AUC Score :

Short-Term Revised1 :

Dominant Strategy : Buy

Time series to forecast n:

Methodology : Statistical Inference (ML)

Hypothesis Testing : Pearson Correlation

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

BOAB METALS LIMITED prediction model is evaluated with Statistical Inference (ML) and Pearson Correlation1,2,3,4 and it is concluded that the BML stock is predictable in the short/long term. Statistical inference is a process of drawing conclusions about a population based on data from a sample of that population. In machine learning (ML), statistical inference is used to make predictions about new data based on data that has already been seen. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- Prediction Modeling

- Dominated Move

- What statistical methods are used to analyze data?

BML Target Price Prediction Modeling Methodology

We consider BOAB METALS LIMITED Decision Process with Statistical Inference (ML) where A is the set of discrete actions of BML stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Pearson Correlation)5,6,7= X R(Statistical Inference (ML)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of BML stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Statistical Inference (ML)

Statistical inference is a process of drawing conclusions about a population based on data from a sample of that population. In machine learning (ML), statistical inference is used to make predictions about new data based on data that has already been seen.Pearson Correlation

Pearson correlation, also known as Pearson's product-moment correlation, is a measure of the linear relationship between two variables. It is a statistical measure that assesses the strength and direction of a linear relationship between two variables. The sign of the correlation coefficient indicates the direction of the relationship, while the magnitude of the correlation coefficient indicates the strength of the relationship. A correlation coefficient of 0.9 indicates a strong positive correlation, while a correlation coefficient of 0.2 indicates a weak positive correlation.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

BML Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: BML BOAB METALS LIMITED

Time series to forecast: 8 Weeks

According to price forecasts, the dominant strategy among neural network is: Buy

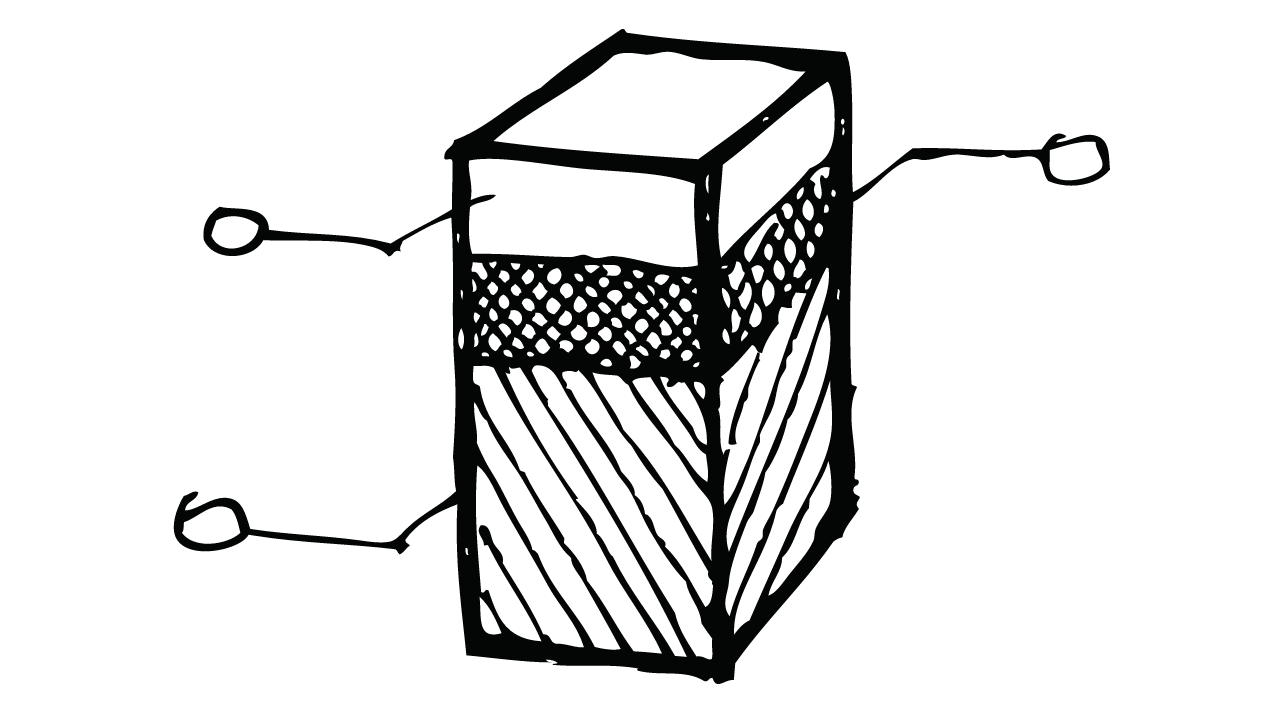

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Statistical Inference (ML) based BML Stock Prediction Model

- If changes are made in addition to those changes required by interest rate benchmark reform to the financial asset or financial liability designated in a hedging relationship (as described in paragraphs 5.4.6–5.4.8) or to the designation of the hedging relationship (as required by paragraph 6.9.1), an entity shall first apply the applicable requirements in this Standard to determine if those additional changes result in the discontinuation of hedge accounting. If the additional changes do not result in the discontinuation of hedge accounting, an entity shall amend the formal designation of the hedging relationship as specified in paragraph 6.9.1.

- For a discontinued hedging relationship, when the interest rate benchmark on which the hedged future cash flows had been based is changed as required by interest rate benchmark reform, for the purpose of applying paragraph 6.5.12 in order to determine whether the hedged future cash flows are expected to occur, the amount accumulated in the cash flow hedge reserve for that hedging relationship shall be deemed to be based on the alternative benchmark rate on which the hedged future cash flows will be based.

- Paragraph 6.3.6 states that in consolidated financial statements the foreign currency risk of a highly probable forecast intragroup transaction may qualify as a hedged item in a cash flow hedge, provided that the transaction is denominated in a currency other than the functional currency of the entity entering into that transaction and that the foreign currency risk will affect consolidated profit or loss. For this purpose an entity can be a parent, subsidiary, associate, joint arrangement or branch. If the foreign currency risk of a forecast intragroup transaction does not affect consolidated profit or loss, the intragroup transaction cannot qualify as a hedged item. This is usually the case for royalty payments, interest payments or management charges between members of the same group, unless there is a related external transaction. However, when the foreign currency risk of a forecast intragroup transaction will affect consolidated profit or loss, the intragroup transaction can qualify as a hedged item. An example is forecast sales or purchases of inventories between members of the same group if there is an onward sale of the inventory to a party external to the group. Similarly, a forecast intragroup sale of plant and equipment from the group entity that manufactured it to a group entity that will use the plant and equipment in its operations may affect consolidated profit or loss. This could occur, for example, because the plant and equipment will be depreciated by the purchasing entity and the amount initially recognised for the plant and equipment may change if the forecast intragroup transaction is denominated in a currency other than the functional currency of the purchasing entity.

- Subject to the conditions in paragraphs 4.1.5 and 4.2.2, this Standard allows an entity to designate a financial asset, a financial liability, or a group of financial instruments (financial assets, financial liabilities or both) as at fair value through profit or loss provided that doing so results in more relevant information.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

BML BOAB METALS LIMITED Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B3 | Ba3 |

| Income Statement | C | Baa2 |

| Balance Sheet | Baa2 | B1 |

| Leverage Ratios | C | Caa2 |

| Cash Flow | C | C |

| Rates of Return and Profitability | Caa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

BOAB METALS LIMITED is assigned short-term B3 & long-term Ba3 estimated rating. BOAB METALS LIMITED prediction model is evaluated with Statistical Inference (ML) and Pearson Correlation1,2,3,4 and it is concluded that the BML stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Buy

Prediction Confidence Score

References

- Dimakopoulou M, Athey S, Imbens G. 2017. Estimation considerations in contextual bandits. arXiv:1711.07077 [stat.ML]

- C. Claus and C. Boutilier. The dynamics of reinforcement learning in cooperative multiagent systems. In Proceedings of the Fifteenth National Conference on Artificial Intelligence and Tenth Innovative Applications of Artificial Intelligence Conference, AAAI 98, IAAI 98, July 26-30, 1998, Madison, Wisconsin, USA., pages 746–752, 1998.

- Burkov A. 2019. The Hundred-Page Machine Learning Book. Quebec City, Can.: Andriy Burkov

- Cheung, Y. M.D. Chinn (1997), "Further investigation of the uncertain unit root in GNP," Journal of Business and Economic Statistics, 15, 68–73.

- Bertsimas D, King A, Mazumder R. 2016. Best subset selection via a modern optimization lens. Ann. Stat. 44:813–52

- Knox SW. 2018. Machine Learning: A Concise Introduction. Hoboken, NJ: Wiley

- Tibshirani R, Hastie T. 1987. Local likelihood estimation. J. Am. Stat. Assoc. 82:559–67

Frequently Asked Questions

Q: What is the prediction methodology for BML stock?A: BML stock prediction methodology: We evaluate the prediction models Statistical Inference (ML) and Pearson Correlation

Q: Is BML stock a buy or sell?

A: The dominant strategy among neural network is to Buy BML Stock.

Q: Is BOAB METALS LIMITED stock a good investment?

A: The consensus rating for BOAB METALS LIMITED is Buy and is assigned short-term B3 & long-term Ba3 estimated rating.

Q: What is the consensus rating of BML stock?

A: The consensus rating for BML is Buy.

Q: What is the prediction period for BML stock?

A: The prediction period for BML is 8 Weeks