AUC Score :

Short-Term Revised1 :

Dominant Strategy : Sell

Time series to forecast n:

Methodology : Transfer Learning (ML)

Hypothesis Testing : Independent T-Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

Cadiz Inc. Depositary Shares prediction model is evaluated with Transfer Learning (ML) and Independent T-Test1,2,3,4 and it is concluded that the CDZIP stock is predictable in the short/long term. Transfer learning is a machine learning (ML) method where a model developed for one task is reused as the starting point for a model on a second task. This can be useful when the second task is similar to the first task, or when there is limited data available for the second task.5 According to price forecasts for 6 Month period, the dominant strategy among neural network is: Sell

Key Points

- Transfer Learning (ML) for CDZIP stock price prediction process.

- Independent T-Test

- Trading Signals

- What is prediction model?

- Operational Risk

CDZIP Stock Price Forecast

We consider Cadiz Inc. Depositary Shares Decision Process with Transfer Learning (ML) where A is the set of discrete actions of CDZIP stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: CDZIP Cadiz Inc. Depositary Shares

Time series to forecast: 6 Month

According to price forecasts, the dominant strategy among neural network is: Sell

n:Time series to forecast

p:Price signals of CDZIP stock

j:Nash equilibria (Neural Network)

k:Dominated move of CDZIP stock holders

a:Best response for CDZIP target price

Transfer learning is a machine learning (ML) method where a model developed for one task is reused as the starting point for a model on a second task. This can be useful when the second task is similar to the first task, or when there is limited data available for the second task.5 An independent t-test is a statistical test that compares the means of two independent samples. In an independent t-test, the data points in each sample are not related to each other. The independent t-test is a parametric test, which means that it assumes that the data is normally distributed. The independent t-test is also a two-sample test, which means that it compares the means of two independent samples.6,7

For further technical information as per how our model work we invite you to visit the article below:

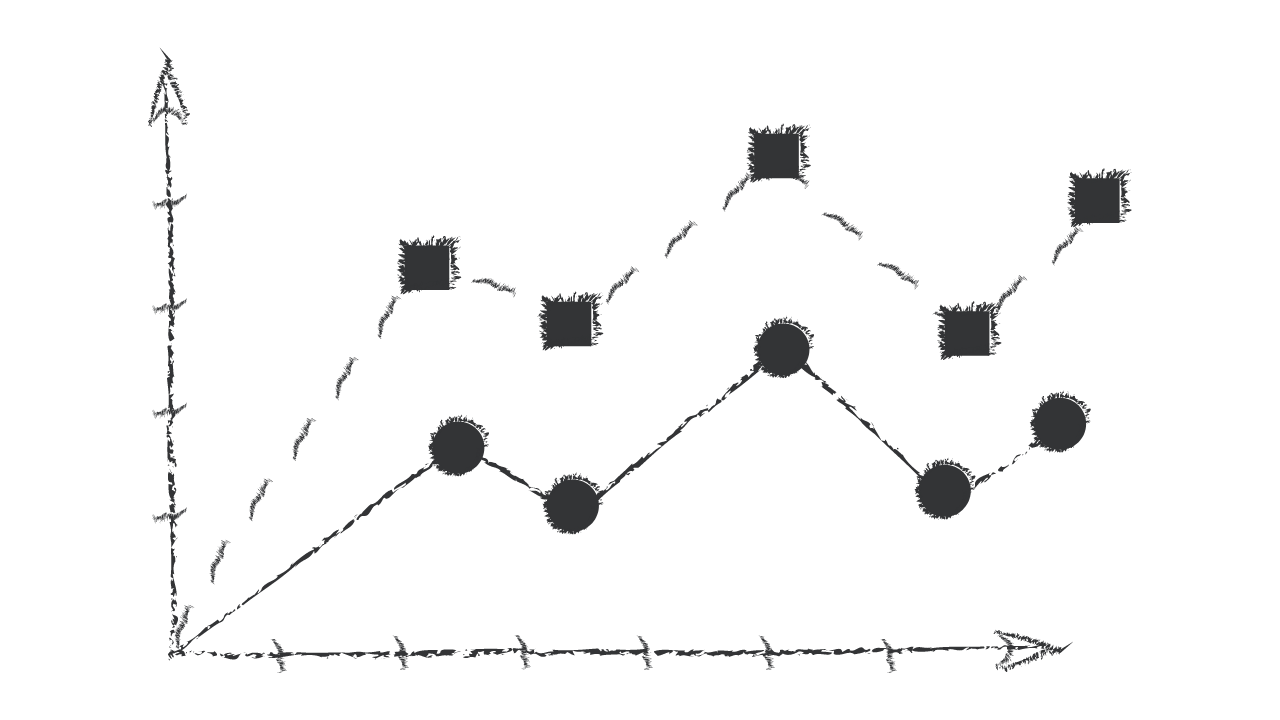

CDZIP Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Transfer Learning (ML) based CDZIP Stock Prediction Model

- An alternative benchmark rate designated as a non-contractually specified risk component that is not separately identifiable (see paragraphs 6.3.7(a) and B6.3.8) at the date it is designated shall be deemed to have met that requirement at that date, if, and only if, the entity reasonably expects the alternative benchmark rate will be separately identifiable within 24 months. The 24-month period applies to each alternative benchmark rate separately and starts from the date the entity designates the alternative benchmark rate as a non-contractually specified risk component for the first time (ie the 24- month period applies on a rate-by-rate basis).

- Expected credit losses reflect an entity's own expectations of credit losses. However, when considering all reasonable and supportable information that is available without undue cost or effort in estimating expected credit losses, an entity should also consider observable market information about the credit risk of the particular financial instrument or similar financial instruments.

- An entity can also designate only changes in the cash flows or fair value of a hedged item above or below a specified price or other variable (a 'one-sided risk'). The intrinsic value of a purchased option hedging instrument (assuming that it has the same principal terms as the designated risk), but not its time value, reflects a one-sided risk in a hedged item. For example, an entity can designate the variability of future cash flow outcomes resulting from a price increase of a forecast commodity purchase. In such a situation, the entity designates only cash flow losses that result from an increase in the price above the specified level. The hedged risk does not include the time value of a purchased option, because the time value is not a component of the forecast transaction that affects profit or loss.

- For loan commitments, an entity considers changes in the risk of a default occurring on the loan to which a loan commitment relates. For financial guarantee contracts, an entity considers the changes in the risk that the specified debtor will default on the contract.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

CDZIP Cadiz Inc. Depositary Shares Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B2 | Ba3 |

| Income Statement | Baa2 | B1 |

| Balance Sheet | B2 | Baa2 |

| Leverage Ratios | C | B3 |

| Cash Flow | C | Baa2 |

| Rates of Return and Profitability | Ba3 | C |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- V. Borkar. A sensitivity formula for the risk-sensitive cost and the actor-critic algorithm. Systems & Control Letters, 44:339–346, 2001

- Cortes C, Vapnik V. 1995. Support-vector networks. Mach. Learn. 20:273–97

- Akgiray, V. (1989), "Conditional heteroscedasticity in time series of stock returns: Evidence and forecasts," Journal of Business, 62, 55–80.

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. MRNA: The Next Big Thing in mRNA Vaccines. AC Investment Research Journal, 220(44).

- S. J. Russell and P. Norvig. Artificial Intelligence: A Modern Approach. Prentice Hall, Englewood Cliffs, NJ, 3nd edition, 2010

- Harris ZS. 1954. Distributional structure. Word 10:146–62

- Morris CN. 1983. Parametric empirical Bayes inference: theory and applications. J. Am. Stat. Assoc. 78:47–55

Frequently Asked Questions

Q: Is CDZIP stock expected to rise?A: CDZIP stock prediction model is evaluated with Transfer Learning (ML) and Independent T-Test and it is concluded that dominant strategy for CDZIP stock is Sell

Q: Is CDZIP stock a buy or sell?

A: The dominant strategy among neural network is to Sell CDZIP Stock.

Q: Is Cadiz Inc. Depositary Shares stock a good investment?

A: The consensus rating for Cadiz Inc. Depositary Shares is Sell and is assigned short-term B2 & long-term Ba3 estimated rating.

Q: What is the consensus rating of CDZIP stock?

A: The consensus rating for CDZIP is Sell.

Q: What is the forecast for CDZIP stock?

A: CDZIP target price forecast: Sell