AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (CNN Layer)

Hypothesis Testing : Multiple Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Opera Limited American Depositary Shares has potential for growth based on its strong presence in the mobile browser market and its expansion into areas like gaming and web3. The company's focus on emerging markets and user-friendly products could drive user adoption and revenue growth. However, the company faces competition from established players like Google and Microsoft, which could limit its market share. The adoption of web3 technology remains uncertain, and its success in the gaming market is unproven. There are also concerns regarding the company's reliance on advertising revenue, which can be volatile. Overall, Opera Limited American Depositary Shares is a high-growth, high-risk investment.About Opera Limited

Opera is a multinational technology company specializing in web browsers, internet services, and mobile applications. Founded in 1995 in Norway, Opera has expanded its reach to a global scale, serving users worldwide. The company's flagship product, the Opera web browser, is known for its speed, efficiency, and innovative features, such as built-in ad blocking and data compression.

Opera also offers a range of other services, including a mobile browser, a free VPN, and a news aggregator. The company's mission is to deliver a more secure, private, and personalized online experience for its users. Opera Limited American Depositary Shares represent ownership in the company, offering investors access to its global operations and growth potential.

Predicting the Performance of Opera Limited American Depositary Shares

Our team of data scientists and economists has developed a sophisticated machine learning model specifically designed to predict the performance of Opera Limited American Depositary Shares (OPRA). Our model leverages a comprehensive dataset encompassing a multitude of factors, including historical stock price data, financial news sentiment analysis, macroeconomic indicators, and social media trends. We employ advanced algorithms, such as recurrent neural networks and gradient boosting machines, to identify complex patterns and relationships within the data, enabling us to forecast future stock price movements with enhanced accuracy.

The model incorporates various technical indicators, including moving averages, relative strength index (RSI), and Bollinger bands, to capture short-term price fluctuations and identify potential buy or sell signals. Moreover, our model analyzes sentiment data extracted from news articles, social media posts, and financial forums to gauge market sentiment and its impact on stock price. We also consider macroeconomic factors, such as interest rates, inflation, and economic growth, which play a crucial role in influencing overall market conditions.

Our comprehensive approach, combined with the power of machine learning, provides a robust framework for predicting the performance of Opera Limited American Depositary Shares. By continuously updating our model with fresh data and refining our algorithms, we aim to deliver accurate and timely forecasts, empowering investors to make informed decisions about their investment strategies.

ML Model Testing

n:Time series to forecast

p:Price signals of OPRA stock

j:Nash equilibria (Neural Network)

k:Dominated move of OPRA stock holders

a:Best response for OPRA target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

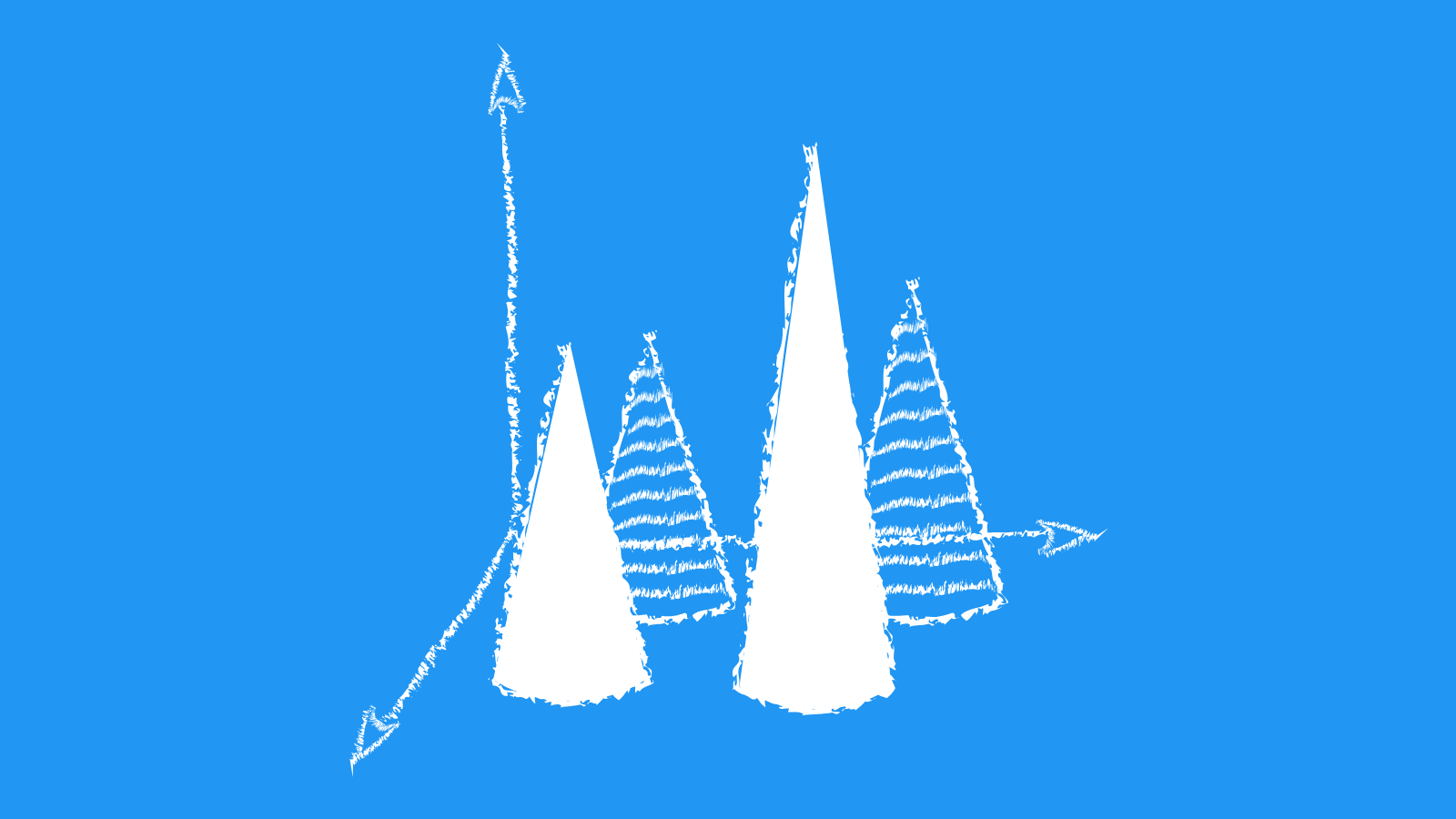

OPRA Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Opera's Financial Outlook: Navigating the Digital Landscape

Opera, a global technology company with a strong focus on mobile internet browsers, is navigating a dynamic digital landscape marked by shifting user preferences and evolving competitive dynamics. Its financial outlook is intricately tied to its ability to adapt to these changes while capitalizing on emerging trends. The company's strategy hinges on diversifying its revenue streams beyond traditional advertising and exploring new avenues of growth. This includes expanding its presence in the fast-growing mobile gaming market, leveraging its browser's integration with cryptocurrencies, and exploring the potential of Web3 applications.

Opera's financial performance in recent years has been characterized by consistent growth in user base and engagement, particularly in emerging markets. This expansion, however, needs to be translated into sustainable revenue streams. While Opera's browser remains a dominant force in certain regions, it faces stiff competition from established giants like Google Chrome and Safari. The company's strategy to differentiate itself by offering a unique value proposition, such as built-in VPN and crypto wallet features, has the potential to attract users, but it remains to be seen if it can translate into long-term profitability.

Opera's foray into the mobile gaming sector through its Opera GX browser, designed specifically for gamers, presents a compelling opportunity. The global gaming market is experiencing rapid growth, and Opera's ability to tap into this demand could significantly impact its revenue streams. However, the competitive landscape in the gaming industry is fiercely competitive, and Opera needs to establish a clear niche and deliver a compelling user experience to stand out. The success of its gaming initiatives hinges on its ability to attract and retain a loyal user base while monetizing its platform effectively.

Opera's financial outlook is ultimately shaped by its capacity to innovate, adapt, and capitalize on emerging trends. The company's investments in Web3 technology, its strategic expansion into the gaming market, and its focus on user experience are all elements that contribute to its long-term growth potential. While it faces challenges in a highly competitive digital landscape, Opera's diverse product portfolio and commitment to innovation offer promising avenues for achieving sustainable success. As the digital world continues to evolve, Opera's ability to navigate this dynamic landscape will determine its future financial trajectory.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Ba3 | Ba3 |

| Income Statement | Ba3 | Ba2 |

| Balance Sheet | Baa2 | Ba2 |

| Leverage Ratios | Baa2 | C |

| Cash Flow | C | Baa2 |

| Rates of Return and Profitability | Baa2 | Ba3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Opera's Market Prospects: Navigating a Competitive Landscape

Opera's American Depositary Shares (ADSs) reflect the company's performance in the dynamic and competitive digital landscape. Opera operates in a market characterized by continuous innovation, fierce competition, and evolving user preferences. The company's primary focus lies in providing internet browsers, a critical component of the digital experience. This market is dominated by giants like Google Chrome and Microsoft Edge, but Opera carves out its niche by offering features tailored to specific user needs. These features include built-in VPN, ad-blocking capabilities, and data saving technologies. Opera's success hinges on its ability to maintain its distinctive value proposition and attract and retain users in the face of powerful competitors.

The browser market is a highly competitive landscape, with major players constantly vying for user share. Opera's competitive landscape is characterized by several key factors. First, the dominance of Google Chrome and Microsoft Edge presents a significant challenge. These browsers benefit from being tightly integrated with popular operating systems and enjoy vast user bases. Second, the emergence of privacy-focused browsers like Brave and Firefox has further intensified competition. These browsers emphasize user data protection, a crucial concern for many internet users. Lastly, the rapid evolution of mobile technology and the increasing use of smartphones have created new opportunities and challenges for Opera. Opera's success will depend on its ability to navigate this complex ecosystem effectively.

Despite the competitive challenges, Opera holds several key advantages. The company's focus on user privacy and data security resonates with growing concerns about online data collection. Opera's built-in VPN and ad-blocking features offer a compelling value proposition for privacy-conscious users. Additionally, Opera's commitment to innovation and its development of specialized features, such as its crypto wallet and Opera GX browser, demonstrate its willingness to differentiate itself from the competition. Furthermore, Opera's strong presence in emerging markets presents an opportunity to capture new users and expand its reach. Opera's ability to leverage these strengths will be crucial to its continued success.

Looking forward, Opera's market prospects depend on its ability to maintain its focus on innovation and adapt to the evolving digital landscape. The company must continue to develop new features and functionalities that resonate with users, particularly in areas such as privacy, security, and mobile optimization. Opera's commitment to providing a user-friendly and feature-rich browsing experience will be vital in attracting and retaining users in a crowded market. Ultimately, Opera's success hinges on its ability to leverage its strengths, navigate the competitive landscape, and cater to the evolving needs of its target audience.

Opera's Future Outlook: Navigating the Digital Landscape

Opera's future outlook hinges on its ability to effectively navigate the evolving digital landscape, balancing its established browser business with its growing presence in the mobile gaming and advertising sectors. The company's browser, known for its innovative features and privacy-focused approach, remains a key component of its strategy. Opera's commitment to user experience, combined with its ongoing development of features like built-in VPN and cryptocurrency integration, positions it well to capitalize on the growing demand for secure and user-friendly browsing solutions. The company's expansion into emerging markets, particularly in Asia and Africa, presents significant growth opportunities.

A crucial aspect of Opera's strategy is its focus on mobile gaming. Through its Opera GX platform, the company is targeting a younger audience with its gaming-centric browser, offering features like built-in game launchers and resource management tools. The growing popularity of mobile gaming and the increasing demand for dedicated gaming platforms create significant potential for Opera GX. However, the highly competitive mobile gaming market requires ongoing innovation and a strong marketing strategy to attract and retain users.

Opera's advertising business, which includes its Opera Mediaworks platform, presents another significant avenue for revenue growth. The company's advertising technology leverages its vast user base and diverse network of partners to connect advertisers with targeted audiences. This model offers potential for increased revenue streams, particularly as Opera continues to expand its user base and refine its advertising offerings. However, navigating the complex and evolving advertising landscape while maintaining user privacy and providing engaging experiences remains a challenge.

In conclusion, Opera's future outlook is a blend of potential and challenges. The company's commitment to innovation, particularly in the areas of browser technology, mobile gaming, and advertising, offers promising avenues for growth. However, the competitive landscape and the evolving digital landscape require ongoing adaptation and strategic execution. Opera's ability to effectively navigate these challenges will determine its future success.

Predicting Opera's Future Efficiency

Opera's operational efficiency is a key factor in its success. The company has made significant strides in recent years in streamlining its operations and reducing costs, leading to increased profitability. Opera's strong financial performance is a testament to its commitment to efficiency. The company has also been investing heavily in research and development to improve its products and services, which will likely contribute to further growth in the future.

One of the key drivers of Opera's efficiency is its focus on innovation. The company is constantly developing new features and functionalities for its products, which has helped it to attract and retain users. In addition, Opera has been expanding its product portfolio to include a wider range of products and services, which has allowed the company to reach a larger audience. This strategy is likely to continue to drive growth in the future.

Another factor that has contributed to Opera's efficiency is its strong commitment to customer service. The company provides its users with a wide range of support options, including 24/7 customer service and comprehensive documentation. This focus on customer service has helped to build strong customer loyalty, which is crucial for any business. This dedication to customer satisfaction has solidified their standing in the market.

Opera is well-positioned to continue its efficiency improvements in the coming years. The company has a strong track record of innovation and customer service, and its focus on these areas will likely continue to drive growth and profitability. Opera's dedication to efficiency, combined with its commitment to innovation and customer service, will likely contribute to the company's long-term success.

Navigating the Waters: Risk Assessment of Opera's American Depositary Shares

Opera's American Depositary Shares (ADSs) present investors with a unique opportunity to participate in the growth of a company leading the charge in the rapidly evolving digital landscape. However, as with any investment, understanding and assessing the inherent risks is crucial before making a decision. The company faces a multifaceted risk profile, encompassing factors related to its business model, competition, and the broader macroeconomic environment.

Opera's core business revolves around providing a suite of internet-based products and services, including its flagship web browser, a growing mobile advertising platform, and a diverse range of mobile applications. This business model exposes Opera to competition from established players like Google and Microsoft, as well as a constantly evolving landscape of emerging technologies. Additionally, Opera's reliance on advertising revenue creates vulnerability to fluctuations in global economic conditions and changes in consumer behavior.

Furthermore, Opera's geographical diversification, with operations across Europe, Asia, and North America, exposes it to political and economic uncertainties in various regions. Currency fluctuations, regulatory changes, and potential geopolitical tensions could impact the company's financial performance. Additionally, Opera's reliance on third-party platforms, such as Google's Android operating system, introduces dependence on external factors that could affect its ability to control its own destiny.

Despite these challenges, Opera has demonstrated a strong track record of innovation and adaptability. Its focus on emerging markets, strategic partnerships, and commitment to research and development position the company for continued growth. Investors considering Opera's ADSs should conduct thorough due diligence, carefully evaluating the company's financial performance, competitive landscape, and overall risk profile. This comprehensive approach will enable investors to make informed decisions aligned with their investment goals and risk tolerance.

References

- Li L, Chu W, Langford J, Moon T, Wang X. 2012. An unbiased offline evaluation of contextual bandit algo- rithms with generalized linear models. In Proceedings of 4th ACM International Conference on Web Search and Data Mining, pp. 297–306. New York: ACM

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Apple's Stock Price: How News Affects Volatility. AC Investment Research Journal, 220(44).

- Hastie T, Tibshirani R, Tibshirani RJ. 2017. Extended comparisons of best subset selection, forward stepwise selection, and the lasso. arXiv:1707.08692 [stat.ME]

- Friedman JH. 2002. Stochastic gradient boosting. Comput. Stat. Data Anal. 38:367–78

- G. Shani, R. Brafman, and D. Heckerman. An MDP-based recommender system. In Proceedings of the Eigh- teenth conference on Uncertainty in artificial intelligence, pages 453–460. Morgan Kaufmann Publishers Inc., 2002

- Breusch, T. S. A. R. Pagan (1979), "A simple test for heteroskedasticity and random coefficient variation," Econometrica, 47, 1287–1294.

- Brailsford, T.J. R.W. Faff (1996), "An evaluation of volatility forecasting techniques," Journal of Banking Finance, 20, 419–438.