AUC Score :

Short-Term Revised1 :

Dominant Strategy : Buy

Time series to forecast n:

Methodology : Transfer Learning (ML)

Hypothesis Testing : Polynomial Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

TRITAX EUROBOX PLC prediction model is evaluated with Transfer Learning (ML) and Polynomial Regression1,2,3,4 and it is concluded that the LON:EBOX stock is predictable in the short/long term. Transfer learning is a machine learning (ML) method where a model developed for one task is reused as the starting point for a model on a second task. This can be useful when the second task is similar to the first task, or when there is limited data available for the second task. According to price forecasts for 1 Year period, the dominant strategy among neural network is: Buy

Key Points

- What is neural prediction?

- How do you decide buy or sell a stock?

- Game Theory

LON:EBOX Stock Price Forecast

We consider TRITAX EUROBOX PLC Decision Process with Transfer Learning (ML) where A is the set of discrete actions of LON:EBOX stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: LON:EBOX TRITAX EUROBOX PLC

Time series to forecast: 1 Year

According to price forecasts, the dominant strategy among neural network is: Buy

n:Time series to forecast

p:Price signals of LON:EBOX stock

j:Nash equilibria (Neural Network)

k:Dominated move of LON:EBOX stock holders

a:Best response for LON:EBOX target price

Transfer learning is a machine learning (ML) method where a model developed for one task is reused as the starting point for a model on a second task. This can be useful when the second task is similar to the first task, or when there is limited data available for the second task.Polynomial regression is a type of regression analysis that uses a polynomial function to model the relationship between a dependent variable and one or more independent variables. Polynomial functions are mathematical functions that have a polynomial term, which is a term that is raised to a power greater than 1. In polynomial regression, the dependent variable is modeled as a polynomial function of the independent variables. The degree of the polynomial function is determined by the researcher. The higher the degree of the polynomial function, the more complex the model will be.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

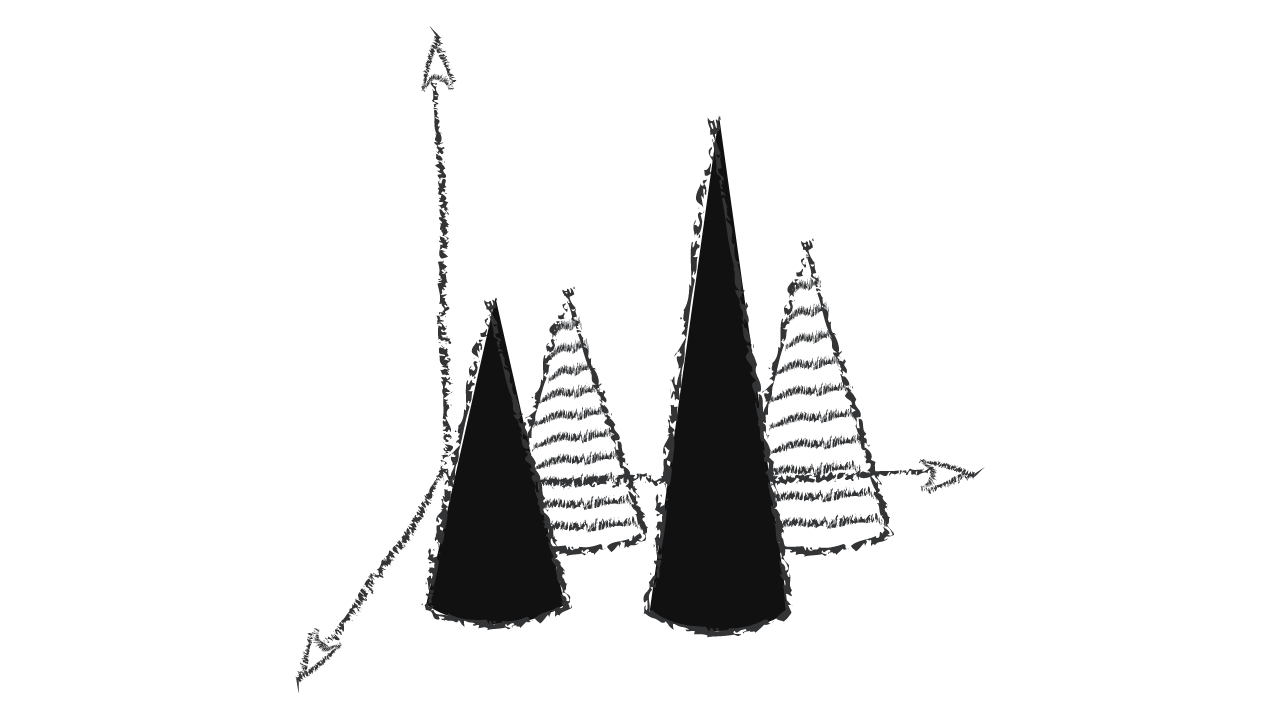

LON:EBOX Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Transfer Learning (ML) based LON:EBOX Stock Prediction Model

- An embedded prepayment option in an interest-only or principal-only strip is closely related to the host contract provided the host contract (i) initially resulted from separating the right to receive contractual cash flows of a financial instrument that, in and of itself, did not contain an embedded derivative, and (ii) does not contain any terms not present in the original host debt contract.

- The requirements in paragraphs 6.8.4–6.8.8 may cease to apply at different times. Therefore, in applying paragraph 6.9.1, an entity may be required to amend the formal designation of its hedging relationships at different times, or may be required to amend the formal designation of a hedging relationship more than once. When, and only when, such a change is made to the hedge designation, an entity shall apply paragraphs 6.9.7–6.9.12 as applicable. An entity also shall apply paragraph 6.5.8 (for a fair value hedge) or paragraph 6.5.11 (for a cash flow hedge) to account for any changes in the fair value of the hedged item or the hedging instrument.

- An entity can rebut this presumption. However, it can do so only when it has reasonable and supportable information available that demonstrates that even if contractual payments become more than 30 days past due, this does not represent a significant increase in the credit risk of a financial instrument. For example when non-payment was an administrative oversight, instead of resulting from financial difficulty of the borrower, or the entity has access to historical evidence that demonstrates that there is no correlation between significant increases in the risk of a default occurring and financial assets on which payments are more than 30 days past due, but that evidence does identify such a correlation when payments are more than 60 days past due.

- If a financial instrument that was previously recognised as a financial asset is measured at fair value through profit or loss and its fair value decreases below zero, it is a financial liability measured in accordance with paragraph 4.2.1. However, hybrid contracts with hosts that are assets within the scope of this Standard are always measured in accordance with paragraph 4.3.2.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

LON:EBOX TRITAX EUROBOX PLC Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | B1 |

| Income Statement | Baa2 | Baa2 |

| Balance Sheet | B1 | Caa2 |

| Leverage Ratios | B3 | B3 |

| Cash Flow | Baa2 | C |

| Rates of Return and Profitability | Caa2 | B1 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Mikolov T, Chen K, Corrado GS, Dean J. 2013a. Efficient estimation of word representations in vector space. arXiv:1301.3781 [cs.CL]

- Hartford J, Lewis G, Taddy M. 2016. Counterfactual prediction with deep instrumental variables networks. arXiv:1612.09596 [stat.AP]

- L. Prashanth and M. Ghavamzadeh. Actor-critic algorithms for risk-sensitive MDPs. In Proceedings of Advances in Neural Information Processing Systems 26, pages 252–260, 2013.

- T. Shardlow and A. Stuart. A perturbation theory for ergodic Markov chains and application to numerical approximations. SIAM journal on numerical analysis, 37(4):1120–1137, 2000

- Barrett, C. B. (1997), "Heteroscedastic price forecasting for food security management in developing countries," Oxford Development Studies, 25, 225–236.

- Mikolov T, Chen K, Corrado GS, Dean J. 2013a. Efficient estimation of word representations in vector space. arXiv:1301.3781 [cs.CL]

- Kitagawa T, Tetenov A. 2015. Who should be treated? Empirical welfare maximization methods for treatment choice. Tech. Rep., Cent. Microdata Methods Pract., Inst. Fiscal Stud., London

Frequently Asked Questions

Q: What is the prediction methodology for LON:EBOX stock?A: LON:EBOX stock prediction methodology: We evaluate the prediction models Transfer Learning (ML) and Polynomial Regression

Q: Is LON:EBOX stock a buy or sell?

A: The dominant strategy among neural network is to Buy LON:EBOX Stock.

Q: Is TRITAX EUROBOX PLC stock a good investment?

A: The consensus rating for TRITAX EUROBOX PLC is Buy and is assigned short-term Ba3 & long-term B1 estimated rating.

Q: What is the consensus rating of LON:EBOX stock?

A: The consensus rating for LON:EBOX is Buy.

Q: What is the prediction period for LON:EBOX stock?

A: The prediction period for LON:EBOX is 1 Year