AUC Score :

Short-Term Revised1 :

Dominant Strategy : Speculative Trend

Time series to forecast n:

Methodology : Ensemble Learning (ML)

Hypothesis Testing : Spearman Correlation

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share prediction model is evaluated with Ensemble Learning (ML) and Spearman Correlation1,2,3,4 and it is concluded that the BEDU stock is predictable in the short/long term. Ensemble learning is a machine learning (ML) technique that combines multiple models to create a single model that is more accurate than any of the individual models. This is done by combining the predictions of the individual models, typically using a voting scheme or a weighted average. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Speculative Trend

Key Points

- What is prediction in deep learning?

- How do you know when a stock will go up or down?

- Can we predict stock market using machine learning?

BEDU Target Price Prediction Modeling Methodology

We consider Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share Decision Process with Ensemble Learning (ML) where A is the set of discrete actions of BEDU stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Spearman Correlation)5,6,7= X R(Ensemble Learning (ML)) X S(n):→ 8 Weeks

n:Time series to forecast

p:Price signals of BEDU stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Ensemble Learning (ML)

Ensemble learning is a machine learning (ML) technique that combines multiple models to create a single model that is more accurate than any of the individual models. This is done by combining the predictions of the individual models, typically using a voting scheme or a weighted average.Spearman Correlation

Spearman correlation is a nonparametric measure of the strength and direction of association between two variables. It is a rank-based correlation, which means that it does not assume that the data is normally distributed. Spearman correlation is calculated by first ranking the data for each variable, and then calculating the Pearson correlation between the ranks.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

BEDU Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: BEDU Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share

Time series to forecast: 8 Weeks

According to price forecasts, the dominant strategy among neural network is: Speculative Trend

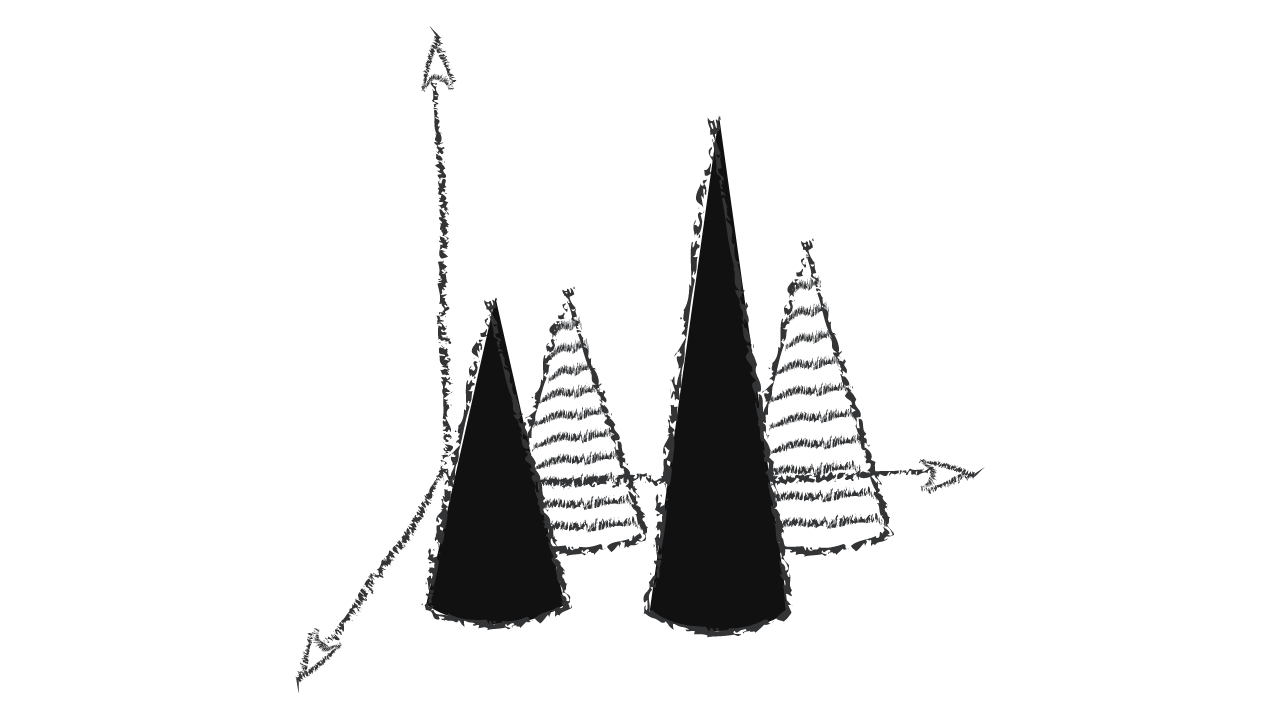

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Ensemble Learning (ML) based BEDU Stock Prediction Model

- When measuring a loss allowance for a lease receivable, the cash flows used for determining the expected credit losses should be consistent with the cash flows used in measuring the lease receivable in accordance with IFRS 16 Leases.

- Contractual cash flows that are solely payments of principal and interest on the principal amount outstanding are consistent with a basic lending arrangement. In a basic lending arrangement, consideration for the time value of money (see paragraphs B4.1.9A–B4.1.9E) and credit risk are typically the most significant elements of interest. However, in such an arrangement, interest can also include consideration for other basic lending risks (for example, liquidity risk) and costs (for example, administrative costs) associated with holding the financial asset for a particular period of time. In addition, interest can include a profit margin that is consistent with a basic lending arrangement. In extreme economic circumstances, interest can be negative if, for example, the holder of a financial asset either explicitly or implicitly pays for the deposit of its money for a particular period of time (and that fee exceeds the consideration that the holder receives for the time value of money, credit risk and other basic lending risks and costs).

- An entity has not retained control of a transferred asset if the transferee has the practical ability to sell the transferred asset. An entity has retained control of a transferred asset if the transferee does not have the practical ability to sell the transferred asset. A transferee has the practical ability to sell the transferred asset if it is traded in an active market because the transferee could repurchase the transferred asset in the market if it needs to return the asset to the entity. For example, a transferee may have the practical ability to sell a transferred asset if the transferred asset is subject to an option that allows the entity to repurchase it, but the transferee can readily obtain the transferred asset in the market if the option is exercised. A transferee does not have the practical ability to sell the transferred asset if the entity retains such an option and the transferee cannot readily obtain the transferred asset in the market if the entity exercises its option

- Contractual cash flows that are solely payments of principal and interest on the principal amount outstanding are consistent with a basic lending arrangement. In a basic lending arrangement, consideration for the time value of money (see paragraphs B4.1.9A–B4.1.9E) and credit risk are typically the most significant elements of interest. However, in such an arrangement, interest can also include consideration for other basic lending risks (for example, liquidity risk) and costs (for example, administrative costs) associated with holding the financial asset for a particular period of time. In addition, interest can include a profit margin that is consistent with a basic lending arrangement. In extreme economic circumstances, interest can be negative if, for example, the holder of a financial asset either explicitly or implicitly pays for the deposit of its money for a particular period of time (and that fee exceeds the consideration that the holder receives for the time value of money, credit risk and other basic lending risks and costs).

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

BEDU Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B1 | B1 |

| Income Statement | B3 | B1 |

| Balance Sheet | B2 | B2 |

| Leverage Ratios | Baa2 | B1 |

| Cash Flow | C | B2 |

| Rates of Return and Profitability | Baa2 | B2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share is assigned short-term B1 & long-term B1 estimated rating. Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share prediction model is evaluated with Ensemble Learning (ML) and Spearman Correlation1,2,3,4 and it is concluded that the BEDU stock is predictable in the short/long term. According to price forecasts for 8 Weeks period, the dominant strategy among neural network is: Speculative Trend

Prediction Confidence Score

References

- A. K. Agogino and K. Tumer. Analyzing and visualizing multiagent rewards in dynamic and stochastic environments. Journal of Autonomous Agents and Multi-Agent Systems, 17(2):320–338, 2008

- M. L. Littman. Friend-or-foe q-learning in general-sum games. In Proceedings of the Eighteenth International Conference on Machine Learning (ICML 2001), Williams College, Williamstown, MA, USA, June 28 - July 1, 2001, pages 322–328, 2001

- B. Derfer, N. Goodyear, K. Hung, C. Matthews, G. Paoni, K. Rollins, R. Rose, M. Seaman, and J. Wiles. Online marketing platform, August 17 2007. US Patent App. 11/893,765

- Bertsimas D, King A, Mazumder R. 2016. Best subset selection via a modern optimization lens. Ann. Stat. 44:813–52

- Breusch, T. S. (1978), "Testing for autocorrelation in dynamic linear models," Australian Economic Papers, 17, 334–355.

- Tibshirani R. 1996. Regression shrinkage and selection via the lasso. J. R. Stat. Soc. B 58:267–88

- Efron B, Hastie T, Johnstone I, Tibshirani R. 2004. Least angle regression. Ann. Stat. 32:407–99

Frequently Asked Questions

Q: What is the prediction methodology for BEDU stock?A: BEDU stock prediction methodology: We evaluate the prediction models Ensemble Learning (ML) and Spearman Correlation

Q: Is BEDU stock a buy or sell?

A: The dominant strategy among neural network is to Speculative Trend BEDU Stock.

Q: Is Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share stock a good investment?

A: The consensus rating for Bright Scholar Education Holdings Limited American Depositary Shares each representing four Class A Ordinary Share is Speculative Trend and is assigned short-term B1 & long-term B1 estimated rating.

Q: What is the consensus rating of BEDU stock?

A: The consensus rating for BEDU is Speculative Trend.

Q: What is the prediction period for BEDU stock?

A: The prediction period for BEDU is 8 Weeks