AUC Score :

Short-Term Revised1 :

Dominant Strategy : Hold

Time series to forecast n:

Methodology : Deductive Inference (ML)

Hypothesis Testing : Beta

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

Valhi Inc. Common Stock prediction model is evaluated with Deductive Inference (ML) and Beta1,2,3,4 and it is concluded that the VHI stock is predictable in the short/long term. Deductive inference is a type of reasoning in which a conclusion is drawn based on a set of premises that are assumed to be true. In machine learning (ML), deductive inference can be used to create models that can make predictions about new data based on a set of known rules. Deductive inference is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of deductive inference algorithms, including decision trees, rule-based systems, and expert systems. Each type of algorithm has its own strengths and weaknesses.5 According to price forecasts for 3 Month period, the dominant strategy among neural network is: Hold

Key Points

- Deductive Inference (ML) for VHI stock price prediction process.

- Beta

- Prediction Modeling

- What is statistical models in machine learning?

- Investment Risk

VHI Stock Price Forecast

We consider Valhi Inc. Common Stock Decision Process with Deductive Inference (ML) where A is the set of discrete actions of VHI stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: VHI Valhi Inc. Common Stock

Time series to forecast: 3 Month

According to price forecasts, the dominant strategy among neural network is: Hold

n:Time series to forecast

p:Price signals of VHI stock

j:Nash equilibria (Neural Network)

k:Dominated move of VHI stock holders

a:Best response for VHI target price

Deductive inference is a type of reasoning in which a conclusion is drawn based on a set of premises that are assumed to be true. In machine learning (ML), deductive inference can be used to create models that can make predictions about new data based on a set of known rules. Deductive inference is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of deductive inference algorithms, including decision trees, rule-based systems, and expert systems. Each type of algorithm has its own strengths and weaknesses.5 In statistics, beta (β) is a measure of the strength of the relationship between two variables. It is calculated as the slope of the line of best fit in a regression analysis. Beta can range from -1 to 1, with a value of 0 indicating no relationship between the two variables. A positive beta indicates that as one variable increases, the other variable also increases. A negative beta indicates that as one variable increases, the other variable decreases. For example, a study might find that there is a positive relationship between height and weight. This means that taller people tend to weigh more. The beta coefficient for this relationship would be positive.6,7

For further technical information as per how our model work we invite you to visit the article below:

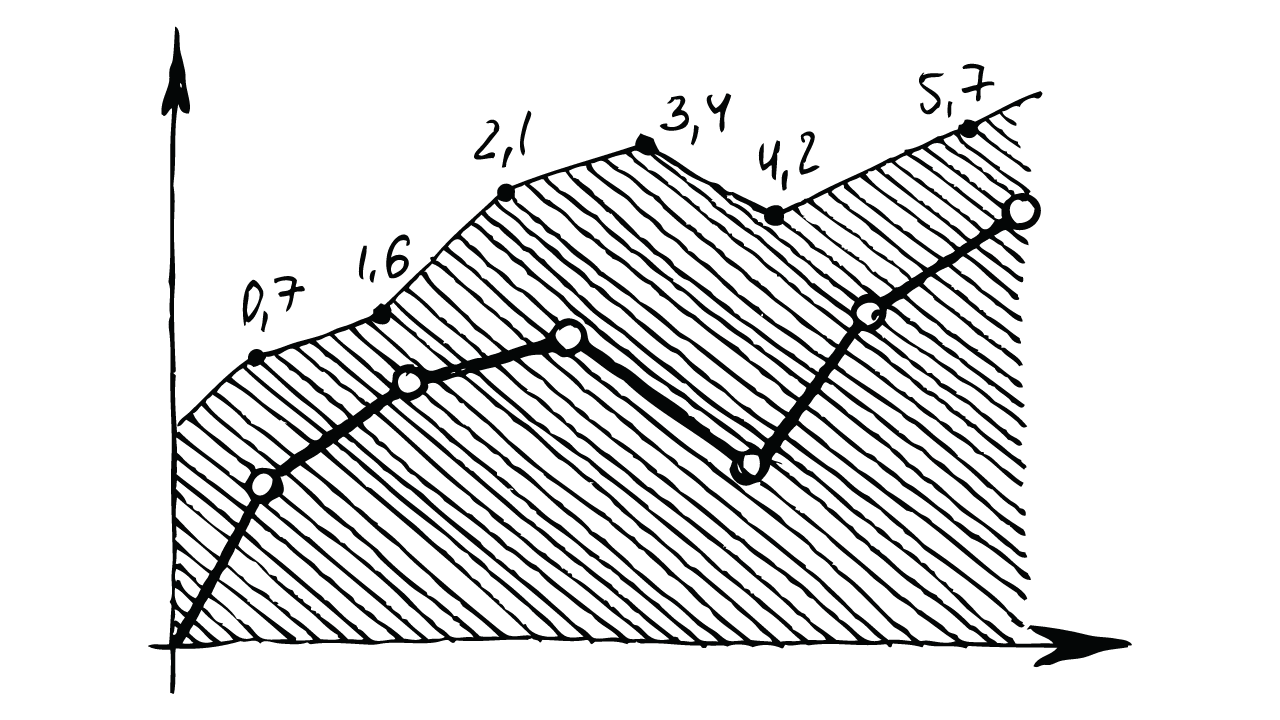

VHI Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Deductive Inference (ML) based VHI Stock Prediction Model

- However, the fact that a financial asset is non-recourse does not in itself necessarily preclude the financial asset from meeting the condition in paragraphs 4.1.2(b) and 4.1.2A(b). In such situations, the creditor is required to assess ('look through to') the particular underlying assets or cash flows to determine whether the contractual cash flows of the financial asset being classified are payments of principal and interest on the principal amount outstanding. If the terms of the financial asset give rise to any other cash flows or limit the cash flows in a manner inconsistent with payments representing principal and interest, the financial asset does not meet the condition in paragraphs 4.1.2(b) and 4.1.2A(b). Whether the underlying assets are financial assets or non-financial assets does not in itself affect this assessment.

- A regular way purchase or sale gives rise to a fixed price commitment between trade date and settlement date that meets the definition of a derivative. However, because of the short duration of the commitment it is not recognised as a derivative financial instrument. Instead, this Standard provides for special accounting for such regular way contracts (see paragraphs 3.1.2 and B3.1.3–B3.1.6).

- An entity shall assess at the inception of the hedging relationship, and on an ongoing basis, whether a hedging relationship meets the hedge effectiveness requirements. At a minimum, an entity shall perform the ongoing assessment at each reporting date or upon a significant change in the circumstances affecting the hedge effectiveness requirements, whichever comes first. The assessment relates to expectations about hedge effectiveness and is therefore only forward-looking.

- Interest Rate Benchmark Reform, which amended IFRS 9, IAS 39 and IFRS 7, issued in September 2019, added Section 6.8 and amended paragraph 7.2.26. An entity shall apply these amendments for annual periods beginning on or after 1 January 2020. Earlier application is permitted. If an entity applies these amendments for an earlier period, it shall disclose that fact.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

VHI Valhi Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B1 | B1 |

| Income Statement | Ba1 | Caa2 |

| Balance Sheet | C | Baa2 |

| Leverage Ratios | Caa2 | Ba2 |

| Cash Flow | Baa2 | C |

| Rates of Return and Profitability | Baa2 | B1 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Tesla Stock: Hold for Now, But Watch for Opportunities. AC Investment Research Journal, 220(44).

- Varian HR. 2014. Big data: new tricks for econometrics. J. Econ. Perspect. 28:3–28

- Candès E, Tao T. 2007. The Dantzig selector: statistical estimation when p is much larger than n. Ann. Stat. 35:2313–51

- Li L, Chen S, Kleban J, Gupta A. 2014. Counterfactual estimation and optimization of click metrics for search engines: a case study. In Proceedings of the 24th International Conference on the World Wide Web, pp. 929–34. New York: ACM

- Barkan O. 2016. Bayesian neural word embedding. arXiv:1603.06571 [math.ST]

- S. Bhatnagar and K. Lakshmanan. An online actor-critic algorithm with function approximation for con- strained Markov decision processes. Journal of Optimization Theory and Applications, 153(3):688–708, 2012.

- J. Filar, L. Kallenberg, and H. Lee. Variance-penalized Markov decision processes. Mathematics of Opera- tions Research, 14(1):147–161, 1989

Frequently Asked Questions

Q: Is VHI stock expected to rise?A: VHI stock prediction model is evaluated with Deductive Inference (ML) and Beta and it is concluded that dominant strategy for VHI stock is Hold

Q: Is VHI stock a buy or sell?

A: The dominant strategy among neural network is to Hold VHI Stock.

Q: Is Valhi Inc. Common Stock stock a good investment?

A: The consensus rating for Valhi Inc. Common Stock is Hold and is assigned short-term B1 & long-term B1 estimated rating.

Q: What is the consensus rating of VHI stock?

A: The consensus rating for VHI is Hold.

Q: What is the forecast for VHI stock?

A: VHI target price forecast: Hold