AUC Score :

Short-Term Revised1 :

Dominant Strategy : Hold

Time series to forecast n:

Methodology : Inductive Learning (ML)

Hypothesis Testing : Logistic Regression

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

DatChat Inc. Common Stock prediction model is evaluated with Inductive Learning (ML) and Logistic Regression1,2,3,4 and it is concluded that the DATS stock is predictable in the short/long term. Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.5 According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Hold

Key Points

- Which neural network is best for prediction?

- Can we predict stock market using machine learning?

- Trading Interaction

DATS Stock Price Forecast

We consider DatChat Inc. Common Stock Decision Process with Inductive Learning (ML) where A is the set of discrete actions of DATS stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

Sample Set: Neural Network

Stock/Index: DATS DatChat Inc. Common Stock

Time series to forecast: 16 Weeks

According to price forecasts, the dominant strategy among neural network is: Hold

n:Time series to forecast

p:Price signals of DATS stock

j:Nash equilibria (Neural Network)

k:Dominated move of DATS stock holders

a:Best response for DATS target price

Inductive learning is a type of machine learning in which the model learns from a set of labeled data and makes predictions about new, unlabeled data. The model is trained on the labeled data and then used to make predictions on new data. Inductive learning is a supervised learning algorithm, which means that it requires labeled data to train. The labeled data is used to train the model to make predictions about new data. There are many different types of inductive learning algorithms, including decision trees, support vector machines, and neural networks. Each type of algorithm has its own strengths and weaknesses.5 In statistics, logistic regression is a type of regression analysis used when the dependent variable is categorical. Logistic regression is a probability model that predicts the probability of an event occurring based on a set of independent variables. In logistic regression, the dependent variable is represented as a binary variable, such as "yes" or "no," "true" or "false," or "sick" or "healthy." The independent variables can be continuous or categorical variables.6,7

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

DATS Stock Forecast (Buy or Sell) Strategic Interaction Table

Strategic Interaction Table Legend:

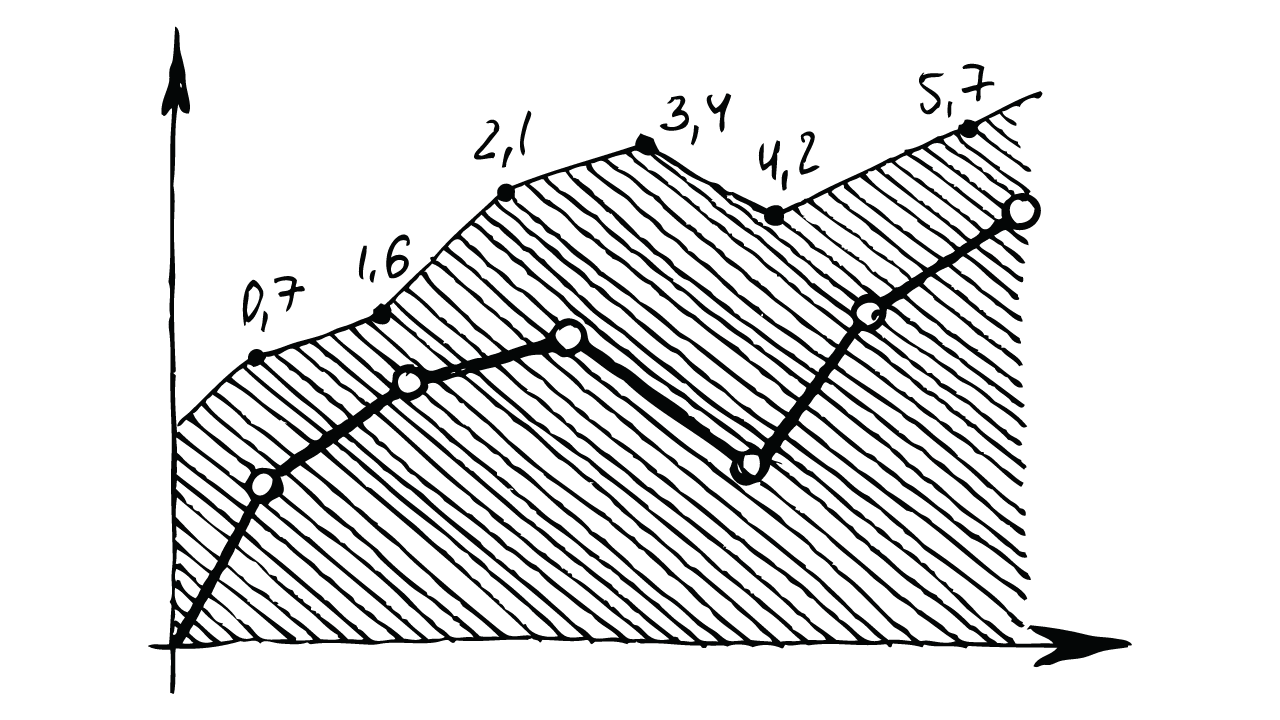

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Inductive Learning (ML) based DATS Stock Prediction Model

- This Standard does not specify a method for assessing whether a hedging relationship meets the hedge effectiveness requirements. However, an entity shall use a method that captures the relevant characteristics of the hedging relationship including the sources of hedge ineffectiveness. Depending on those factors, the method can be a qualitative or a quantitative assessment.

- If a component of the cash flows of a financial or a non-financial item is designated as the hedged item, that component must be less than or equal to the total cash flows of the entire item. However, all of the cash flows of the entire item may be designated as the hedged item and hedged for only one particular risk (for example, only for those changes that are attributable to changes in LIBOR or a benchmark commodity price).

- The following are examples of when the objective of the entity's business model may be achieved by both collecting contractual cash flows and selling financial assets. This list of examples is not exhaustive. Furthermore, the examples are not intended to describe all the factors that may be relevant to the assessment of the entity's business model nor specify the relative importance of the factors.

- The fair value of a financial instrument at initial recognition is normally the transaction price (ie the fair value of the consideration given or received, see also paragraph B5.1.2A and IFRS 13). However, if part of the consideration given or received is for something other than the financial instrument, an entity shall measure the fair value of the financial instrument. For example, the fair value of a long-term loan or receivable that carries no interest can be measured as the present value of all future cash receipts discounted using the prevailing market rate(s) of interest for a similar instrument (similar as to currency, term, type of interest rate and other factors) with a similar credit rating. Any additional amount lent is an expense or a reduction of income unless it qualifies for recognition as some other type of asset.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

DATS DatChat Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | B2 |

| Income Statement | Caa2 | B3 |

| Balance Sheet | B1 | Ba1 |

| Leverage Ratios | Baa2 | C |

| Cash Flow | Baa2 | B3 |

| Rates of Return and Profitability | B2 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

References

- Bamler R, Mandt S. 2017. Dynamic word embeddings via skip-gram filtering. In Proceedings of the 34th Inter- national Conference on Machine Learning, pp. 380–89. La Jolla, CA: Int. Mach. Learn. Soc.

- Harris ZS. 1954. Distributional structure. Word 10:146–62

- Van der Vaart AW. 2000. Asymptotic Statistics. Cambridge, UK: Cambridge Univ. Press

- P. Artzner, F. Delbaen, J. Eber, and D. Heath. Coherent measures of risk. Journal of Mathematical Finance, 9(3):203–228, 1999

- V. Borkar. An actor-critic algorithm for constrained Markov decision processes. Systems & Control Letters, 54(3):207–213, 2005.

- C. Szepesvári. Algorithms for Reinforcement Learning. Synthesis Lectures on Artificial Intelligence and Machine Learning. Morgan & Claypool Publishers, 2010

- Knox SW. 2018. Machine Learning: A Concise Introduction. Hoboken, NJ: Wiley

Frequently Asked Questions

Q: What is the prediction methodology for DATS stock?A: DATS stock prediction methodology: We evaluate the prediction models Inductive Learning (ML) and Logistic Regression

Q: Is DATS stock a buy or sell?

A: The dominant strategy among neural network is to Hold DATS Stock.

Q: Is DatChat Inc. Common Stock stock a good investment?

A: The consensus rating for DatChat Inc. Common Stock is Hold and is assigned short-term Ba3 & long-term B2 estimated rating.

Q: What is the consensus rating of DATS stock?

A: The consensus rating for DATS is Hold.

Q: What is the prediction period for DATS stock?

A: The prediction period for DATS is 16 Weeks