AUC Score :

Short-Term Revised1 :

Dominant Strategy : Buy

Time series to forecast n:

Methodology : Supervised Machine Learning (ML)

Hypothesis Testing : Stepwise Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

Ambrx Biopharma Inc. Common Stock prediction model is evaluated with Supervised Machine Learning (ML) and Stepwise Regression1,2,3,4 and it is concluded that the AMAM stock is predictable in the short/long term. Supervised machine learning (ML) is a type of machine learning where a model is trained on labeled data. This means that the data has been tagged with the correct output for the input data. The model learns to predict the output for new input data based on the labeled data. Supervised ML is a powerful tool that can be used for a variety of tasks, including classification, regression, and forecasting. Classification tasks involve predicting the category of an input data, such as whether an email is spam or not. Regression tasks involve predicting a numerical value for an input data, such as the price of a house. Forecasting tasks involve predicting future values for a time series, such as the sales of a product.5 According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- Supervised Machine Learning (ML) for AMAM stock price prediction process.

- Stepwise Regression

- Understanding Buy, Sell, and Hold Ratings

- How can neural networks improve predictions?

- Short/Long Term Stocks

AMAM Stock Price Forecast

We consider Ambrx Biopharma Inc. Common Stock Decision Process with Supervised Machine Learning (ML) where A is the set of discrete actions of AMAM stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: AMAM Ambrx Biopharma Inc. Common Stock

Time series to forecast: 4 Weeks

According to price forecasts, the dominant strategy among neural network is: Buy

n:Time series to forecast

p:Price signals of AMAM stock

j:Nash equilibria (Neural Network)

k:Dominated move of AMAM stock holders

a:Best response for AMAM target price

Supervised machine learning (ML) is a type of machine learning where a model is trained on labeled data. This means that the data has been tagged with the correct output for the input data. The model learns to predict the output for new input data based on the labeled data. Supervised ML is a powerful tool that can be used for a variety of tasks, including classification, regression, and forecasting. Classification tasks involve predicting the category of an input data, such as whether an email is spam or not. Regression tasks involve predicting a numerical value for an input data, such as the price of a house. Forecasting tasks involve predicting future values for a time series, such as the sales of a product.5 Stepwise regression is a method of variable selection in which variables are added or removed from a model one at a time, based on their statistical significance. There are two main types of stepwise regression: forward selection and backward elimination. In forward selection, variables are added to the model one at a time, starting with the variable with the highest F-statistic. The F-statistic is a measure of how much improvement in the model is gained by adding the variable. Variables are added to the model until no variable adds a statistically significant improvement to the model.6,7

For further technical information as per how our model work we invite you to visit the article below:

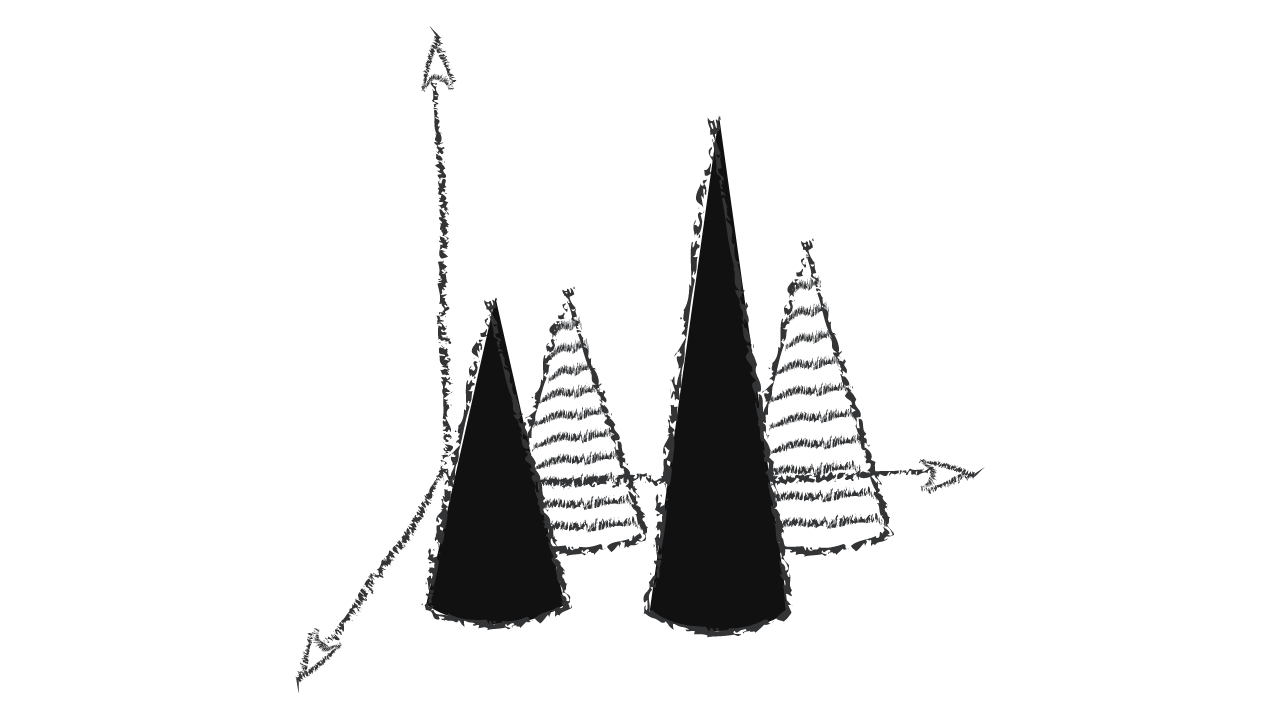

AMAM Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Supervised Machine Learning (ML) based AMAM Stock Prediction Model

- An entity can also designate only changes in the cash flows or fair value of a hedged item above or below a specified price or other variable (a 'one-sided risk'). The intrinsic value of a purchased option hedging instrument (assuming that it has the same principal terms as the designated risk), but not its time value, reflects a one-sided risk in a hedged item. For example, an entity can designate the variability of future cash flow outcomes resulting from a price increase of a forecast commodity purchase. In such a situation, the entity designates only cash flow losses that result from an increase in the price above the specified level. The hedged risk does not include the time value of a purchased option, because the time value is not a component of the forecast transaction that affects profit or loss.

- For the purposes of applying the requirement in paragraph 5.7.7(a), credit risk is different from asset-specific performance risk. Asset-specific performance risk is not related to the risk that an entity will fail to discharge a particular obligation but instead it is related to the risk that a single asset or a group of assets will perform poorly (or not at all).

- If a financial instrument is designated in accordance with paragraph 6.7.1 as measured at fair value through profit or loss after its initial recognition, or was previously not recognised, the difference at the time of designation between the carrying amount, if any, and the fair value shall immediately be recognised in profit or loss. For financial assets measured at fair value through other comprehensive income in accordance with paragraph 4.1.2A, the cumulative gain or loss previously recognised in other comprehensive income shall immediately be reclassified from equity to profit or loss as a reclassification adjustment.

- The significance of a change in the credit risk since initial recognition depends on the risk of a default occurring as at initial recognition. Thus, a given change, in absolute terms, in the risk of a default occurring will be more significant for a financial instrument with a lower initial risk of a default occurring compared to a financial instrument with a higher initial risk of a default occurring.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

AMAM Ambrx Biopharma Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B1 | B1 |

| Income Statement | Ba1 | Baa2 |

| Balance Sheet | Baa2 | C |

| Leverage Ratios | B3 | C |

| Cash Flow | C | Baa2 |

| Rates of Return and Profitability | B3 | B3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Dimakopoulou M, Athey S, Imbens G. 2017. Estimation considerations in contextual bandits. arXiv:1711.07077 [stat.ML]

- Chamberlain G. 2000. Econometrics and decision theory. J. Econom. 95:255–83

- Breusch, T. S. (1978), "Testing for autocorrelation in dynamic linear models," Australian Economic Papers, 17, 334–355.

- E. van der Pol and F. A. Oliehoek. Coordinated deep reinforcement learners for traffic light control. NIPS Workshop on Learning, Inference and Control of Multi-Agent Systems, 2016.

- F. A. Oliehoek and C. Amato. A Concise Introduction to Decentralized POMDPs. SpringerBriefs in Intelligent Systems. Springer, 2016

- R. Rockafellar and S. Uryasev. Conditional value-at-risk for general loss distributions. Journal of Banking and Finance, 26(7):1443 – 1471, 2002

- Farrell MH, Liang T, Misra S. 2018. Deep neural networks for estimation and inference: application to causal effects and other semiparametric estimands. arXiv:1809.09953 [econ.EM]

Frequently Asked Questions

Q: Is AMAM stock expected to rise?A: AMAM stock prediction model is evaluated with Supervised Machine Learning (ML) and Stepwise Regression and it is concluded that dominant strategy for AMAM stock is Buy

Q: Is AMAM stock a buy or sell?

A: The dominant strategy among neural network is to Buy AMAM Stock.

Q: Is Ambrx Biopharma Inc. Common Stock stock a good investment?

A: The consensus rating for Ambrx Biopharma Inc. Common Stock is Buy and is assigned short-term B1 & long-term B1 estimated rating.

Q: What is the consensus rating of AMAM stock?

A: The consensus rating for AMAM is Buy.

Q: What is the forecast for AMAM stock?

A: AMAM target price forecast: Buy