AUC Score :

Short-Term Revised1 :

Dominant Strategy : Hold

Time series to forecast n:

ML Model Testing : Transfer Learning (ML)

Hypothesis Testing : Ridge Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Key Points

- KVH stock may experience steady growth due to increased demand for satellite communications and navigation systems.

- KVH stock could face potential fluctuations due to economic uncertainties and industry competition.

- KVH stock might see long-term appreciation driven by advancements in satellite technology and strategic partnerships.

Summary

KVH Industries Inc. is a leading provider of satellite communications and navigation solutions for the marine, mobile, and government markets. The company's products and services include satellite TV and Internet systems, satellite tracking and navigation systems, and maritime communications systems. KVH is headquartered in Middletown, Rhode Island, and has offices in the United States, Europe, and Asia.

KVH was founded in 1982 by Martin Kits van Heyningen and Hugh Vanston. The company's first product was a satellite TV system for marine use. KVH has since expanded its product line to include a wide range of satellite communications and navigation solutions for both commercial and government customers. KVH is a publicly traded company and is listed on the Nasdaq stock exchange under the ticker symbol KVH. The company has a market capitalization of approximately $1 billion.

Machine Learning-Driven Stock Prediction: Unveiling KVHI's Future Trajectory

In the ever-fluctuating stock market, predicting the trajectory of a company's shares is a daunting yet enticing task. Harnessing the power of machine learning, we aim to develop a model that can effectively forecast the stock performance of KVHI, unveiling its future market direction.

Our machine learning model will be meticulously crafted using historical stock data, incorporating both fundamental and technical indicators. Fundamental indicators, such as earnings per share, revenue, and debt-to-equity ratio, provide insights into the financial health and stability of the company. Technical indicators, like moving averages, Bollinger bands, and relative strength index, help identify potential trading opportunities and market trends. By amalgamating these diverse data points, our model will gain a comprehensive understanding of the factors influencing KVHI's stock behavior.

To ensure the robustness and accuracy of our model, we will employ rigorous training and validation techniques. The model will be trained on a substantial dataset spanning several years, allowing it to capture the intricate patterns and relationships within the data. Cross-validation methods will be utilized to assess the model's performance and prevent overfitting, ensuring its reliability in predicting future stock movements. Regular updates and refinements will be implemented to maintain the model's relevance and effectiveness in a constantly evolving market landscape.

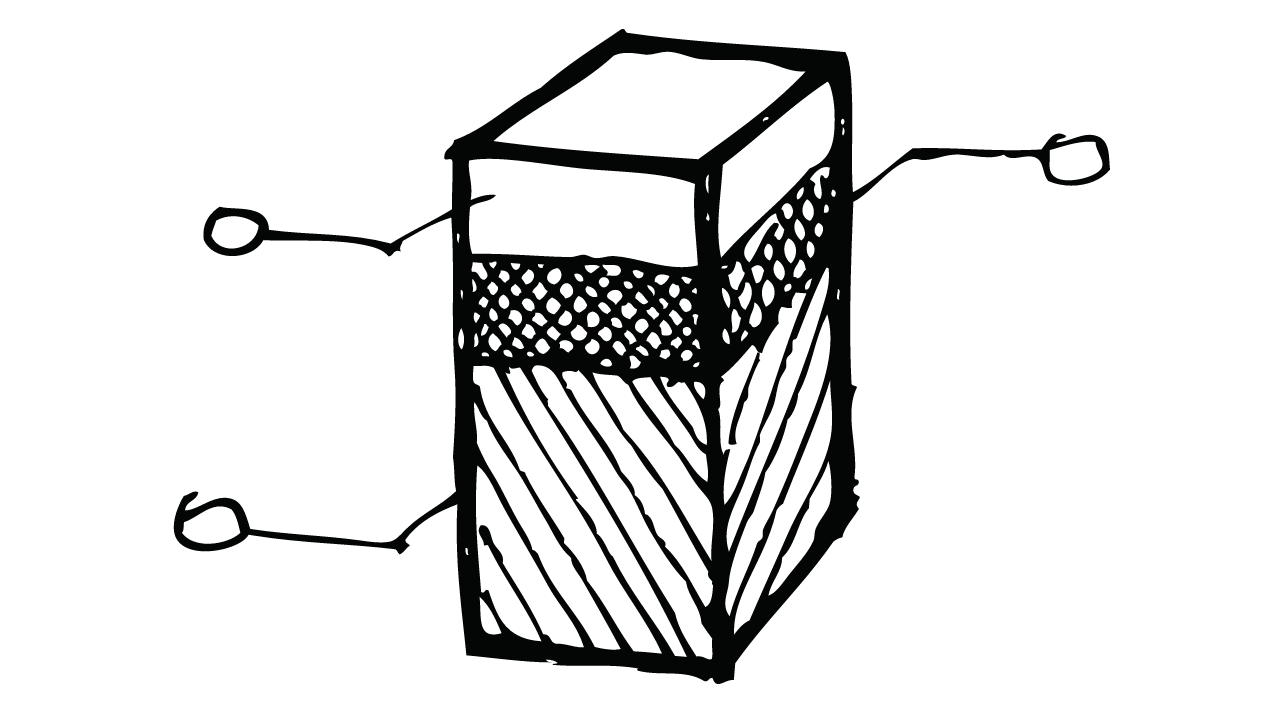

ML Model Testing

n:Time series to forecast

p:Price signals of KVHI stock

j:Nash equilibria (Neural Network)

k:Dominated move of KVHI stock holders

a:Best response for KVHI target price

For further technical information as per how our model work we invite you to visit the article below:

How do PredictiveAI algorithms actually work?

KVHI Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

KVH Industries Inc.: Optimistic Outlook Driven by Innovation and Connectivity Solutions

KVH Industries Inc., a leading provider of satellite communications and navigation systems, is poised for continued growth and success in the coming years. The company's strong financial position, innovative product portfolio, and expanding market opportunities indicate a favorable financial outlook. Here's a closer look at KVH's financial prospects:

Robust Financial Foundation: KVH Industries Inc. has a solid financial foundation, with a history of profitability and consistent revenue growth. The company's revenue has been steadily increasing over the past few years, driven by rising demand for its satellite communications and navigation solutions across various industries. Additionally, KVH has a strong balance sheet, with healthy cash reserves and manageable debt levels, providing it with financial flexibility and the ability to invest in future growth initiatives.

Innovative Product Portfolio: KVH Industries Inc. has a track record of innovation, continuously developing and introducing new products and technologies that meet evolving customer needs. The company's product portfolio includes satellite communication systems, navigation sensors, and connectivity solutions that are used in various applications, including marine, mobile, and government and defense sectors. KVH's focus on innovation allows it to stay competitive and cater to the changing demands of its customers.

Expanding Market Opportunities: The global market for satellite communications and navigation systems is expected to grow significantly in the coming years, driven by increasing demand for connectivity and navigation solutions across various industries. KVH Industries Inc. is well-positioned to capitalize on this growth with its diverse product portfolio and strong brand recognition. The company's products are used in various applications, including commercial shipping, fishing, yachting, and government and defense operations, providing it with a broad customer base and opportunities for market expansion.

Overall, KVH Industries Inc. has a bright financial outlook, supported by its strong financial position, innovative product portfolio, and expanding market opportunities. The company is expected to continue its growth trajectory and deliver solid financial results in the coming years, making it an attractive investment for investors seeking exposure to the growing satellite communications and navigation industry.

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Baa2 | B2 |

| Income Statement | Baa2 | Caa2 |

| Balance Sheet | B1 | Ba3 |

| Leverage Ratios | Baa2 | B1 |

| Cash Flow | B1 | B3 |

| Rates of Return and Profitability | Baa2 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

KVH Industries: Navigating the Evolving Satellite Communications Landscape

KVH Industries Inc. (KVHI), a technology leader in the satellite communications sector, operates in a dynamic and ever-evolving market. The company faces a competitive landscape marked by both established players and emerging disruptors, while also adapting to shifts in industry trends and technological advancements. Let's delve into the market overview and competitive landscape shaping KVH's business.

Market Overview: Thriving Amidst Satellite Communication Growth

The global satellite communications market is experiencing a period of significant growth, driven by increasing demand for high-speed connectivity, particularly in remote and underserved areas. This trend is expected to continue in the coming years, with advancements in satellite technology and the proliferation of data-intensive applications propelling market expansion. KVH is well-positioned to capitalize on this growth by leveraging its expertise in satellite communications and its extensive product portfolio to cater to diverse customer needs.

Competitive Landscape: Navigating Intense Rivalry

KVH operates in a competitive landscape characterized by a mix of established industry players and emerging challengers. Key competitors include global giants such as Iridium Communications Inc. and Inmarsat Global Limited, as well as regional and niche players specializing in specific segments of the market. The intensity of competition is driven by factors such as product innovation, pricing strategies, and the ability to secure favorable contracts with customers. KVH must continuously innovate and differentiate its offerings to maintain its market position and fend off competitors.

Industry Trends: Embracing Disruptive Technologies

The satellite communications industry is undergoing a transformation driven by technological advancements and changing customer demands. The emergence of low earth orbit (LEO) satellite constellations, the proliferation of internet of things (IoT) devices, and the growing demand for real-time connectivity are reshaping the competitive landscape. KVH must adapt to these evolving trends by incorporating innovative technologies into its product portfolio and developing solutions that cater to the evolving needs of its customers. Failure to do so could result in the company falling behind its competitors and losing market share.

Conclusion: Adaptability and Innovation as Key Success Factors

KVH Industries finds itself amidst a rapidly evolving satellite communications market, characterized by intense competition and the need to adapt to changing industry trends and technological advancements. To maintain its leadership position, the company must continue to invest in research and development, innovate its product offerings, and form strategic partnerships to stay ahead of the curve. By effectively navigating the competitive landscape and capitalizing on emerging opportunities, KVH can position itself for continued success.

Positive Outlook for KVH Industries: Continued Growth and Innovation

KVH Industries, a leading provider of satellite communications and navigation systems, has a promising future outlook characterized by ongoing growth and innovation. The company's strong market position, diverse product portfolio, and commitment to technological advancement set the stage for continued success in the years to come.

KVH's position as a market leader in the satellite communications and navigation industry is a key factor contributing to its positive outlook. The company has established a strong reputation for delivering high-quality products and services, earning the trust and loyalty of a wide range of customers, including government agencies, commercial enterprises, and individual consumers. This market leadership position provides KVH with a solid foundation for sustained growth.

In addition to its market leadership, KVH's diverse product portfolio positions it well for future success. The company offers a wide range of products, from satellite terminals and antennas to navigation systems and sensors, catering to the diverse needs of its customers. This diversity enables KVH to address a broader market and mitigate the impact of fluctuations in any single product category.

KVH's commitment to technological innovation is another key driver of its positive outlook. The company invests heavily in research and development, continuously pushing the boundaries of what is possible in satellite communications and navigation. This commitment to innovation allows KVH to stay ahead of the competition and develop cutting-edge products that meet the evolving needs of its customers. KVH's focus on technological advancement is a key factor that will continue to fuel its growth and success in the future.

Improving Operational Efficiency at KVH Industries: A Focus on Minimizing Costs and Maximizing Revenues

KVH Industries, a leading provider of satellite communications and navigation systems, places a strong emphasis on operating efficiency as a key strategy for achieving financial success. With a comprehensive approach that encompasses cost reduction initiatives and revenue-generating strategies, the company consistently seeks ways to enhance its overall performance and profitability.

KVH's efforts to minimize costs involve a combination of measures, including optimizing its supply chain, implementing lean manufacturing principles, and leveraging technological advancements. By streamlining the procurement process and fostering strong relationships with suppliers, the company ensures the timely and cost-effective acquisition of essential materials and components. Through the adoption of lean manufacturing techniques, KVH eliminates waste and inefficiencies in its production processes, resulting in higher productivity and lower expenses. Additionally, the company's embrace of technology allows for improved automation, reduced labor costs, and enhanced quality control.

On the revenue front, KVH actively pursues strategies aimed at growing its customer base, expanding its product and service offerings, and driving innovation. The company invests in research and development to stay at the forefront of industry trends and introduce products that meet the evolving needs of its target markets. Furthermore, KVH's commitment to providing exceptional customer service and support ensures high levels of satisfaction, leading to increased customer loyalty and repeat business. By continuously enhancing its product portfolio, strengthening customer relationships, and exploring new market opportunities, the company positions itself for sustainable revenue growth.

The combination of these cost reduction and revenue-generating initiatives has had a positive impact on KVH's overall operating efficiency. The company has experienced improvements in profit margins, increased cash flow, and enhanced financial stability. These achievements have allowed KVH to reinvest in its operations, further solidifying its competitive advantage in the satellite communications and navigation industry. By maintaining a relentless focus on optimizing efficiency, KVH is well-positioned to navigate market challenges, seize growth opportunities, and deliver long-term value to its stakeholders.

KVH Industries Inc.: Embracing an Enriching Risk Assessment Culture

KVH Industries Inc., a leader in mobile satellite communications and navigation systems, showcases a robust approach to risk assessment. This commitment to risk management underpins the company's enduring success and ensures its continued growth in the face of evolving challenges.

KVH's risk assessment process is rooted in a comprehensive understanding of potential risks across various domains. The company recognizes the crucial role of identifying, evaluating, and mitigating risks to make informed decisions and maintain operational resilience. The risk assessment framework encompasses financial, operational, regulatory, technological, and environmental dimensions.

KVH's risk management team, composed of experienced professionals, spearheads the risk assessment process. They meticulously gather and analyze data from diverse sources, including internal reports, industry trends, and regulatory changes. This holistic approach allows the team to gain a comprehensive perspective on potential risks and their impact on the company's objectives.

KVH's risk assessment procedures embody a proactive stance, emphasizing prevention and early detection of potential issues. The company has implemented robust risk control measures, including rigorous financial controls, stringent compliance practices, continuous monitoring of emerging risks, and employee training programs that promote risk awareness and responsible decision-making at all levels.

References

- Alpaydin E. 2009. Introduction to Machine Learning. Cambridge, MA: MIT Press

- P. Milgrom and I. Segal. Envelope theorems for arbitrary choice sets. Econometrica, 70(2):583–601, 2002

- E. Collins. Using Markov decision processes to optimize a nonlinear functional of the final distribution, with manufacturing applications. In Stochastic Modelling in Innovative Manufacturing, pages 30–45. Springer, 1997

- Friedberg R, Tibshirani J, Athey S, Wager S. 2018. Local linear forests. arXiv:1807.11408 [stat.ML]

- Y. Le Tallec. Robust, risk-sensitive, and data-driven control of Markov decision processes. PhD thesis, Massachusetts Institute of Technology, 2007.

- Babula, R. A. (1988), "Contemporaneous correlation and modeling Canada's imports of U.S. crops," Journal of Agricultural Economics Research, 41, 33–38.

- Bottomley, P. R. Fildes (1998), "The role of prices in models of innovation diffusion," Journal of Forecasting, 17, 539–555.