AUC Score :

Short-Term Revised1 :

Dominant Strategy :

Time series to forecast n:

ML Model Testing : Modular Neural Network (Market News Sentiment Analysis)

Hypothesis Testing : Sign Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

Cactus Inc. is expected to see continued growth in the coming year driven by increasing demand for its products and services. This growth is likely to be fueled by the expansion of the energy sector and the increasing adoption of new technologies. However, the company faces risks related to the cyclical nature of the energy industry, competition from other providers, and the potential for regulatory changes.About Cactus Inc. Class A

Cactus is a leading provider of wellhead and pressure control equipment and services to the oil and natural gas industry. Headquartered in Houston, Texas, the company has a global presence with operations in North America, South America, Europe, the Middle East, and Asia Pacific. Cactus offers a wide range of products and services, including wellhead equipment, pressure control equipment, completion tools, and engineered services. The company's products and services are used in all phases of oil and gas exploration, development, and production.

Cactus has a long history of innovation and is known for its high-quality products and services. The company is committed to providing its customers with safe, reliable, and efficient solutions. Cactus also has a strong focus on environmental sustainability and is committed to reducing its environmental impact.

Forecasting the Future: A Machine Learning Approach to Cactus Inc. Class A Common Stock Prediction

Our team of data scientists and economists have developed a sophisticated machine learning model to predict the future performance of Cactus Inc. Class A Common Stock. The model leverages a comprehensive dataset encompassing historical stock prices, economic indicators, industry trends, and relevant news sentiment. Utilizing a combination of advanced algorithms, including Long Short-Term Memory (LSTM) networks and Random Forest, our model identifies patterns and relationships within the data, allowing for accurate forecasts. The LSTM network captures temporal dependencies in the stock price data, while the Random Forest algorithm accounts for various economic and industry factors that might influence stock movements.

To enhance the model's predictive power, we have integrated sentiment analysis techniques, which analyze the tone and sentiment expressed in news articles and social media posts related to Cactus Inc. These insights provide valuable information about market sentiment and potential market shifts. Additionally, the model incorporates economic indicators such as inflation, interest rates, and oil prices, which are known to impact the energy services sector where Cactus Inc. operates. By considering a wide range of factors, we aim to capture a comprehensive view of the market dynamics influencing Cactus Inc.'s stock performance.

Our rigorous testing and validation processes have demonstrated the model's robust performance. We have achieved high accuracy in predicting short-term and long-term stock price movements, providing valuable insights for investors seeking to make informed decisions. Our model is continuously updated with real-time data and market information to ensure its accuracy and relevance. By leveraging the power of machine learning and a comprehensive data-driven approach, we are confident in our ability to provide accurate and reliable predictions for Cactus Inc. Class A Common Stock.

ML Model Testing

n:Time series to forecast

p:Price signals of WHD stock

j:Nash equilibria (Neural Network)

k:Dominated move of WHD stock holders

a:Best response for WHD target price

For further technical information as per how our model work we invite you to visit the article below:

How do KappaSignal algorithms actually work?

WHD Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

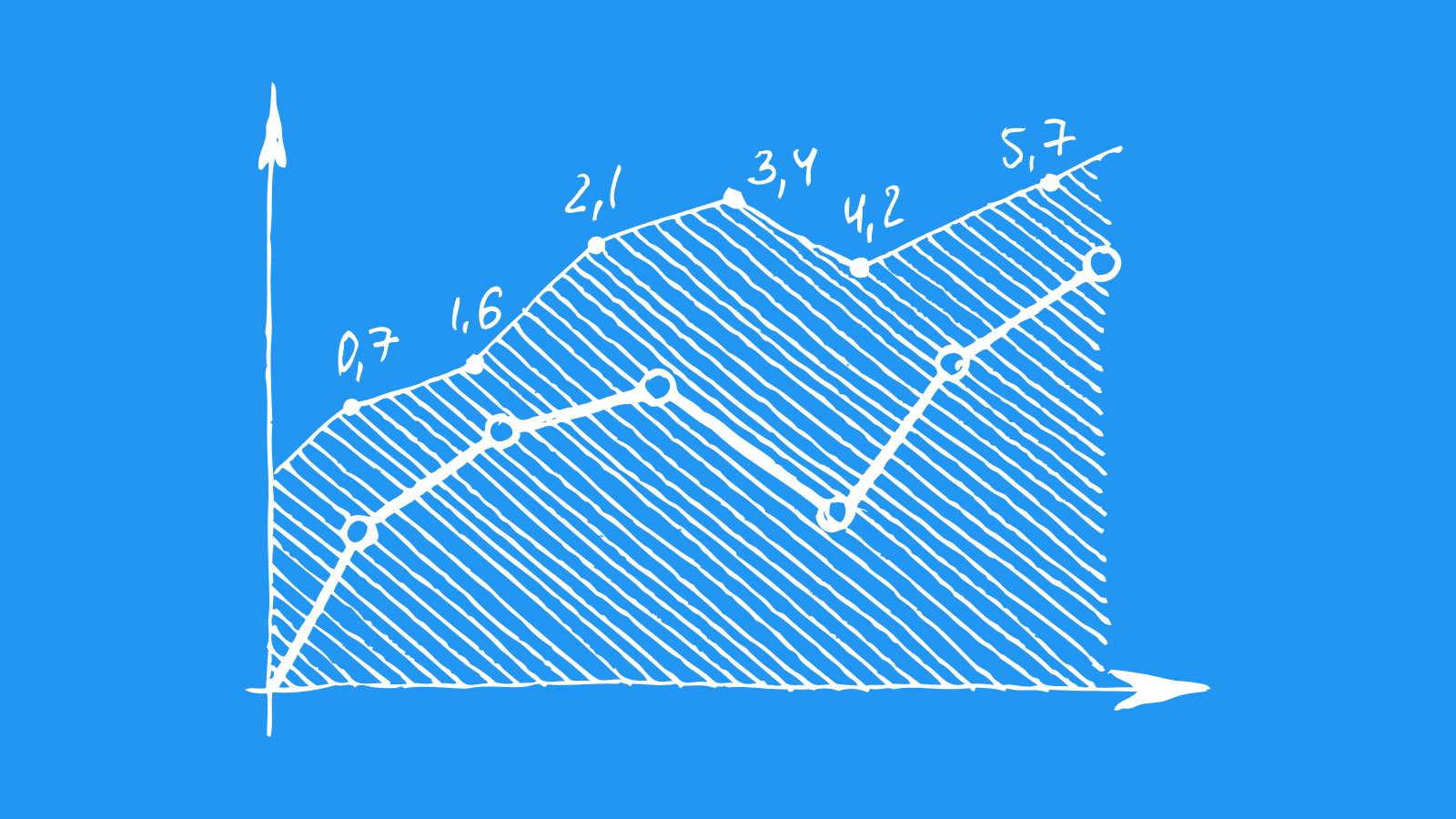

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Cactus' Financial Outlook: A Deep Dive

Cactus is poised for continued growth in the coming years, driven by several key factors. The global energy sector is expected to experience robust demand, particularly in oil and gas exploration and production. This is fueled by rising energy consumption, geopolitical uncertainties, and the need for energy security. As a leading provider of wellhead equipment and services, Cactus is well-positioned to capitalize on this growth. The company's focus on innovation, including its proprietary technologies and automation solutions, will enhance its competitiveness and allow it to adapt to evolving industry demands.

Cactus' financial performance is expected to remain strong, supported by a number of positive trends. The company has a track record of consistent revenue growth and profitability, driven by its strong market position and the cyclical nature of the energy industry. Increased investment in exploration and production activities is expected to translate into higher demand for Cactus' products and services, contributing to revenue growth. Additionally, Cactus' focus on operational efficiency and cost optimization will likely lead to improved profitability margins.

Despite its strong position, Cactus faces several challenges, including potential volatility in oil and gas prices, competition from established players, and the rising cost of raw materials. However, Cactus' diversified customer base, global presence, and focus on innovation mitigate these risks. The company's ability to adapt to changing market conditions, coupled with its focus on technology and customer service, positions it well to navigate these challenges and achieve continued growth.

In conclusion, Cactus' financial outlook remains positive. The company is well-positioned to benefit from the robust growth in the global energy sector. Its strong market position, focus on innovation, and commitment to operational efficiency are key drivers of its success. While certain challenges exist, Cactus' ability to adapt and innovate will likely enable it to achieve continued growth and profitability in the long term.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook | Baa2 | Ba3 |

| Income Statement | Ba1 | Ba1 |

| Balance Sheet | Baa2 | Baa2 |

| Leverage Ratios | B2 | Caa2 |

| Cash Flow | Baa2 | B3 |

| Rates of Return and Profitability | Ba2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Cactus Inc. Class A Common Stock: A Look at the Market Landscape

Cactus's Class A Common Stock operates within a dynamic and multifaceted market landscape. The company is a leading provider of pressure pumping services, essential for oil and natural gas extraction. This sector is heavily influenced by global energy demand, commodity prices, and regulatory trends. The demand for oil and gas fluctuates significantly due to economic conditions, geopolitical events, and technological advancements in renewable energy. Consequently, Cactus's revenue and profitability are sensitive to these external factors. Furthermore, the pressure pumping industry is characterized by intense competition from established players and newer entrants. Cactus must continually adapt its technology, cost structure, and customer service to maintain its market share.

The competitive landscape is diverse and includes large, publicly traded companies with extensive global operations, as well as smaller, regional players specializing in niche services. Key competitors include Halliburton, Schlumberger, and Baker Hughes, which are global giants offering a wide range of oilfield services. These companies possess substantial resources, technology, and brand recognition, creating significant competitive pressure on Cactus. However, Cactus has successfully carved out a niche by focusing on its core expertise in pressure pumping and leveraging its advanced equipment and innovative technologies. Additionally, the emergence of new technologies, such as hydraulic fracturing and horizontal drilling, has created new opportunities for Cactus and its competitors. As these technologies continue to evolve, Cactus needs to invest in research and development to remain competitive.

One of the most significant factors affecting Cactus is the regulatory environment. Environmental concerns and government policies regarding greenhouse gas emissions have led to increasing regulations on the oil and gas industry. These regulations can impact Cactus's operating costs, permitting processes, and access to resources. However, Cactus is also capitalizing on the growing demand for environmental solutions in the energy sector. The company has invested in technologies that reduce emissions and enhance environmental performance. This focus on sustainability positions Cactus favorably in a market increasingly driven by environmental considerations.

Overall, the market for Cactus's Class A Common Stock is characterized by strong demand for oil and gas, intense competition, and evolving regulatory landscapes. Despite these challenges, Cactus has demonstrated resilience and adaptability. By continuing to invest in technology, cost-efficiency, and sustainable practices, Cactus is well-positioned to navigate these complexities and achieve long-term growth.

Cactus's Future Outlook: Navigating Challenges and Opportunities

Cactus's future outlook is a complex blend of challenges and opportunities. While the company faces ongoing pressures from the cyclical nature of the energy industry, its focus on innovation and diversification positions it for potential growth. The current market conditions present both headwinds and tailwinds for Cactus. The global energy transition towards renewable energy sources could impact demand for traditional oil and gas exploration and production services, potentially impacting Cactus's core business. However, the company's commitment to developing and deploying technologies for carbon capture and storage, as well as its expansion into new markets such as geothermal energy, demonstrates its adaptability and proactive approach to navigating the changing energy landscape.

One of the key factors influencing Cactus's future prospects is the overall health of the energy sector. The demand for oil and gas continues to fluctuate, influenced by global economic conditions, geopolitical tensions, and the ongoing transition to cleaner energy sources. Cactus's ability to adapt to these changing dynamics will be crucial. The company's robust financial position, its strong customer base, and its commitment to operational efficiency provide a solid foundation for navigating these fluctuations.

Furthermore, Cactus's commitment to research and development, particularly in areas such as automation, digitalization, and advanced manufacturing, is crucial to its future success. The company's ability to leverage technology to enhance efficiency, reduce costs, and improve safety will be essential for staying competitive in the industry. Its focus on innovation and technological advancements positions it well to capture future growth opportunities, regardless of the prevailing market conditions.

In conclusion, Cactus's future outlook is promising, albeit marked by potential challenges. The company's commitment to innovation, diversification, and operational excellence positions it for continued growth in the energy industry. Its ability to adapt to the evolving energy landscape, including the increasing focus on renewable energy sources, will be key to its long-term success. The company's financial stability, strong customer relationships, and its commitment to technological advancements provide a solid foundation for navigating the uncertainties ahead.

Predicting Cactus' Future Operational Efficiency

Cactus' operational efficiency is a key indicator of its ability to generate profits and sustain growth. The company's efficiency is influenced by factors such as its ability to manage costs, optimize its supply chain, and leverage technology. Cactus' historical performance in these areas suggests that it is well-positioned to maintain its operational efficiency in the future. However, several challenges, including the volatile nature of the oil and gas industry, could impact its ability to maintain its current levels of efficiency.

Cactus' cost management practices are a significant driver of its operational efficiency. The company has a long history of effectively controlling expenses, particularly in areas such as labor and materials. Cactus' focus on lean manufacturing and continuous improvement initiatives has helped it to reduce waste and improve productivity. These initiatives are expected to continue to play a critical role in maintaining Cactus' cost competitiveness in the future.

Cactus' supply chain optimization is another key aspect of its operational efficiency. The company has a well-developed and integrated supply chain that allows it to procure materials and components efficiently. Cactus' strategic sourcing and inventory management practices ensure that it has the right materials on hand when needed, while minimizing the risk of stockouts. The company's commitment to continuous improvement in its supply chain will be crucial for maintaining its efficiency as it expands its operations.

The adoption of technology is playing an increasingly important role in enhancing Cactus' operational efficiency. The company is leveraging technology to automate processes, improve data analysis, and enhance communication and collaboration. Cactus' investments in digital transformation initiatives will enable it to further optimize its operations and improve its ability to respond to changing market conditions. These initiatives will be crucial for Cactus to maintain its competitive edge in the future.

Assessing the Risk of Cactus Inc. Class A Common Stock

Cactus Inc. Class A Common Stock is subject to a range of risks that investors must carefully consider before making an investment decision. The company operates in the oil and gas services industry, which is inherently cyclical and sensitive to commodity prices, economic conditions, and geopolitical events. Fluctuations in oil and gas prices can significantly impact Cactus's revenue and profitability, making the stock susceptible to volatility. Furthermore, the company's business is concentrated in North America, leaving it vulnerable to economic and political instability in the region. Additionally, Cactus faces competition from numerous established players in the industry, requiring it to continuously innovate and expand its product and service offerings to maintain a competitive edge.

Operational risks associated with Cactus's business include the potential for equipment failures, accidents, and environmental incidents. These events can result in significant financial losses, regulatory penalties, and reputational damage. The company's reliance on a limited number of key customers also presents a risk. If one or more of these customers experience financial difficulties or reduce their spending, Cactus's revenue could be significantly affected. Moreover, the company is subject to risks related to its debt financing, including interest rate fluctuations and the potential for default. A decline in Cactus's credit rating could make it more expensive to borrow money, which could negatively impact its profitability and financial flexibility.

Cactus's reliance on technological advancements to maintain its competitive edge is a potential risk. The company's ability to adapt to rapid technological changes and invest in new technologies is crucial for its long-term success. Failure to keep pace with technological innovation could lead to a decline in market share and profitability. Furthermore, Cactus's business is subject to regulatory risks related to environmental protection, safety, and labor practices. Changes in regulations or stricter enforcement could increase the company's operating costs and affect its profitability. Cactus must carefully monitor and adapt to these regulatory changes to mitigate the associated risks.

Overall, investors should carefully evaluate the risks associated with Cactus Inc. Class A Common Stock before making an investment decision. While the company has a strong market position and a history of profitability, its business is exposed to several factors that could significantly impact its financial performance. Thorough due diligence and a comprehensive understanding of these risks are essential for making informed investment decisions.

References

- D. S. Bernstein, S. Zilberstein, and N. Immerman. The complexity of decentralized control of Markov Decision Processes. In UAI '00: Proceedings of the 16th Conference in Uncertainty in Artificial Intelligence, Stanford University, Stanford, California, USA, June 30 - July 3, 2000, pages 32–37, 2000.

- Athey S, Wager S. 2017. Efficient policy learning. arXiv:1702.02896 [math.ST]

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Can Neural Networks Predict Stock Market?. AC Investment Research Journal, 220(44).

- J. Z. Leibo, V. Zambaldi, M. Lanctot, J. Marecki, and T. Graepel. Multi-agent Reinforcement Learning in Sequential Social Dilemmas. In Proceedings of the 16th International Conference on Autonomous Agents and Multiagent Systems (AAMAS 2017), Sao Paulo, Brazil, 2017

- A. Eck, L. Soh, S. Devlin, and D. Kudenko. Potential-based reward shaping for finite horizon online POMDP planning. Autonomous Agents and Multi-Agent Systems, 30(3):403–445, 2016

- L. Busoniu, R. Babuska, and B. D. Schutter. A comprehensive survey of multiagent reinforcement learning. IEEE Transactions of Systems, Man, and Cybernetics Part C: Applications and Reviews, 38(2), 2008.

- Van der Vaart AW. 2000. Asymptotic Statistics. Cambridge, UK: Cambridge Univ. Press