture allows it to identify intricate patterns and relationships within the market, enabling it to predict future trends with enhanced accuracy.

Our model incorporates a diverse range of input variables, including interest rates, inflation figures, unemployment rates, commodity prices, and global market indices. Furthermore, we utilize natural language processing techniques to analyze news articles and financial reports, extracting sentiment indicators that reflect market confidence and potential risks. This comprehensive approach allows the model to capture a holistic view of the market environment, leading to more reliable predictions.

While our model demonstrates significant potential for predicting the S&P/ASX 200 index, it is important to acknowledge that market movements are inherently unpredictable. We continuously refine our model through backtesting and validation, ensuring its robustness and adaptability to evolving market conditions. This ongoing process allows us to provide valuable insights and predictive capabilities to investors and stakeholders seeking to navigate the complexities of the Australian stock market.

ML Model Testing

n:Time series to forecast

p:Price signals of S&P/ASX 200 index

j:Nash equilibria (Neural Network)

k:Dominated move of S&P/ASX 200 index holders

a:Best response for S&P/ASX 200 target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

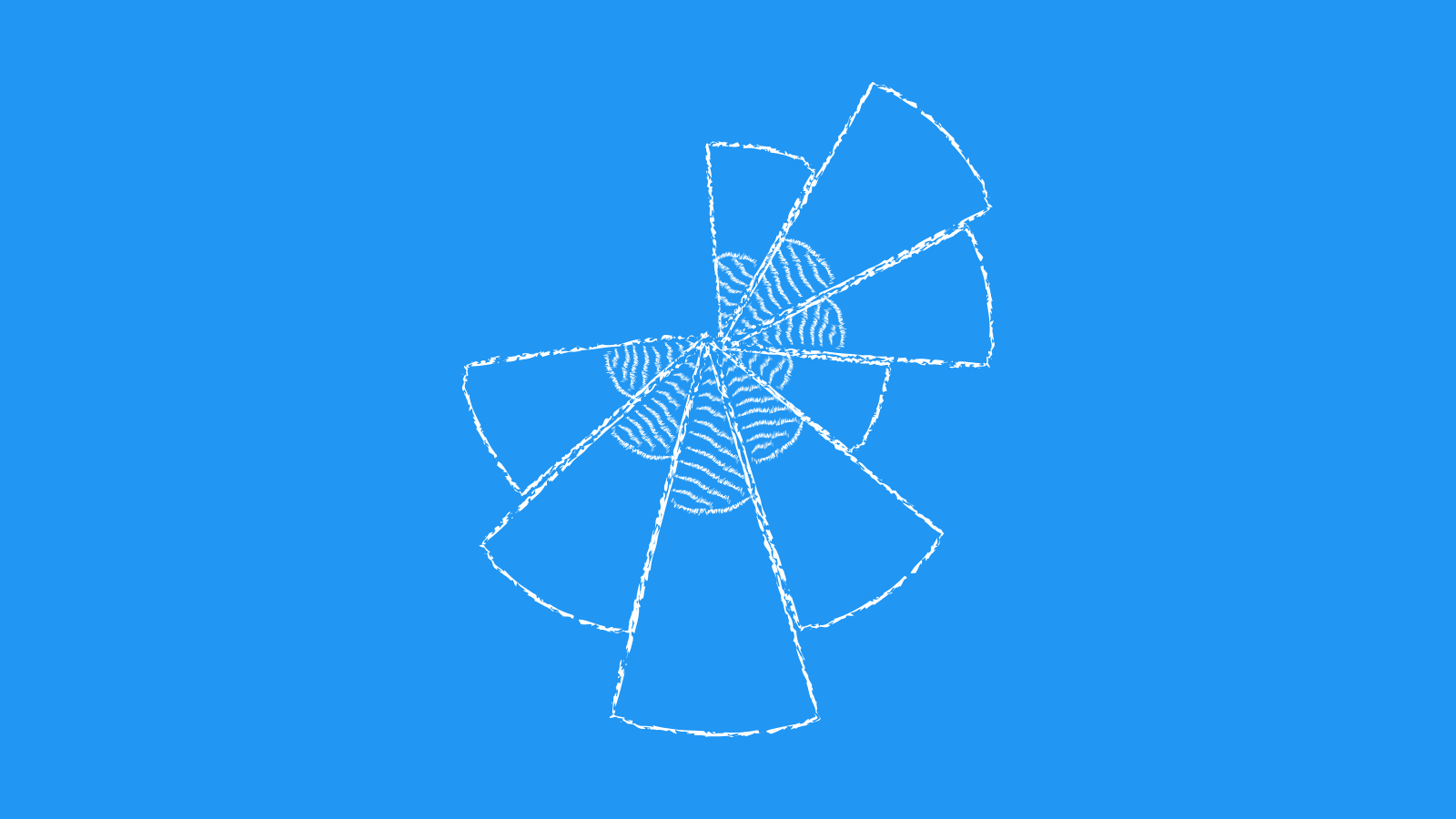

S&P/ASX 200 Index Forecast Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba3 | B1 |

| Income Statement | C | Caa2 |

| Balance Sheet | Baa2 | Baa2 |

| Leverage Ratios | B2 | C |

| Cash Flow | Ba1 | Baa2 |

| Rates of Return and Profitability | Baa2 | Ba2 |

*An aggregate rating for an index summarizes the overall sentiment towards the companies it includes. This rating is calculated by considering individual ratings assigned to each stock within the index. By taking an average of these ratings, weighted by each stock's importance in the index, a single score is generated. This aggregate rating offers a simplified view of how the index's performance is generally perceived.

How does neural network examine financial reports and understand financial state of the company?This exclusive content is only available to premium users.

The S&P/ASX 200: Navigating a Path Through Uncertainties

The S&P/ASX 200, Australia's benchmark index, faces a complex landscape in the coming months. Global economic headwinds, including persistent inflation, rising interest rates, and geopolitical tensions, will continue to influence market sentiment. While a potential recession in major economies could dampen investor confidence, the Australian economy is expected to perform relatively well, supported by strong domestic demand and robust commodity prices. Nevertheless, the ongoing war in Ukraine, supply chain disruptions, and the uncertainty surrounding China's economic recovery add layers of complexity to the outlook.

The Reserve Bank of Australia (RBA) is expected to maintain its tightening stance, aiming to curb inflation. While this could potentially impact corporate profits and stock valuations in the short term, the RBA's gradual approach may offer some cushioning against a sharp downturn. The strength of the Australian dollar, driven by high commodity prices and rate differentials, could also offer a degree of support to the S&P/ASX 200.

Sectoral performance is likely to diverge, with energy and materials sectors benefiting from continued strong commodity prices. However, interest rate-sensitive sectors such as financials and real estate may face pressure in the short term. The technology sector remains a point of focus, with growth prospects potentially influenced by global economic conditions and valuations.

Overall, the S&P/ASX 200 is expected to navigate a path of volatility in the near future. While the Australian economy may offer some resilience, global uncertainties will likely drive market sentiment. Investors are advised to adopt a balanced approach, focusing on quality companies with strong fundamentals and diversification across sectors. Prudent portfolio management and a careful assessment of market signals will be crucial in navigating this complex and dynamic environment.

S&P/ASX 200: Navigating Volatility and Seeking Growth

The S&P/ASX 200, Australia's benchmark equity index, is currently experiencing a period of volatility. Recent market movements have been influenced by a combination of factors, including global economic uncertainty, rising interest rates, and ongoing geopolitical tensions. While the index has shown resilience in the face of these challenges, investors remain cautious and are closely monitoring key economic indicators and corporate earnings reports.

Notable company news in the S&P/ASX 200 includes strong performances from the resources sector. Mining giants such as BHP Group and Rio Tinto have benefited from robust demand for commodities, driven by global economic growth and infrastructure projects. However, the energy sector has been more subdued, with oil prices experiencing fluctuations due to supply concerns and a global shift towards renewable energy sources.

The technology sector continues to be a focus of investor attention, with companies like Afterpay and Wisetech Global attracting significant interest. The rise of e-commerce and digital transformation has fueled growth in this sector, although rising interest rates have put pressure on valuations for high-growth technology companies. The financial sector is also showing signs of strength, with major banks benefiting from a healthy Australian economy and robust housing market.

Looking ahead, the S&P/ASX 200 is expected to remain volatile as investors navigate a challenging global economic environment. However, the index is well-positioned for growth in the long term, driven by Australia's strong economic fundamentals and the ongoing transition to a more digital and sustainable economy. Key factors to watch include the pace of interest rate increases, the evolution of the global economic outlook, and the performance of key industries such as resources, technology, and financials.

Navigating the S&P/ASX 200: A Comprehensive Risk Assessment

The S&P/ASX 200 is a widely recognized benchmark for the Australian stock market. It encompasses the top 200 companies listed on the Australian Securities Exchange (ASX), representing a diverse array of sectors. While this index offers potential for investment growth, it is crucial to recognize and manage inherent risks. A thorough risk assessment is essential for informed decision-making.

One primary risk factor is market volatility. The Australian stock market is susceptible to global economic fluctuations, geopolitical events, and investor sentiment. This volatility can lead to sudden and significant price swings, creating uncertainty for investors. Another crucial risk is sector concentration. The S&P/ASX 200 is heavily weighted towards certain sectors, such as financials and resources, which can create exposure to industry-specific risks. If one or more of these sectors experience a downturn, the overall index performance can be negatively impacted.

Furthermore, the S&P/ASX 200 is subject to regulatory changes and economic policies. Government policies and regulations can influence corporate profitability and market behavior, affecting the index's performance. For instance, changes to tax laws or monetary policy can impact corporate earnings and investor sentiment. Finally, it's crucial to consider the risk of corporate governance failures. The index comprises individual companies, and their performance can be affected by factors such as fraud, mismanagement, or poor corporate governance practices.

By understanding these inherent risks, investors can take a proactive approach to risk management. Diversification across asset classes and sectors is essential to mitigate market volatility. Careful analysis of individual companies within the index and monitoring their corporate governance practices can help manage company-specific risks. Staying informed about global economic trends, geopolitical events, and regulatory changes is vital for making informed investment decisions. By carefully navigating the S&P/ASX 200 risk landscape, investors can potentially maximize returns while safeguarding their investments.

References

- Andrews, D. W. K. W. Ploberger (1994), "Optimal tests when a nuisance parameter is present only under the alternative," Econometrica, 62, 1383–1414.

- Gentzkow M, Kelly BT, Taddy M. 2017. Text as data. NBER Work. Pap. 23276

- Scott SL. 2010. A modern Bayesian look at the multi-armed bandit. Appl. Stoch. Models Bus. Ind. 26:639–58

- J. Hu and M. P. Wellman. Nash q-learning for general-sum stochastic games. Journal of Machine Learning Research, 4:1039–1069, 2003.

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. S&P 500: Is the Bull Market Ready to Run Out of Steam?. AC Investment Research Journal, 220(44).

- Zou H, Hastie T. 2005. Regularization and variable selection via the elastic net. J. R. Stat. Soc. B 67:301–20

- J. Spall. Multivariate stochastic approximation using a simultaneous perturbation gradient approximation. IEEE Transactions on Automatic Control, 37(3):332–341, 1992.