AUC Score :

Short-Term Revised1 :

Dominant Strategy : Speculative Trend

Time series to forecast n:

Methodology : Modular Neural Network (Market Direction Analysis)

Hypothesis Testing : Wilcoxon Rank-Sum Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Abstract

The ODP Corporation Common Stock prediction model is evaluated with Modular Neural Network (Market Direction Analysis) and Wilcoxon Rank-Sum Test1,2,3,4 and it is concluded that the ODP stock is predictable in the short/long term. Modular neural networks (MNNs) are a type of artificial neural network that can be used for market direction analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying patterns in data or predicting future price movements. The modules are then combined to form a single neural network that can perform multiple tasks.In the context of market direction analysis, MNNs can be used to identify patterns in market data that suggest that the market is likely to move in a particular direction. This information can then be used to make predictions about future price movements. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Speculative Trend

Key Points

- Stock Forecast Based On a Predictive Algorithm

- What is prediction in deep learning?

- What are main components of Markov decision process?

ODP Target Price Prediction Modeling Methodology

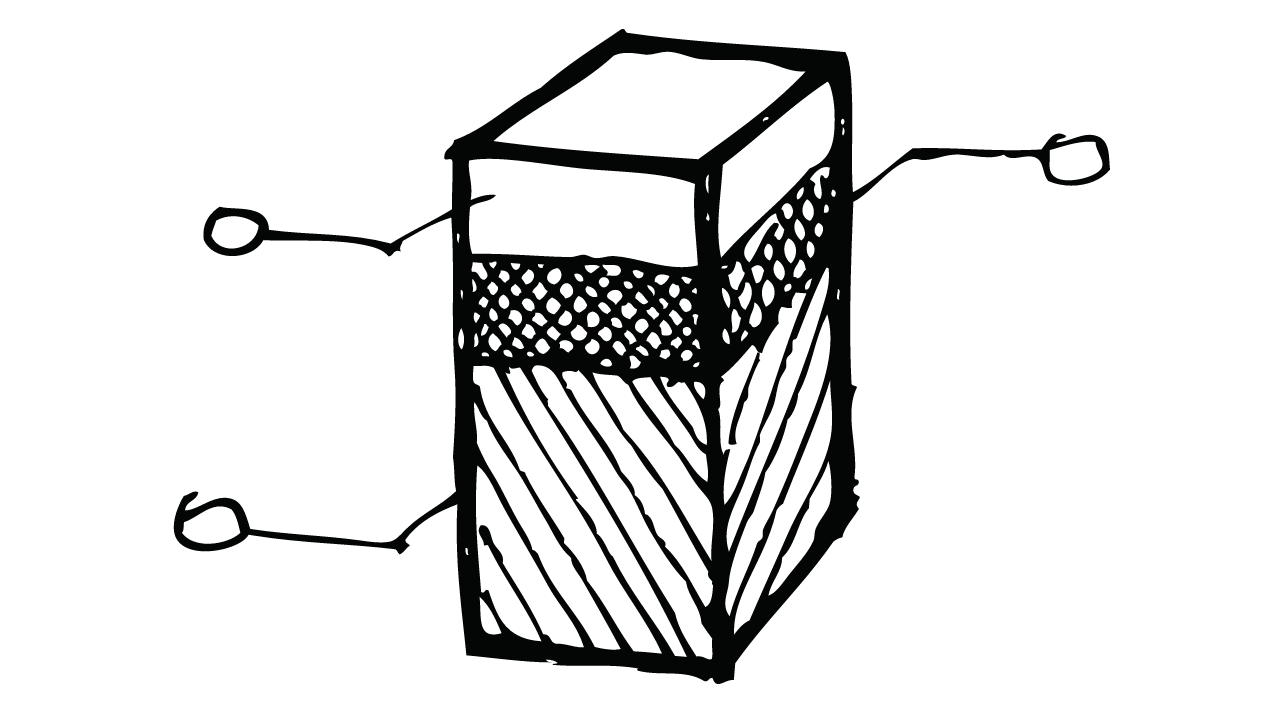

We consider The ODP Corporation Common Stock Decision Process with Modular Neural Network (Market Direction Analysis) where A is the set of discrete actions of ODP stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Wilcoxon Rank-Sum Test)5,6,7= X R(Modular Neural Network (Market Direction Analysis)) X S(n):→ 16 Weeks

n:Time series to forecast

p:Price signals of ODP stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Market Direction Analysis)

Modular neural networks (MNNs) are a type of artificial neural network that can be used for market direction analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying patterns in data or predicting future price movements. The modules are then combined to form a single neural network that can perform multiple tasks.In the context of market direction analysis, MNNs can be used to identify patterns in market data that suggest that the market is likely to move in a particular direction. This information can then be used to make predictions about future price movements.Wilcoxon Rank-Sum Test

The Wilcoxon rank-sum test, also known as the Mann-Whitney U test, is a non-parametric test that is used to compare the medians of two independent samples. It is a rank-based test, which means that it does not assume that the data is normally distributed. The Wilcoxon rank-sum test is calculated by first ranking the data from both samples, and then finding the sum of the ranks for one of the samples. The Wilcoxon rank-sum test statistic is then calculated by subtracting the sum of the ranks for one sample from the sum of the ranks for the other sample. The p-value for the Wilcoxon rank-sum test is calculated using a table of critical values. The p-value is the probability of obtaining a test statistic at least as extreme as the one observed, assuming that the null hypothesis is true.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

ODP Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: ODP The ODP Corporation Common Stock

Time series to forecast: 16 Weeks

According to price forecasts, the dominant strategy among neural network is: Speculative Trend

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (Market Direction Analysis) based ODP Stock Prediction Model

- The assessment of whether an economic relationship exists includes an analysis of the possible behaviour of the hedging relationship during its term to ascertain whether it can be expected to meet the risk management objective. The mere existence of a statistical correlation between two variables does not, by itself, support a valid conclusion that an economic relationship exists.

- An entity has not retained control of a transferred asset if the transferee has the practical ability to sell the transferred asset. An entity has retained control of a transferred asset if the transferee does not have the practical ability to sell the transferred asset. A transferee has the practical ability to sell the transferred asset if it is traded in an active market because the transferee could repurchase the transferred asset in the market if it needs to return the asset to the entity. For example, a transferee may have the practical ability to sell a transferred asset if the transferred asset is subject to an option that allows the entity to repurchase it, but the transferee can readily obtain the transferred asset in the market if the option is exercised. A transferee does not have the practical ability to sell the transferred asset if the entity retains such an option and the transferee cannot readily obtain the transferred asset in the market if the entity exercises its option

- An entity's estimate of expected credit losses on loan commitments shall be consistent with its expectations of drawdowns on that loan commitment, ie it shall consider the expected portion of the loan commitment that will be drawn down within 12 months of the reporting date when estimating 12-month expected credit losses, and the expected portion of the loan commitment that will be drawn down over the expected life of the loan commitment when estimating lifetime expected credit losses.

- Fluctuation around a constant hedge ratio (and hence the related hedge ineffectiveness) cannot be reduced by adjusting the hedge ratio in response to each particular outcome. Hence, in such circumstances, the change in the extent of offset is a matter of measuring and recognising hedge ineffectiveness but does not require rebalancing.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

ODP The ODP Corporation Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Caa2 | B2 |

| Income Statement | C | C |

| Balance Sheet | Caa2 | Baa2 |

| Leverage Ratios | Caa2 | C |

| Cash Flow | Caa2 | Caa2 |

| Rates of Return and Profitability | B1 | Caa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

The ODP Corporation Common Stock is assigned short-term Caa2 & long-term B2 estimated rating. The ODP Corporation Common Stock prediction model is evaluated with Modular Neural Network (Market Direction Analysis) and Wilcoxon Rank-Sum Test1,2,3,4 and it is concluded that the ODP stock is predictable in the short/long term. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Speculative Trend

Prediction Confidence Score

References

- J. G. Schneider, W. Wong, A. W. Moore, and M. A. Riedmiller. Distributed value functions. In Proceedings of the Sixteenth International Conference on Machine Learning (ICML 1999), Bled, Slovenia, June 27 - 30, 1999, pages 371–378, 1999.

- N. B ̈auerle and J. Ott. Markov decision processes with average-value-at-risk criteria. Mathematical Methods of Operations Research, 74(3):361–379, 2011

- Greene WH. 2000. Econometric Analysis. Upper Saddle River, N J: Prentice Hall. 4th ed.

- Swaminathan A, Joachims T. 2015. Batch learning from logged bandit feedback through counterfactual risk minimization. J. Mach. Learn. Res. 16:1731–55

- M. J. Hausknecht. Cooperation and Communication in Multiagent Deep Reinforcement Learning. PhD thesis, The University of Texas at Austin, 2016

- Bessler, D. A. S. W. Fuller (1993), "Cointegration between U.S. wheat markets," Journal of Regional Science, 33, 481–501.

- Farrell MH, Liang T, Misra S. 2018. Deep neural networks for estimation and inference: application to causal effects and other semiparametric estimands. arXiv:1809.09953 [econ.EM]

Frequently Asked Questions

Q: What is the prediction methodology for ODP stock?A: ODP stock prediction methodology: We evaluate the prediction models Modular Neural Network (Market Direction Analysis) and Wilcoxon Rank-Sum Test

Q: Is ODP stock a buy or sell?

A: The dominant strategy among neural network is to Speculative Trend ODP Stock.

Q: Is The ODP Corporation Common Stock stock a good investment?

A: The consensus rating for The ODP Corporation Common Stock is Speculative Trend and is assigned short-term Caa2 & long-term B2 estimated rating.

Q: What is the consensus rating of ODP stock?

A: The consensus rating for ODP is Speculative Trend.

Q: What is the prediction period for ODP stock?

A: The prediction period for ODP is 16 Weeks