AUC Score :

Short-Term Revised :

Dominant Strategy : Buy

Time series to forecast n:

Methodology : Modular Neural Network (Market Direction Analysis)

Hypothesis Testing : Multiple Regression

Surveillance : Major exchange and OTC

Summary

Teledyne Technologies Incorporated Common Stock prediction model is evaluated with Modular Neural Network (Market Direction Analysis) and Multiple Regression1,2,3,4 and it is concluded that the TDY stock is predictable in the short/long term. Modular neural networks (MNNs) are a type of artificial neural network that can be used for market direction analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying patterns in data or predicting future price movements. The modules are then combined to form a single neural network that can perform multiple tasks.In the context of market direction analysis, MNNs can be used to identify patterns in market data that suggest that the market is likely to move in a particular direction. This information can then be used to make predictions about future price movements. According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

Key Points

- What is statistical models in machine learning?

- Dominated Move

- How do you decide buy or sell a stock?

TDY Target Price Prediction Modeling Methodology

We consider Teledyne Technologies Incorporated Common Stock Decision Process with Modular Neural Network (Market Direction Analysis) where A is the set of discrete actions of TDY stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Multiple Regression)5,6,7= X R(Modular Neural Network (Market Direction Analysis)) X S(n):→ 4 Weeks

n:Time series to forecast

p:Price signals of TDY stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Market Direction Analysis)

Modular neural networks (MNNs) are a type of artificial neural network that can be used for market direction analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying patterns in data or predicting future price movements. The modules are then combined to form a single neural network that can perform multiple tasks.In the context of market direction analysis, MNNs can be used to identify patterns in market data that suggest that the market is likely to move in a particular direction. This information can then be used to make predictions about future price movements.Multiple Regression

Multiple regression is a statistical method that analyzes the relationship between a dependent variable and multiple independent variables. The dependent variable is the variable that is being predicted, and the independent variables are the variables that are used to predict the dependent variable. Multiple regression is a more complex statistical method than simple linear regression, which only analyzes the relationship between a dependent variable and one independent variable. Multiple regression can be used to analyze more complex relationships between variables, and it can also be used to control for confounding variables. A confounding variable is a variable that is correlated with both the dependent variable and one or more of the independent variables. Confounding variables can distort the relationship between the dependent variable and the independent variables. Multiple regression can be used to control for confounding variables by including them in the model.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

TDY Stock Forecast (Buy or Sell) for 4 Weeks

Sample Set: Neural NetworkStock/Index: TDY Teledyne Technologies Incorporated Common Stock

Time series to forecast: 4 Weeks

According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

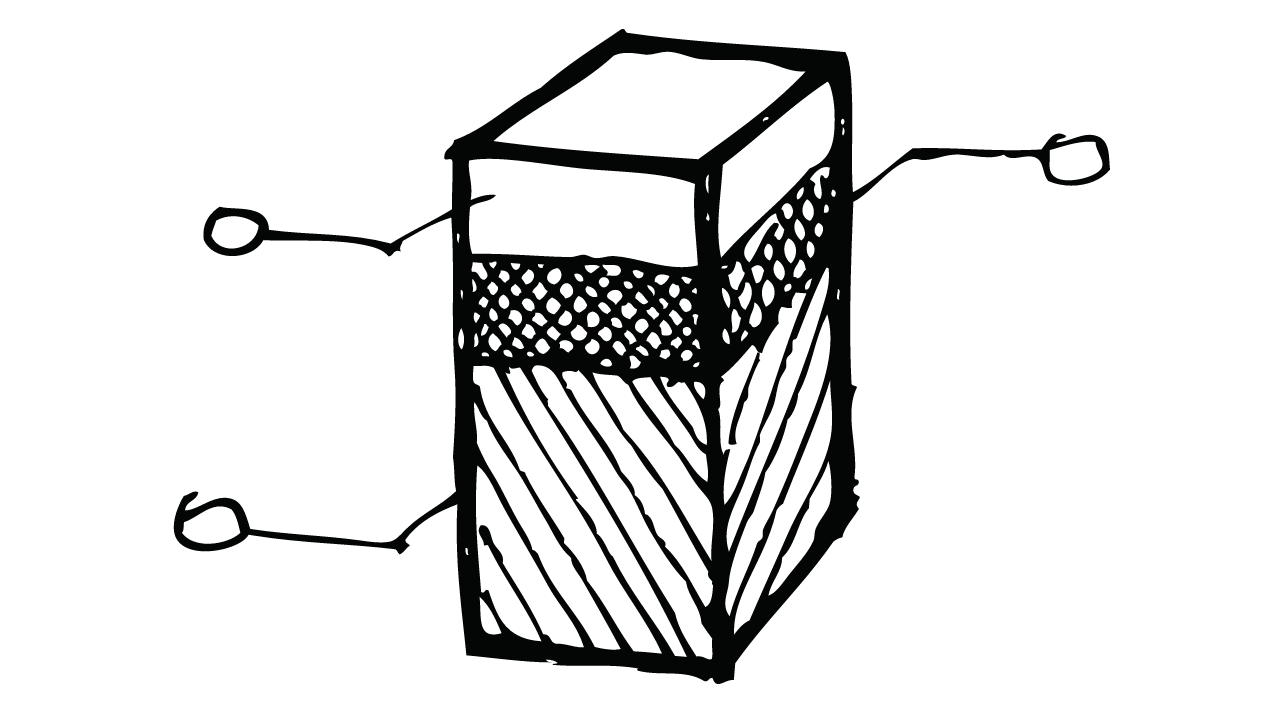

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (Market Direction Analysis) based TDY Stock Prediction Model

- At the date of initial application, an entity is permitted to make the designation in paragraph 2.5 for contracts that already exist on the date but only if it designates all similar contracts. The change in the net assets resulting from such designations shall be recognised in retained earnings at the date of initial application.

- The fair value of a financial instrument at initial recognition is normally the transaction price (ie the fair value of the consideration given or received, see also paragraph B5.1.2A and IFRS 13). However, if part of the consideration given or received is for something other than the financial instrument, an entity shall measure the fair value of the financial instrument. For example, the fair value of a long-term loan or receivable that carries no interest can be measured as the present value of all future cash receipts discounted using the prevailing market rate(s) of interest for a similar instrument (similar as to currency, term, type of interest rate and other factors) with a similar credit rating. Any additional amount lent is an expense or a reduction of income unless it qualifies for recognition as some other type of asset.

- Subject to the conditions in paragraphs 4.1.5 and 4.2.2, this Standard allows an entity to designate a financial asset, a financial liability, or a group of financial instruments (financial assets, financial liabilities or both) as at fair value through profit or loss provided that doing so results in more relevant information.

- Paragraph 4.1.1(a) requires an entity to classify financial assets on the basis of the entity's business model for managing the financial assets, unless paragraph 4.1.5 applies. An entity assesses whether its financial assets meet the condition in paragraph 4.1.2(a) or the condition in paragraph 4.1.2A(a) on the basis of the business model as determined by the entity's key management personnel (as defined in IAS 24 Related Party Disclosures).

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

TDY Teledyne Technologies Incorporated Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba2 | B2 |

| Income Statement | Ba1 | Ba3 |

| Balance Sheet | Baa2 | C |

| Leverage Ratios | Ba2 | C |

| Cash Flow | B1 | C |

| Rates of Return and Profitability | Baa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

Teledyne Technologies Incorporated Common Stock is assigned short-term Ba2 & long-term B2 estimated rating. Teledyne Technologies Incorporated Common Stock prediction model is evaluated with Modular Neural Network (Market Direction Analysis) and Multiple Regression1,2,3,4 and it is concluded that the TDY stock is predictable in the short/long term. According to price forecasts for 4 Weeks period, the dominant strategy among neural network is: Buy

Prediction Confidence Score

References

- Barrett, C. B. (1997), "Heteroscedastic price forecasting for food security management in developing countries," Oxford Development Studies, 25, 225–236.

- Athey S, Tibshirani J, Wager S. 2016b. Generalized random forests. arXiv:1610.01271 [stat.ME]

- Çetinkaya, A., Zhang, Y.Z., Hao, Y.M. and Ma, X.Y., What are buy sell or hold recommendations?(AIRC Stock Forecast). AC Investment Research Journal, 101(3).

- Vapnik V. 2013. The Nature of Statistical Learning Theory. Berlin: Springer

- Kallus N. 2017. Balanced policy evaluation and learning. arXiv:1705.07384 [stat.ML]

- Y. Chow and M. Ghavamzadeh. Algorithms for CVaR optimization in MDPs. In Advances in Neural Infor- mation Processing Systems, pages 3509–3517, 2014.

- Bessler, D. A. T. Covey (1991), "Cointegration: Some results on U.S. cattle prices," Journal of Futures Markets, 11, 461–474.

Frequently Asked Questions

Q: What is the prediction methodology for TDY stock?A: TDY stock prediction methodology: We evaluate the prediction models Modular Neural Network (Market Direction Analysis) and Multiple Regression

Q: Is TDY stock a buy or sell?

A: The dominant strategy among neural network is to Buy TDY Stock.

Q: Is Teledyne Technologies Incorporated Common Stock stock a good investment?

A: The consensus rating for Teledyne Technologies Incorporated Common Stock is Buy and is assigned short-term Ba2 & long-term B2 estimated rating.

Q: What is the consensus rating of TDY stock?

A: The consensus rating for TDY is Buy.

Q: What is the prediction period for TDY stock?

A: The prediction period for TDY is 4 Weeks