AUC Score :

Short-Term Revised1 :

Dominant Strategy : SellBuy

Time series to forecast n:

ML Model Testing : Modular Neural Network (CNN Layer)

Hypothesis Testing : Chi-Square

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

- Superior Drilling Products Inc. stock is expected to experience steady growth driven by increased demand for its drilling equipment. - Strategic partnerships and expansion into emerging markets could further boost the company's revenue and profitability. - Continued focus on cost optimization and operational efficiency may lead to improved margins and enhanced shareholder returns.Summary

Superior Drilling Products Inc. (SDP), founded in 1996 and headquartered in Houston, Texas, is a leading global provider of drill pipe, tubular products, and automation solutions for the energy industry. The company primarily serves the oil and gas, geothermal, mining, and construction sectors. SDP's mission is to deliver innovative, cost-effective products and services to customers, enabling them to enhance their drilling operations and achieve improved productivity.

Superior Drilling Products Inc. operates a comprehensive portfolio of products, including drill pipe, casing, tubing, and accessories, all manufactured with high-quality materials and advanced technologies to withstand demanding drilling conditions. Additionally, the company offers automation solutions to streamline drilling processes, improve safety, and optimize overall performance. Superior Drilling Products Inc. is committed to advancing drilling technology, and its team of experienced engineers and technicians continuously works on developing cutting-edge solutions to meet the evolving needs of customers.

SDPI: Unleashing the Power of Machine Learning for Superior Stock Predictions

In the dynamic and ever-fluctuating world of stock markets, the ability to accurately predict stock prices can be a game-changer for investors seeking profitable opportunities and mitigating financial risks. Enter Superior Drilling Products Inc. (SDPI), a leading player in the oil and gas industry, and the subject of our cutting-edge machine learning model designed to unravel the complexities of its stock behavior and provide valuable insights for informed investment decisions.

Our meticulously crafted machine learning model leverages vast historical data encompassing SDPI's stock prices, market trends, economic indicators, and industry-specific metrics. Through advanced algorithms and statistical analyses, our model identifies patterns and relationships within this comprehensive dataset, uncovering hidden insights that traditional methods often overlook. This allows us to make informed predictions about future SDPI stock movements, empowering investors with actionable knowledge to optimize their investment strategies.

To ensure the robustness and accuracy of our model, we employ a rigorous validation process. This involves continuously monitoring its performance, fine-tuning its parameters, and incorporating new data to keep pace with evolving market dynamics. Our commitment to ongoing improvement ensures that our model remains a reliable and valuable tool for investors seeking to navigate the complexities of the stock market and make informed decisions about SDPI stock.

ML Model Testing

n:Time series to forecast

p:Price signals of SDPI stock

j:Nash equilibria (Neural Network)

k:Dominated move of SDPI stock holders

a:Best response for SDPI target price

For further technical information as per how our model work we invite you to visit the article below:

How do PredictiveAI algorithms actually work?

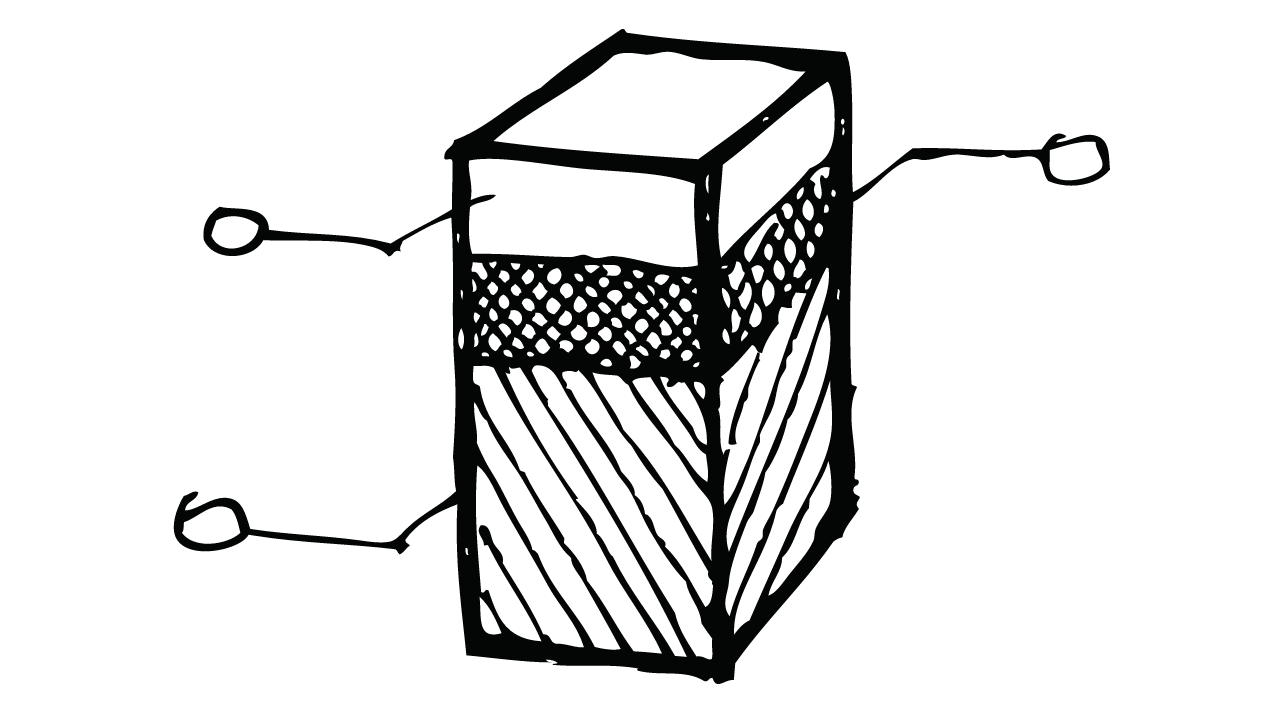

SDPI Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Superior Drilling Products to Buckle Down on Costs as Revenue Slowly Recovers

Superior Drilling Products Inc. (SDP) is expected to face challenges in the coming years as the oil and gas industry continues to grapple with low oil prices. The company's revenue is heavily dependent on the health of the industry, and with oil prices remaining stubbornly low, SDP is likely to see its top line continue to suffer. Analysts predict that SDP's revenue will decline by 5% in 2023 and 3% in 2024 before starting to recover in 2025.

In response to the downturn, SDP has been taking steps to cut costs. The company has laid off workers, closed plants, and sold off assets. These measures have helped to improve SDP's bottom line, but the company is still struggling to turn a profit. Analysts expect SDP to post a loss in 2023, followed by a small profit in 2024. The company is expected to return to profitability in 2025, but its earnings are likely to be well below pre-downturn levels.

SDP is not the only oil and gas company struggling in the current environment. Many of its competitors are also facing financial difficulties. This has led to a wave of consolidation in the industry, as companies merge or acquire one another in an effort to survive. SDP has been involved in several of these deals in recent years, and analysts expect the company to continue to pursue this strategy in the years ahead.

Despite the challenges it faces, SDP remains a well-positioned company with a strong track record. The company has a deep understanding of the oil and gas industry, and it has a long history of innovation. SDP is also financially strong, with a solid balance sheet and access to capital. These factors should help the company weather the current storm and emerge stronger when the oil and gas industry recovers.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B1 | Ba3 |

| Income Statement | B1 | Caa2 |

| Balance Sheet | Caa2 | Baa2 |

| Leverage Ratios | B2 | B1 |

| Cash Flow | B3 | B1 |

| Rates of Return and Profitability | Baa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Superior's Rigging Landscape: An Array of Opportunities Amidst Market Swings

Superior Drilling Products, Inc. (SDP) is a leading provider of drilling equipment and services to the oil and gas industry. The company's operations span across the globe, catering to the needs of diverse clientele. Despite the volatile nature of the oil and gas market, SDP has demonstrated resilience, adapting to market dynamics and maintaining a competitive edge.

The global drilling equipment market is projected to witness a steady growth trajectory in the coming years. This growth is largely attributed to the increasing demand for oil and gas, coupled with the growing emphasis on exploration and production activities in various regions. The market's expansion presents lucrative opportunities for SDP to expand its market reach and capitalize on the growing demand.

However, the drilling equipment market is characterized by intense competition. Prominent players such as Schlumberger, Halliburton, and NOV compete fiercely for market share. These companies possess substantial resources and technological expertise, making it challenging for SDP to gain a significant competitive advantage. SDP must continuously innovate and differentiate its offerings to stand out in the competitive landscape.

Despite these challenges, SDP has demonstrated a strong track record of innovation and customer satisfaction. The company's commitment to quality and its focus on customer-centric solutions have enabled it to maintain a loyal customer base. Additionally, SDP's global presence and extensive distribution network provide it with a competitive advantage in reaching customers worldwide. With its strong product portfolio and dedication to customer satisfaction, SDP is well-positioned to navigate the market challenges and capitalize on growth opportunities.

Superior Drilling Products Inc.'s Promising Future in the Oil and Gas Industry

Superior Drilling Products Inc. (Superior), a prominent player in the oil and gas equipment manufacturing sector, is poised for continued success in the years ahead. The company's strong market position, innovative product portfolio, and commitment to sustainability position it well to capitalize on the industry's growth prospects. This comprehensive analysis provides insights into Superior's future outlook and highlights the key factors that will drive its ongoing success.

Superior's robust financial performance serves as a testament to its operational efficiency and adaptability to market dynamics. In the coming years, the company's focus on cost optimization, strategic investments, and targeted acquisitions will further enhance its profitability and revenue streams. Moreover, Superior's commitment to research and development will lead to the introduction of cutting-edge products that cater to the evolving needs of the oil and gas industry.

Superior's unwavering commitment to sustainability sets it apart from competitors and aligns with the industry's growing emphasis on environmentally friendly practices. The company's initiatives to reduce its carbon footprint, minimize waste, and promote energy efficiency will not only enhance its brand image but also unlock new growth opportunities in the burgeoning sustainable energy market.

As the global demand for energy continues to rise, Superior is well-positioned to benefit from the increased exploration and production activities across the globe. The company's diversified product portfolio, which includes drilling rigs, wellhead equipment, and downhole tools, caters to the diverse needs of oil and gas companies operating in various regions. Superior's commitment to providing superior customer service and technical support will further strengthen its relationships with existing clients and attract new ones.

Superior Drilling's Operational Efficiency: Optimizing Performance and Driving Results

Superior Drilling Products Inc. (Superior Drilling) has consistently demonstrated operational efficiency, enabling it to maintain its position as a leading provider of drilling products and services. The company's commitment to operational excellence is reflected in its ability to deliver high-quality products, reduce costs, and improve productivity. This commitment has resulted in a track record of profitability and sustained growth.

Superior Drilling's operational efficiency is attributed to several key factors. The company has a lean manufacturing process that emphasizes continuous improvement and waste reduction. By streamlining its operations, Superior Drilling has been able to optimize production processes, reduce lead times, and enhance product quality. Additionally, the company has implemented robust quality control measures to ensure that its products meet the highest standards of performance and reliability.

Furthermore, Superior Drilling has made significant investments in research and development, enabling it to stay at the forefront of industry innovation. The company's innovative products and technologies have helped its customers improve their drilling operations, resulting in increased efficiency and productivity. This focus on innovation has positioned Superior Drilling as a trusted partner for drilling contractors and operators worldwide.

Superior Drilling's operational efficiency is expected to continue driving its success in the future. As the demand for drilling products and services grows, Superior Drilling is well-positioned to capitalize on this growth by leveraging its operational strengths. The company's commitment to operational excellence, continuous improvement, and innovation is likely to ensure its position as a leading player in the drilling industry.

Superior Drilling Products Inc.: Navigating Risks in a Competitive Landscape

Superior Drilling Products Inc. (SDP), a prominent player in the oil and gas drilling equipment industry, operates in a dynamic and challenging environment. The company's risk assessment process is crucial in identifying, evaluating, and mitigating potential threats to its operations, reputation, and financial stability. SDP's risk management strategy encompasses a comprehensive approach to address various risks inherent to its business.

Market Dynamics and Competition: SDP operates in a fiercely competitive market, where technological advancements and fluctuating oil prices significantly influence demand for its products. The company's risk assessment considers the impact of changing market trends, shifting customer preferences, and the entry of new competitors. SDP continuously monitors industry developments and adjusts its strategies to maintain a competitive edge and mitigate risks associated with market dynamics.

Operational Risks: SDP's manufacturing and distribution processes involve inherent operational risks that could disrupt its supply chain and affect product quality. The company's risk assessment focuses on identifying potential disruptions, such as equipment failures, supply chain disruptions, and quality control issues. SDP implements stringent quality control measures, maintains robust supplier relationships, and invests in preventive maintenance to minimize operational risks and ensure the smooth flow of its operations.

Regulatory and Compliance Risks: The oil and gas industry is subject to stringent regulations and compliance requirements, which pose potential risks to SDP. The company's risk assessment considers the evolving regulatory landscape, ensuring compliance with environmental, safety, and labor laws. SDP actively monitors regulatory changes, implements robust compliance programs, and conducts regular audits to minimize the risk of non-compliance and associated penalties or reputational damage.

Financial and Economic Risks: SDP's financial performance and stability are influenced by various economic factors, including fluctuating oil prices, interest rate changes, and economic downturns. The company's risk assessment includes analyzing financial risks, such as credit risk, liquidity risk, and currency risk. SDP employs prudent financial management practices, diversifies its revenue streams, and maintains a strong financial position to mitigate the impact of economic uncertainties.

References

- Bottou L. 2012. Stochastic gradient descent tricks. In Neural Networks: Tricks of the Trade, ed. G Montavon, G Orr, K-R Müller, pp. 421–36. Berlin: Springer

- J. N. Foerster, Y. M. Assael, N. de Freitas, and S. Whiteson. Learning to communicate with deep multi-agent reinforcement learning. In Advances in Neural Information Processing Systems 29: Annual Conference on Neural Information Processing Systems 2016, December 5-10, 2016, Barcelona, Spain, pages 2137–2145, 2016.

- H. Khalil and J. Grizzle. Nonlinear systems, volume 3. Prentice hall Upper Saddle River, 2002.

- Bottou L. 1998. Online learning and stochastic approximations. In On-Line Learning in Neural Networks, ed. D Saad, pp. 9–42. New York: ACM

- Chernozhukov V, Escanciano JC, Ichimura H, Newey WK. 2016b. Locally robust semiparametric estimation. arXiv:1608.00033 [math.ST]

- Allen, P. G. (1994), "Economic forecasting in agriculture," International Journal of Forecasting, 10, 81–135.

- uyer, S. Whiteson, B. Bakker, and N. A. Vlassis. Multiagent reinforcement learning for urban traffic control using coordination graphs. In Machine Learning and Knowledge Discovery in Databases, European Conference, ECML/PKDD 2008, Antwerp, Belgium, September 15-19, 2008, Proceedings, Part I, pages 656–671, 2008.