AUC Score :

Short-Term Revised1 :

Dominant Strategy : Speculative Trend

Time series to forecast n:

Methodology : Modular Neural Network (Market News Sentiment Analysis)

Hypothesis Testing : Sign Test

Surveillance : Major exchange and OTC

1The accuracy of the model is being monitored on a regular basis.(15-minute period)

2Time series is updated based on short-term trends.

Summary

Compass Therapeutics Inc. Common Stock prediction model is evaluated with Modular Neural Network (Market News Sentiment Analysis) and Sign Test1,2,3,4 and it is concluded that the CMPX stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for news feed sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of news feed sentiment analysis, MNNs can be used to identify the sentiment of news articles, social media posts, and other forms of online content. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising. According to price forecasts for 6 Month period, the dominant strategy among neural network is: Speculative Trend

Key Points

- Understanding Buy, Sell, and Hold Ratings

- Can statistics predict the future?

- How do you decide buy or sell a stock?

CMPX Target Price Prediction Modeling Methodology

We consider Compass Therapeutics Inc. Common Stock Decision Process with Modular Neural Network (Market News Sentiment Analysis) where A is the set of discrete actions of CMPX stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Sign Test)5,6,7= X R(Modular Neural Network (Market News Sentiment Analysis)) X S(n):→ 6 Month

n:Time series to forecast

p:Price signals of CMPX stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Market News Sentiment Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for news feed sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of news feed sentiment analysis, MNNs can be used to identify the sentiment of news articles, social media posts, and other forms of online content. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising.Sign Test

The sign test is a non-parametric hypothesis test that is used to compare two paired samples. In a paired sample, each data point in one sample is paired with a data point in the other sample. The pairs are typically related in some way, such as before and after measurements, or measurements from the same subject under different conditions. The sign test is a non-parametric test, which means that it does not assume that the data is normally distributed. The sign test is also a dependent samples test, which means that the data points in each pair are correlated.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

CMPX Stock Forecast (Buy or Sell)

Sample Set: Neural NetworkStock/Index: CMPX Compass Therapeutics Inc. Common Stock

Time series to forecast: 6 Month

According to price forecasts, the dominant strategy among neural network is: Speculative Trend

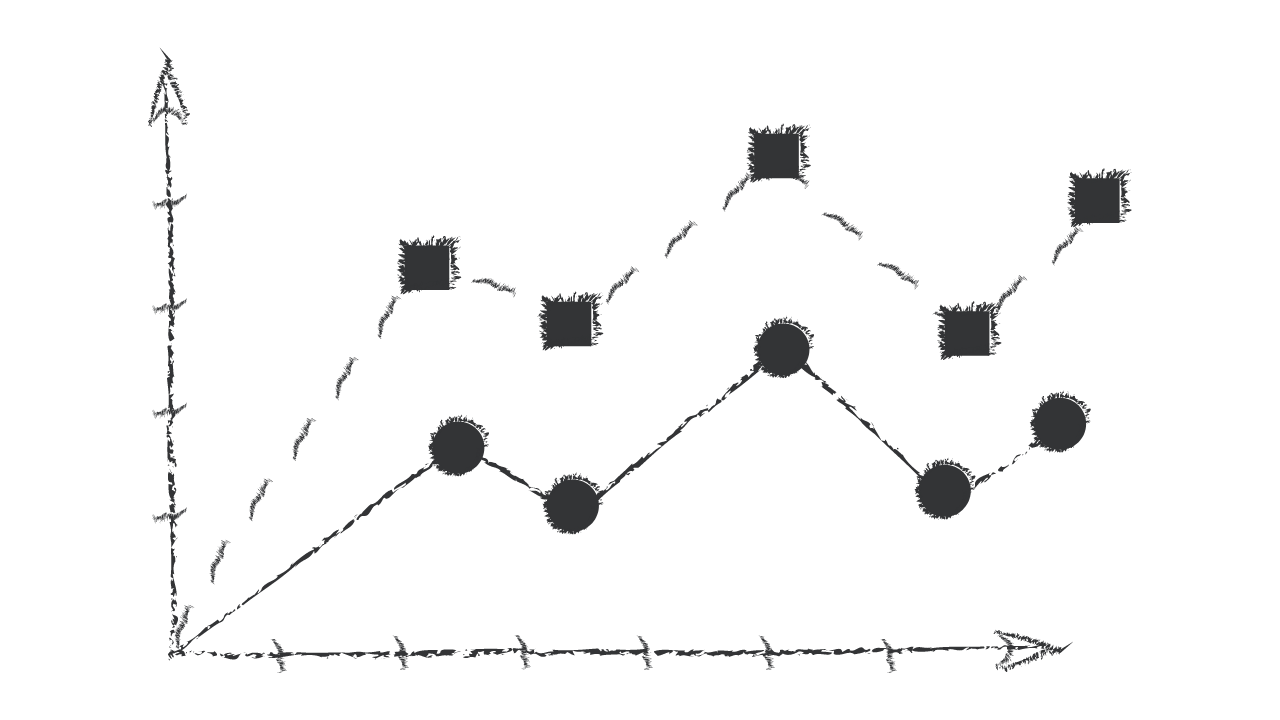

Strategic Interaction Table Legend:

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

Financial Data Adjustments for Modular Neural Network (Market News Sentiment Analysis) based CMPX Stock Prediction Model

- The change in the value of the hedged item determined using a hypothetical derivative may also be used for the purpose of assessing whether a hedging relationship meets the hedge effectiveness requirements.

- At the date of initial application, an entity shall use reasonable and supportable information that is available without undue cost or effort to determine the credit risk at the date that a financial instrument was initially recognised (or for loan commitments and financial guarantee contracts at the date that the entity became a party to the irrevocable commitment in accordance with paragraph 5.5.6) and compare that to the credit risk at the date of initial application of this Standard.

- The methods used to determine whether credit risk has increased significantly on a financial instrument since initial recognition should consider the characteristics of the financial instrument (or group of financial instruments) and the default patterns in the past for comparable financial instruments. Despite the requirement in paragraph 5.5.9, for financial instruments for which default patterns are not concentrated at a specific point during the expected life of the financial instrument, changes in the risk of a default occurring over the next 12 months may be a reasonable approximation of the changes in the lifetime risk of a default occurring. In such cases, an entity may use changes in the risk of a default occurring over the next 12 months to determine whether credit risk has increased significantly since initial recognition, unless circumstances indicate that a lifetime assessment is necessary

- The underlying pool must contain one or more instruments that have contractual cash flows that are solely payments of principal and interest on the principal amount outstanding

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

CMPX Compass Therapeutics Inc. Common Stock Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | B1 | Ba1 |

| Income Statement | B3 | Baa2 |

| Balance Sheet | Baa2 | Caa2 |

| Leverage Ratios | Baa2 | B3 |

| Cash Flow | C | Baa2 |

| Rates of Return and Profitability | Caa2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Conclusions

Compass Therapeutics Inc. Common Stock is assigned short-term B1 & long-term Ba1 estimated rating. Compass Therapeutics Inc. Common Stock prediction model is evaluated with Modular Neural Network (Market News Sentiment Analysis) and Sign Test1,2,3,4 and it is concluded that the CMPX stock is predictable in the short/long term. According to price forecasts for 6 Month period, the dominant strategy among neural network is: Speculative Trend

Prediction Confidence Score

References

- Byron, R. P. O. Ashenfelter (1995), "Predicting the quality of an unborn grange," Economic Record, 71, 40–53.

- Meinshausen N. 2007. Relaxed lasso. Comput. Stat. Data Anal. 52:374–93

- Chernozhukov V, Demirer M, Duflo E, Fernandez-Val I. 2018b. Generic machine learning inference on heteroge- nous treatment effects in randomized experiments. NBER Work. Pap. 24678

- Jacobs B, Donkers B, Fok D. 2014. Product Recommendations Based on Latent Purchase Motivations. Rotterdam, Neth.: ERIM

- T. Shardlow and A. Stuart. A perturbation theory for ergodic Markov chains and application to numerical approximations. SIAM journal on numerical analysis, 37(4):1120–1137, 2000

- Bera, A. M. L. Higgins (1997), "ARCH and bilinearity as competing models for nonlinear dependence," Journal of Business Economic Statistics, 15, 43–50.

- Krizhevsky A, Sutskever I, Hinton GE. 2012. Imagenet classification with deep convolutional neural networks. In Advances in Neural Information Processing Systems, Vol. 25, ed. Z Ghahramani, M Welling, C Cortes, ND Lawrence, KQ Weinberger, pp. 1097–105. San Diego, CA: Neural Inf. Process. Syst. Found.

Frequently Asked Questions

Q: What is the prediction methodology for CMPX stock?A: CMPX stock prediction methodology: We evaluate the prediction models Modular Neural Network (Market News Sentiment Analysis) and Sign Test

Q: Is CMPX stock a buy or sell?

A: The dominant strategy among neural network is to Speculative Trend CMPX Stock.

Q: Is Compass Therapeutics Inc. Common Stock stock a good investment?

A: The consensus rating for Compass Therapeutics Inc. Common Stock is Speculative Trend and is assigned short-term B1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of CMPX stock?

A: The consensus rating for CMPX is Speculative Trend.

Q: What is the prediction period for CMPX stock?

A: The prediction period for CMPX is 6 Month