AUC Score :

Short-Term Revised1 :

Dominant Strategy : Hold

Time series to forecast n:

Methodology : Transductive Learning (ML)

Hypothesis Testing : Spearman Correlation

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Immix Biopharma Inc. Common Stock prediction model is evaluated with Transductive Learning (ML) and Spearman Correlation1,2,3,4 and it is concluded that the IMMX stock is predictable in the short/long term. Transductive learning is a supervised machine learning (ML) method in which the model is trained on both labeled and unlabeled data. The goal of transductive learning is to predict the labels of the unlabeled data. Transductive learning is a hybrid of inductive and semi-supervised learning. Inductive learning algorithms are trained on labeled data only, while semi-supervised learning algorithms are trained on a combination of labeled and unlabeled data. Transductive learning algorithms can achieve better performance than inductive learning algorithms on tasks where there is a small amount of labeled data. This is because transductive learning algorithms can use the unlabeled data to help them learn the relationships between the features and the labels. According to price forecasts for 1 Year period, the dominant strategy among neural network is: Hold

Key Points

- Stock Rating

- How useful are statistical predictions?

- Market Outlook

IMMX Target Price Prediction Modeling Methodology

We consider Immix Biopharma Inc. Common Stock Decision Process with Transductive Learning (ML) where A is the set of discrete actions of IMMX stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Spearman Correlation)5,6,7= X R(Transductive Learning (ML)) X S(n):→ 1 Year

n:Time series to forecast

p:Price signals of IMMX stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Transductive Learning (ML)

Transductive learning is a supervised machine learning (ML) method in which the model is trained on both labeled and unlabeled data. The goal of transductive learning is to predict the labels of the unlabeled data. Transductive learning is a hybrid of inductive and semi-supervised learning. Inductive learning algorithms are trained on labeled data only, while semi-supervised learning algorithms are trained on a combination of labeled and unlabeled data. Transductive learning algorithms can achieve better performance than inductive learning algorithms on tasks where there is a small amount of labeled data. This is because transductive learning algorithms can use the unlabeled data to help them learn the relationships between the features and the labels.Spearman Correlation

Spearman correlation is a nonparametric measure of the strength and direction of association between two variables. It is a rank-based correlation, which means that it does not assume that the data is normally distributed. Spearman correlation is calculated by first ranking the data for each variable, and then calculating the Pearson correlation between the ranks.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

IMMX Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: IMMX Immix Biopharma Inc. Common Stock

Time series to forecast: 1 Year

According to price forecasts, the dominant strategy among neural network is: Hold

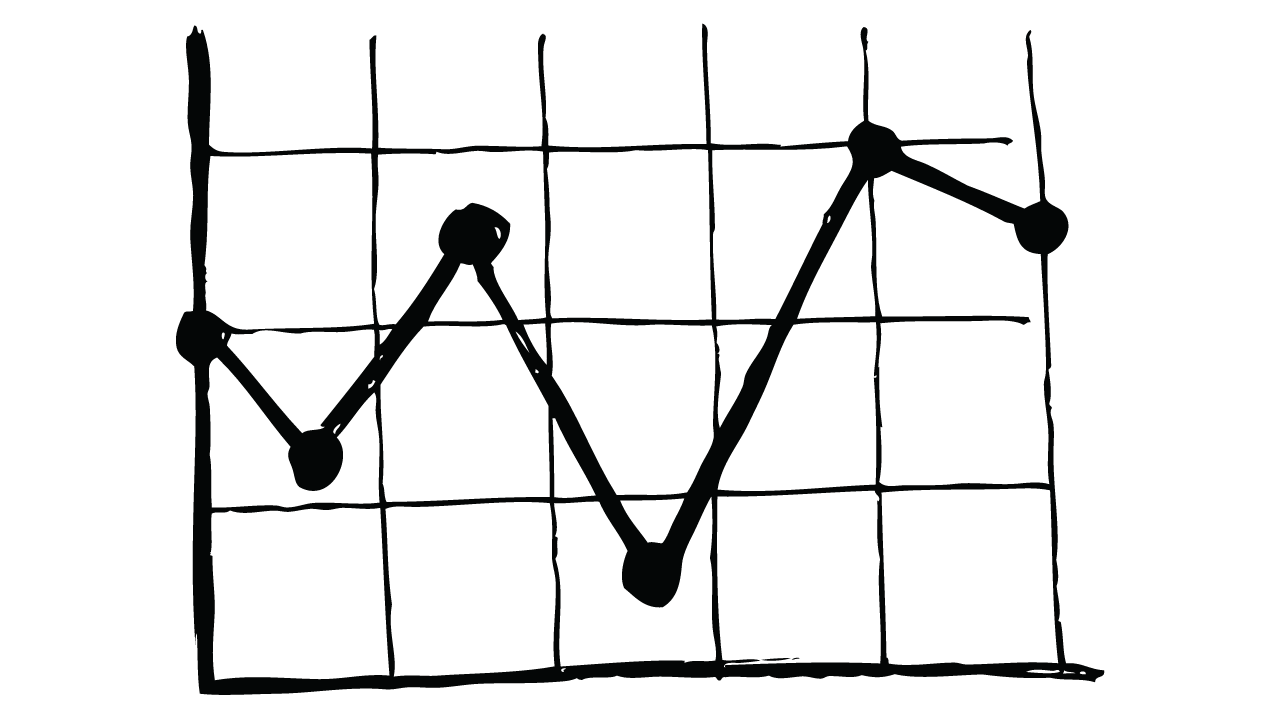

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Transductive Learning (ML) based IMMX Stock Prediction Model

- If an entity previously accounted at cost (in accordance with IAS 39), for an investment in an equity instrument that does not have a quoted price in an active market for an identical instrument (ie a Level 1 input) (or for a derivative asset that is linked to and must be settled by delivery of such an equity instrument) it shall measure that instrument at fair value at the date of initial application. Any difference between the previous carrying amount and the fair value shall be recognised in the opening retained earnings (or other component of equity, as appropriate) of the reporting period that includes the date of initial application.

- For the purpose of determining whether a forecast transaction (or a component thereof) is highly probable as required by paragraph 6.3.3, an entity shall assume that the interest rate benchmark on which the hedged cash flows (contractually or non-contractually specified) are based is not altered as a result of interest rate benchmark reform.

- There is a rebuttable presumption that unless inflation risk is contractually specified, it is not separately identifiable and reliably measurable and hence cannot be designated as a risk component of a financial instrument. However, in limited cases, it is possible to identify a risk component for inflation risk that is separately identifiable and reliably measurable because of the particular circumstances of the inflation environment and the relevant debt market

- The fact that a derivative is in or out of the money when it is designated as a hedging instrument does not in itself mean that a qualitative assessment is inappropriate. It depends on the circumstances whether hedge ineffectiveness arising from that fact could have a magnitude that a qualitative assessment would not adequately capture.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

IMMX Immix Biopharma Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B3 | Baa2 |

| Income Statement | Baa2 | Baa2 |

| Balance Sheet | C | Baa2 |

| Leverage Ratios | B2 | Baa2 |

| Cash Flow | C | Baa2 |

| Rates of Return and Profitability | C | Ba2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- A. Tamar, Y. Glassner, and S. Mannor. Policy gradients beyond expectations: Conditional value-at-risk. In AAAI, 2015

- V. Mnih, A. P. Badia, M. Mirza, A. Graves, T. P. Lillicrap, T. Harley, D. Silver, and K. Kavukcuoglu. Asynchronous methods for deep reinforcement learning. In Proceedings of the 33nd International Conference on Machine Learning, ICML 2016, New York City, NY, USA, June 19-24, 2016, pages 1928–1937, 2016

- Chamberlain G. 2000. Econometrics and decision theory. J. Econom. 95:255–83

- Hastie T, Tibshirani R, Tibshirani RJ. 2017. Extended comparisons of best subset selection, forward stepwise selection, and the lasso. arXiv:1707.08692 [stat.ME]

- LeCun Y, Bengio Y, Hinton G. 2015. Deep learning. Nature 521:436–44

- Breiman L. 1993. Better subset selection using the non-negative garotte. Tech. Rep., Univ. Calif., Berkeley

- Robins J, Rotnitzky A. 1995. Semiparametric efficiency in multivariate regression models with missing data. J. Am. Stat. Assoc. 90:122–29

Frequently Asked Questions

Q: What is the prediction methodology for IMMX stock?A: IMMX stock prediction methodology: We evaluate the prediction models Transductive Learning (ML) and Spearman Correlation

Q: Is IMMX stock a buy or sell?

A: The dominant strategy among neural network is to Hold IMMX Stock.

Q: Is Immix Biopharma Inc. Common Stock stock a good investment?

A: The consensus rating for Immix Biopharma Inc. Common Stock is Hold and is assigned short-term B3 & long-term Baa2 estimated rating.

Q: What is the consensus rating of IMMX stock?

A: The consensus rating for IMMX is Hold.

Q: What is the prediction period for IMMX stock?

A: The prediction period for IMMX is 1 Year