AUC Score :

Short-Term Revised1 :

Dominant Strategy : Sell

Time series to forecast n:

Methodology : Inductive Learning (ML)

Hypothesis Testing : Chi-Square

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Mill City Ventures III Ltd. Common Stock prediction model is evaluated with Inductive Learning (ML) and Chi-Square1,2,3,4 and it is concluded that the MCVT stock is predictable in the short/long term. Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.5 According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

Key Points

- What is the best way to predict stock prices?

- Prediction Modeling

- Dominated Move

MCVT Stock Price Forecast

We consider Mill City Ventures III Ltd. Common Stock Decision Process with Inductive Learning (ML) where A is the set of discrete actions of MCVT stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: MCVT Mill City Ventures III Ltd. Common Stock

Time series to forecast: 1 Year

According to price forecasts, the dominant strategy among neural network is: Sell

n:Time series to forecast

p:Price signals of MCVT stock

j:Nash equilibria (Neural Network)

k:Dominated move of MCVT stock holders

a:Best response for MCVT target price

Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.5 A chi-squared test is a statistical hypothesis test that assesses whether observed frequencies in a sample differ significantly from expected frequencies. It is one of the most widely used statistical tests in the social sciences and in many areas of observational research. The chi-squared test is a non-parametric test, meaning that it does not assume that the data is normally distributed. This makes it a versatile tool that can be used to analyze a wide variety of data. There are two main types of chi-squared tests: the chi-squared goodness of fit test and the chi-squared test of independence.6,7

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

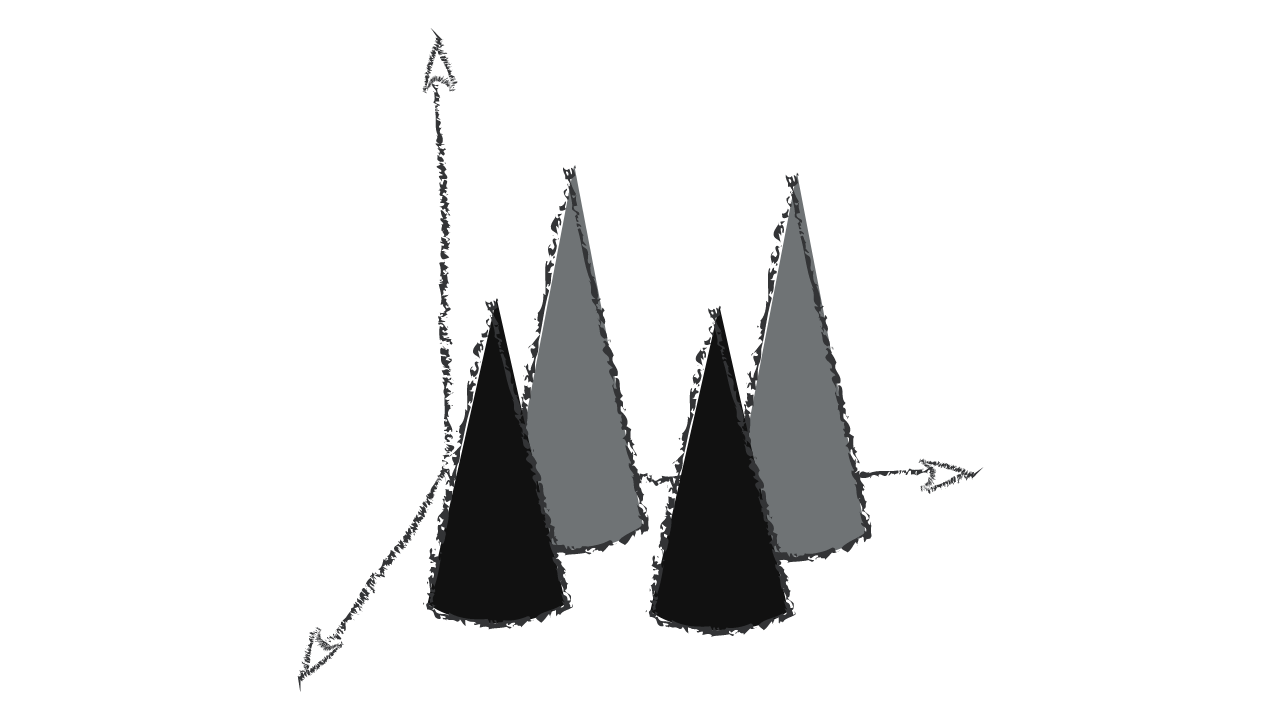

MCVT Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Inductive Learning (ML) based MCVT Stock Prediction Model

- To be eligible for designation as a hedged item, a risk component must be a separately identifiable component of the financial or the non-financial item, and the changes in the cash flows or the fair value of the item attributable to changes in that risk component must be reliably measurable.

- Paragraph 4.1.1(b) requires an entity to classify a financial asset on the basis of its contractual cash flow characteristics if the financial asset is held within a business model whose objective is to hold assets to collect contractual cash flows or within a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets, unless paragraph 4.1.5 applies. To do so, the condition in paragraphs 4.1.2(b) and 4.1.2A(b) requires an entity to determine whether the asset's contractual cash flows are solely payments of principal and interest on the principal amount outstanding.

- If the group of items does not have any offsetting risk positions (for example, a group of foreign currency expenses that affect different line items in the statement of profit or loss and other comprehensive income that are hedged for foreign currency risk) then the reclassified hedging instrument gains or losses shall be apportioned to the line items affected by the hedged items. This apportionment shall be done on a systematic and rational basis and shall not result in the grossing up of the net gains or losses arising from a single hedging instrument.

- A similar example of a non-financial item is a specific type of crude oil from a particular oil field that is priced off the relevant benchmark crude oil. If an entity sells that crude oil under a contract using a contractual pricing formula that sets the price per barrel at the benchmark crude oil price minus CU10 with a floor of CU15, the entity can designate as the hedged item the entire cash flow variability under the sales contract that is attributable to the change in the benchmark crude oil price. However, the entity cannot designate a component that is equal to the full change in the benchmark crude oil price. Hence, as long as the forward price (for each delivery) does not fall below CU25, the hedged item has the same cash flow variability as a crude oil sale at the benchmark crude oil price (or with a positive spread). However, if the forward price for any delivery falls below CU25, the hedged item has a lower cash flow variability than a crude oil sale at the benchmark crude oil price (or with a positive spread).

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

MCVT Mill City Ventures III Ltd. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | B1 |

| Income Statement | Baa2 | Caa2 |

| Balance Sheet | Baa2 | B3 |

| Leverage Ratios | C | C |

| Cash Flow | Baa2 | Baa2 |

| Rates of Return and Profitability | B1 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Byron, R. P. O. Ashenfelter (1995), "Predicting the quality of an unborn grange," Economic Record, 71, 40–53.

- J. Harb and D. Precup. Investigating recurrence and eligibility traces in deep Q-networks. In Deep Reinforcement Learning Workshop, NIPS 2016, Barcelona, Spain, 2016.

- Jorgenson, D.W., Weitzman, M.L., ZXhang, Y.X., Haxo, Y.M. and Mat, Y.X., 2023. Google's Stock Price Set to Soar in the Next 3 Months. AC Investment Research Journal, 220(44).

- Bamler R, Mandt S. 2017. Dynamic word embeddings via skip-gram filtering. In Proceedings of the 34th Inter- national Conference on Machine Learning, pp. 380–89. La Jolla, CA: Int. Mach. Learn. Soc.

- J. G. Schneider, W. Wong, A. W. Moore, and M. A. Riedmiller. Distributed value functions. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 371–378, 1999.

- Morris CN. 1983. Parametric empirical Bayes inference: theory and applications. J. Am. Stat. Assoc. 78:47–55

- Athey S. 2017. Beyond prediction: using big data for policy problems. Science 355:483–85

Frequently Asked Questions

Q: What is the prediction methodology for MCVT stock?A: MCVT stock prediction methodology: We evaluate the prediction models Inductive Learning (ML) and Chi-Square

Q: Is MCVT stock a buy or sell?

A: The dominant strategy among neural network is to Sell MCVT Stock.

Q: Is Mill City Ventures III Ltd. Common Stock stock a good investment?

A: The consensus rating for Mill City Ventures III Ltd. Common Stock is Sell and is assigned short-term Ba3 & long-term B1 estimated rating.

Q: What is the consensus rating of MCVT stock?

A: The consensus rating for MCVT is Sell.

Q: What is the prediction period for MCVT stock?

A: The prediction period for MCVT is 1 Year