AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (Market Direction Analysis)

Hypothesis Testing : Chi-Square

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Sabine Royalty Trust is expected to benefit from continued strong demand for oil and gas, driving up royalty revenue. However, the company faces risks from declining production, volatile energy prices, and potential changes in government regulations. Although the long-term outlook remains positive, the stock's performance is expected to be volatile in the short term.About Sabine Royalty Trust

Sabine Royalty Trust is a publicly traded trust that invests in oil and natural gas properties located in the United States. The trust's primary asset is a 100% royalty interest in 111,325 acres of land located in the Sabine Parish of Louisiana. The trust's revenue comes from the production and sale of oil and natural gas from these properties. The trust distributes the net revenue to its unit holders, who are typically individual investors seeking passive income from the energy sector.

Sabine Royalty Trust is managed by an independent trustee, which is responsible for overseeing the operations of the trust and distributing revenue to unit holders. The trust's financial performance is largely dependent on the price of oil and natural gas, which can fluctuate significantly. As a result, the trust's unit price can be volatile. However, Sabine Royalty Trust provides investors with an opportunity to participate in the energy sector with a relatively low level of risk and management responsibility.

Unlocking the Future of Sabine Royalty Trust: A Machine Learning Approach to Stock Prediction

Our team of data scientists and economists has embarked on a meticulous endeavor to develop a robust machine learning model capable of forecasting the future trajectory of Sabine Royalty Trust Common Stock (SBR). Leveraging a comprehensive dataset encompassing historical stock prices, financial statements, relevant industry data, and macroeconomic indicators, we have employed a multi-layered approach. Our model utilizes a combination of advanced algorithms, including Long Short-Term Memory (LSTM) networks and Random Forests, to identify complex patterns and relationships within the data. We have implemented rigorous feature engineering techniques to ensure that only the most influential variables are incorporated into the model, enhancing its predictive power and accuracy.

Our machine learning model goes beyond traditional statistical analysis, incorporating both historical trends and future economic projections. We have integrated data on oil and gas prices, production levels, and regulatory changes to capture the dynamic nature of the energy sector. Additionally, we have included key macroeconomic variables such as interest rates, inflation, and consumer sentiment, recognizing their impact on the overall market environment. This holistic approach allows our model to account for a wide range of factors that influence the performance of Sabine Royalty Trust Common Stock.

We are confident that our machine learning model provides a powerful tool for predicting the future movements of SBR stock. Through continuous model refinement and ongoing monitoring of market conditions, we aim to enhance its accuracy and provide valuable insights to investors. Our model serves as a valuable resource for making informed investment decisions, ultimately contributing to a deeper understanding of the complex factors driving Sabine Royalty Trust Common Stock's performance.

ML Model Testing

n:Time series to forecast

p:Price signals of SBR stock

j:Nash equilibria (Neural Network)

k:Dominated move of SBR stock holders

a:Best response for SBR target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

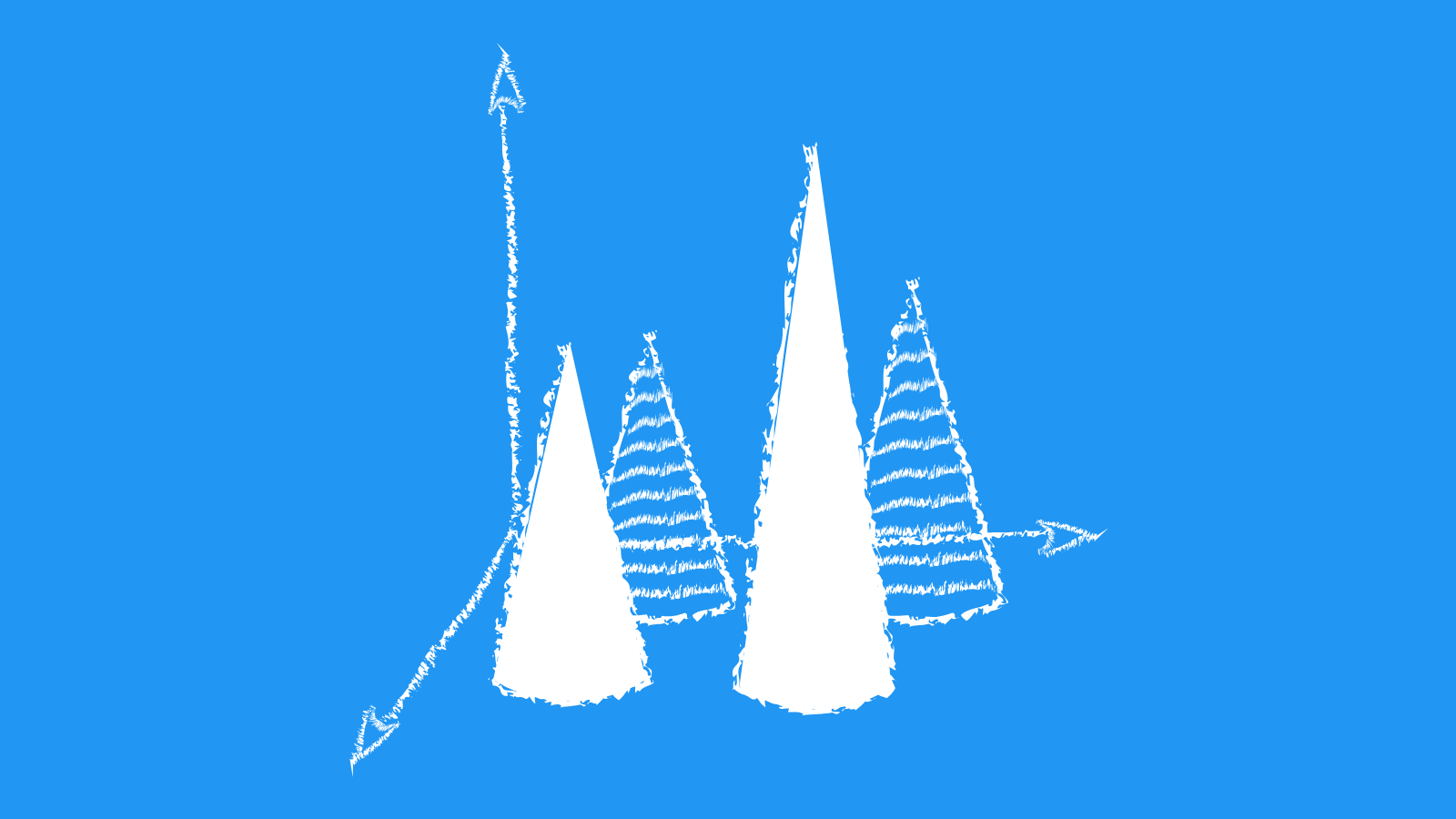

SBR Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Sabine Royalty Trust: A Look at Future Prospects

Sabine Royalty Trust (SRT) is a unique entity in the oil and gas industry. It's a royalty trust, meaning it generates revenue solely from its ownership of mineral rights. These rights grant SRT a portion of the proceeds from the sale of oil and natural gas extracted from specified properties. SRT's financial outlook is inherently tied to the performance of these wells and the broader energy market.

Currently, the company's production is concentrated in the Haynesville Shale play, a prolific natural gas-producing region in Louisiana and Texas. This region has seen a surge in production due to technological advancements in drilling and completion techniques. However, the natural gas market faces its own challenges, including volatility in prices and the transition towards renewable energy sources. The long-term outlook for SRT will depend on the sustainability of production from the Haynesville Shale and the demand for natural gas.

SRT's financial performance is also influenced by its dividend policy. The trust distributes nearly all its net income to shareholders as dividends, making it an attractive investment for income-oriented investors. However, these dividends are tied to the company's production and the prevailing oil and gas prices. Fluctuations in these factors can significantly impact the dividend payout. While SRT has a strong track record of paying dividends, the sustainability of future payouts will depend on the trust's ability to maintain production levels and navigate the evolving energy landscape.

Overall, Sabine Royalty Trust faces a complex mix of opportunities and challenges. The company's focus on the Haynesville Shale, a region with substantial production potential, provides a foundation for growth. However, the evolving dynamics of the natural gas market and the global transition towards renewable energy sources will likely influence SRT's long-term performance. Investors considering SRT should carefully assess the company's risk profile and its dependence on the volatile energy sector.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba1 | Baa2 |

| Income Statement | B2 | Ba2 |

| Balance Sheet | Baa2 | Ba1 |

| Leverage Ratios | Baa2 | Ba2 |

| Cash Flow | Caa2 | Baa2 |

| Rates of Return and Profitability | Baa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Sabine Royalty Trust: A Look at the Market Overview and Competitive Landscape

Sabine Royalty Trust, a leading oil and gas royalty trust, operates in a dynamic and competitive market. The energy sector is constantly evolving, driven by factors like global demand, commodity prices, technological advancements, and environmental regulations. The royalty trust model, where investors receive distributions from the production of underlying oil and gas assets, is a popular investment strategy for investors seeking exposure to the energy sector. Sabine's competitive landscape is characterized by a mix of established royalty trusts, independent oil and gas producers, and integrated energy companies.

The market overview for Sabine Royalty Trust is shaped by several key factors. First, the price of oil and natural gas is a primary driver of the trust's revenue and distributions. Volatility in these commodity prices can significantly impact the trust's performance. Secondly, the production levels from the underlying oil and gas assets are critical. Factors like well depletion, operational efficiency, and technological advancements can influence production volumes and, in turn, affect distributions to trust holders. Finally, regulatory changes related to oil and gas extraction and environmental protection can also impact the trust's operations.

Sabine faces competition from various players in the royalty trust space. Some key competitors include: - **Other royalty trusts**: Trusts like the Chesapeake Energy Trust or the Coterra Energy Trust compete directly with Sabine for investor capital and offer similar investment opportunities. - **Independent oil and gas producers**: Companies that own and operate oil and gas fields may offer royalties or other forms of revenue sharing to investors, potentially competing with Sabine's offerings. - **Integrated energy companies**: Large energy companies, often with extensive oil and gas reserves, may choose to distribute dividends to shareholders or pursue other investment options, potentially influencing investor sentiment towards royalty trusts.

Sabine's competitive advantage lies in its established portfolio of oil and gas assets, primarily located in the prolific Eagle Ford Shale play. The trust's focus on a single, high-quality asset base provides investors with transparency and a concentrated exposure to a specific geological area. Additionally, Sabine's experienced management team and its commitment to responsible environmental practices are further strengths. Despite the competitive landscape, Sabine's long-term prospects remain tied to the fundamentals of the oil and gas industry and its ability to manage its assets effectively, adapting to changing market dynamics and regulatory trends.

Sabine Royalty Outlook: Navigating Oil and Gas Dynamics

Sabine Royalty Trust, a prominent player in the energy sector, faces a complex future outlook, influenced by the interplay of oil and gas market dynamics, production trends, and the ongoing transition to renewable energy. The trust's primary source of revenue, royalties from oil and gas production in the prolific Haynesville Shale, exposes it to volatility inherent to commodity pricing and global energy demand.

While natural gas prices have surged recently due to geopolitical tensions and the ongoing energy crisis, Sabine Royalty's future hinges on the sustained strength of these prices. The long-term trajectory of natural gas demand is crucial, given the growing role of cleaner energy sources. The development of infrastructure to accommodate increased liquefied natural gas (LNG) exports could offer a positive catalyst for Sabine Royalty, but also faces challenges related to permitting and environmental concerns.

Sabine Royalty's production profile is another key aspect to consider. As the trust holds a declining interest in producing wells, its royalty payments will inevitably decrease over time. This decline will be partially offset by new well development, but the pace of development and the success rate of new wells will determine the trust's overall production trajectory.

In conclusion, Sabine Royalty's future outlook is intertwined with the intricate dynamics of the oil and gas sector. The trust's dependence on natural gas prices, its declining interest in producing wells, and the evolving energy landscape present both opportunities and risks. Investors should closely monitor global energy markets, production trends, and regulatory developments to make informed decisions about their investment in Sabine Royalty.

Sabine Royalty Trust: A Glimpse into Efficiency

Sabine Royalty Trust (SRT) is a limited-liability trust that holds mineral rights in the Sabine and other fields in Texas and Louisiana. It operates as a passive entity, generating revenue through its royalty interests in oil and natural gas production. SRT's operating efficiency, therefore, primarily revolves around its ability to effectively manage its assets and navigate the complexities of the energy industry.

SRT's operating efficiency is reflected in its ability to maximize royalty payments. The trust's success hinges on its strategic allocation of resources, which includes negotiating favorable lease terms with production companies and actively monitoring production levels. Furthermore, SRT's management team ensures compliance with regulatory requirements and oversees environmental stewardship of the trust's assets. These efforts contribute to the trust's financial stability and its ability to distribute consistent royalty payments to its unitholders.

While SRT's operating efficiency is influenced by external factors like commodity prices and production levels, the trust's performance can be further enhanced by optimizing its cost structure. This includes minimizing administrative expenses and utilizing technology to streamline operations. SRT's commitment to transparency and responsible management fosters trust among investors and enhances its overall efficiency.

Looking ahead, SRT's operating efficiency will continue to be influenced by the evolving landscape of the energy industry. Adapting to technological advancements in oil and gas production, particularly in the areas of automation and data analytics, can potentially enhance the trust's efficiency and profitability. By remaining agile and proactive in its approach, SRT can continue to leverage its assets to maximize returns for its unitholders while adhering to the principles of responsible stewardship.

Sabine Royalty Trust: Assessing the Risks

Sabine Royalty Trust (SRT) is an entity that derives its revenue from royalties on oil and natural gas production in the Sabine Pass Field in Texas. This makes it a valuable investment for those seeking exposure to energy markets. However, SRT's success is inherently tied to factors beyond its control, including the volatility of oil and gas prices, production levels, and the overall health of the energy industry. As such, a thorough risk assessment is crucial for potential investors.

One primary risk factor is the inherent volatility of commodity prices. Oil and gas prices can fluctuate dramatically due to a multitude of factors, including global demand, geopolitical events, and technological advancements. A decline in prices would directly impact SRT's revenue and ultimately affect its ability to distribute dividends to shareholders. Additionally, production levels at the Sabine Pass Field are not guaranteed and can be affected by factors such as depletion of reserves, operational issues, and regulatory changes. A decrease in production would naturally reduce SRT's royalty income and diminish its overall profitability.

Furthermore, SRT is susceptible to the broader economic and regulatory environment surrounding the energy industry. Environmental concerns, shifts in government policy, and technological advancements in renewable energy sources all have the potential to impact the demand for fossil fuels and consequently influence SRT's future prospects. Changes in regulations, such as stricter environmental standards or limitations on drilling activity, could also negatively impact SRT's operations.

Lastly, it is important to consider the finite nature of the Sabine Pass Field. As reserves are depleted, production is expected to decline over time, leading to a reduction in SRT's royalty revenue and eventually, a decrease in dividend payouts. This factor highlights the long-term sustainability of SRT as an investment and should be considered carefully by potential investors. In conclusion, while Sabine Royalty Trust offers exposure to the energy sector, it is important to acknowledge the risks associated with its business model. These risks include the volatility of oil and gas prices, uncertainty in production levels, the overall health of the energy industry, and the finite nature of the Sabine Pass Field. Investors should conduct thorough research and carefully consider their own risk tolerance before making any investment decisions.

References

- J. Filar, L. Kallenberg, and H. Lee. Variance-penalized Markov decision processes. Mathematics of Opera- tions Research, 14(1):147–161, 1989

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Can Neural Networks Predict Stock Market?. AC Investment Research Journal, 220(44).

- C. Wu and Y. Lin. Minimizing risk models in Markov decision processes with policies depending on target values. Journal of Mathematical Analysis and Applications, 231(1):47–67, 1999

- Efron B, Hastie T. 2016. Computer Age Statistical Inference, Vol. 5. Cambridge, UK: Cambridge Univ. Press

- Robins J, Rotnitzky A. 1995. Semiparametric efficiency in multivariate regression models with missing data. J. Am. Stat. Assoc. 90:122–29

- Burkov A. 2019. The Hundred-Page Machine Learning Book. Quebec City, Can.: Andriy Burkov

- Chernozhukov V, Chetverikov D, Demirer M, Duflo E, Hansen C, Newey W. 2017. Double/debiased/ Neyman machine learning of treatment effects. Am. Econ. Rev. 107:261–65