Dominant Strategy : Hold

Time series to forecast n: 21 Jun 2023 for 16 Weeks

Methodology : Modular Neural Network (Emotional Trigger/Responses Analysis)

Summary

SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP prediction model is evaluated with Modular Neural Network (Emotional Trigger/Responses Analysis) and Chi-Square1,2,3,4 and it is concluded that the SCP stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for emotional trigger/responses analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of emotional trigger/responses analysis, MNNs can be used to identify the emotional triggers that cause people to experience certain emotions, and to identify the responses that people typically exhibit when they experience those emotions. This information can then be used to develop more effective emotional support systems, to improve the accuracy of artificial intelligence systems, and to create more engaging and immersive entertainment experiences. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Hold

Key Points

- How useful are statistical predictions?

- Game Theory

- How can neural networks improve predictions?

SCP Target Price Prediction Modeling Methodology

We consider SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP Decision Process with Modular Neural Network (Emotional Trigger/Responses Analysis) where A is the set of discrete actions of SCP stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Chi-Square)5,6,7= X R(Modular Neural Network (Emotional Trigger/Responses Analysis)) X S(n):→ 16 Weeks

n:Time series to forecast

p:Price signals of SCP stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

Modular Neural Network (Emotional Trigger/Responses Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for emotional trigger/responses analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of emotional trigger/responses analysis, MNNs can be used to identify the emotional triggers that cause people to experience certain emotions, and to identify the responses that people typically exhibit when they experience those emotions. This information can then be used to develop more effective emotional support systems, to improve the accuracy of artificial intelligence systems, and to create more engaging and immersive entertainment experiences.Chi-Square

A chi-squared test is a statistical hypothesis test that assesses whether observed frequencies in a sample differ significantly from expected frequencies. It is one of the most widely used statistical tests in the social sciences and in many areas of observational research. The chi-squared test is a non-parametric test, meaning that it does not assume that the data is normally distributed. This makes it a versatile tool that can be used to analyze a wide variety of data. There are two main types of chi-squared tests: the chi-squared goodness of fit test and the chi-squared test of independence.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

SCP Stock Forecast (Buy or Sell) for 16 Weeks

Sample Set: Neural NetworkStock/Index: SCP SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP

Time series to forecast n: 21 Jun 2023 for 16 Weeks

According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Hold

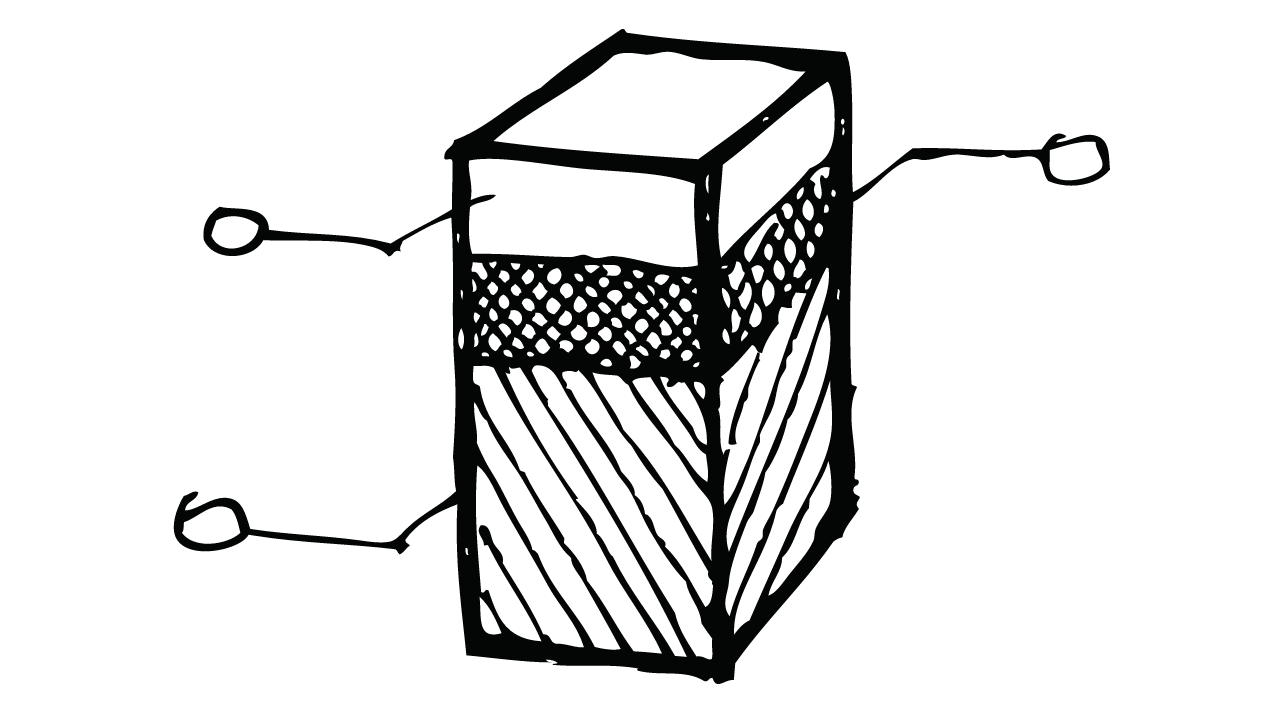

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP

- An example of a fair value hedge is a hedge of exposure to changes in the fair value of a fixed-rate debt instrument arising from changes in interest rates. Such a hedge could be entered into by the issuer or by the holder.

- An entity shall assess whether contractual cash flows are solely payments of principal and interest on the principal amount outstanding for the currency in which the financial asset is denominated.

- IFRS 17, issued in May 2017, amended paragraphs 2.1, B2.1, B2.4, B2.5 and B4.1.30, and added paragraph 3.3.5. Amendments to IFRS 17, issued in June 2020, further amended paragraph 2.1 and added paragraphs 7.2.36‒7.2.42. An entity shall apply those amendments when it applies IFRS 17.

- When applying the effective interest method, an entity generally amortises any fees, points paid or received, transaction costs and other premiums or discounts that are included in the calculation of the effective interest rate over the expected life of the financial instrument. However, a shorter period is used if this is the period to which the fees, points paid or received, transaction costs, premiums or discounts relate. This will be the case when the variable to which the fees, points paid or received, transaction costs, premiums or discounts relate is repriced to market rates before the expected maturity of the financial instrument. In such a case, the appropriate amortisation period is the period to the next such repricing date. For example, if a premium or discount on a floating-rate financial instrument reflects the interest that has accrued on that financial instrument since the interest was last paid, or changes in the market rates since the floating interest rate was reset to the market rates, it will be amortised to the next date when the floating interest is reset to market rates. This is because the premium or discount relates to the period to the next interest reset date because, at that date, the variable to which the premium or discount relates (ie interest rates) is reset to the market rates. If, however, the premium or discount results from a change in the credit spread over the floating rate specified in the financial instrument, or other variables that are not reset to the market rates, it is amortised over the expected life of the financial instrument.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP is assigned short-term Ba3 & long-term B2 estimated rating. SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP prediction model is evaluated with Modular Neural Network (Emotional Trigger/Responses Analysis) and Chi-Square1,2,3,4 and it is concluded that the SCP stock is predictable in the short/long term. According to price forecasts for 16 Weeks period, the dominant strategy among neural network is: Hold

SCP SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba3 | B2 |

| Income Statement | Caa2 | B1 |

| Balance Sheet | Baa2 | Caa2 |

| Leverage Ratios | Caa2 | Ba2 |

| Cash Flow | Baa2 | Caa2 |

| Rates of Return and Profitability | Baa2 | B3 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- K. Boda and J. Filar. Time consistent dynamic risk measures. Mathematical Methods of Operations Research, 63(1):169–186, 2006

- S. Bhatnagar and K. Lakshmanan. An online actor-critic algorithm with function approximation for con- strained Markov decision processes. Journal of Optimization Theory and Applications, 153(3):688–708, 2012.

- Bera, A. M. L. Higgins (1997), "ARCH and bilinearity as competing models for nonlinear dependence," Journal of Business Economic Statistics, 15, 43–50.

- Arora S, Li Y, Liang Y, Ma T. 2016. RAND-WALK: a latent variable model approach to word embeddings. Trans. Assoc. Comput. Linguist. 4:385–99

- Çetinkaya, A., Zhang, Y.Z., Hao, Y.M. and Ma, X.Y., GXO Options & Futures Prediction. AC Investment Research Journal, 101(3).

- V. Borkar. Q-learning for risk-sensitive control. Mathematics of Operations Research, 27:294–311, 2002.

- Tibshirani R, Hastie T. 1987. Local likelihood estimation. J. Am. Stat. Assoc. 82:559–67

Frequently Asked Questions

Q: What is the prediction methodology for SCP stock?A: SCP stock prediction methodology: We evaluate the prediction models Modular Neural Network (Emotional Trigger/Responses Analysis) and Chi-Square

Q: Is SCP stock a buy or sell?

A: The dominant strategy among neural network is to Hold SCP Stock.

Q: Is SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP stock a good investment?

A: The consensus rating for SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP is Hold and is assigned short-term Ba3 & long-term B2 estimated rating.

Q: What is the consensus rating of SCP stock?

A: The consensus rating for SCP is Hold.

Q: What is the prediction period for SCP stock?

A: The prediction period for SCP is 16 Weeks