Dominant Strategy : Sell

Time series to forecast n: 17 Jun 2023 for 1 Year

Methodology : Modular Neural Network (Social Media Sentiment Analysis)

Abstract

Delek Logistics Partners L.P. Common Units representing Limited Partner Interests prediction model is evaluated with Modular Neural Network (Social Media Sentiment Analysis) and Lasso Regression1,2,3,4 and it is concluded that the DKL stock is predictable in the short/long term. A modular neural network (MNN) is a type of artificial neural network that can be used for social media sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of social media sentiment analysis, MNNs can be used to identify the sentiment of social media posts, such as tweets, Facebook posts, and Instagram stories. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising. According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

Key Points

- What is a prediction confidence?

- What statistical methods are used to analyze data?

- Investment Risk

DKL Target Price Prediction Modeling Methodology

We consider Delek Logistics Partners L.P. Common Units representing Limited Partner Interests Decision Process with Modular Neural Network (Social Media Sentiment Analysis) where A is the set of discrete actions of DKL stock holders, F is the set of discrete states, P : S × F × S → R is the transition probability distribution, R : S × F → R is the reaction function, and γ ∈ [0, 1] is a move factor for expectation.1,2,3,4

F(Lasso Regression)5,6,7= X R(Modular Neural Network (Social Media Sentiment Analysis)) X S(n):→ 1 Year

n:Time series to forecast

p:Price signals of DKL stock

j:Nash equilibria (Neural Network)

k:Dominated move

a:Best response for target price

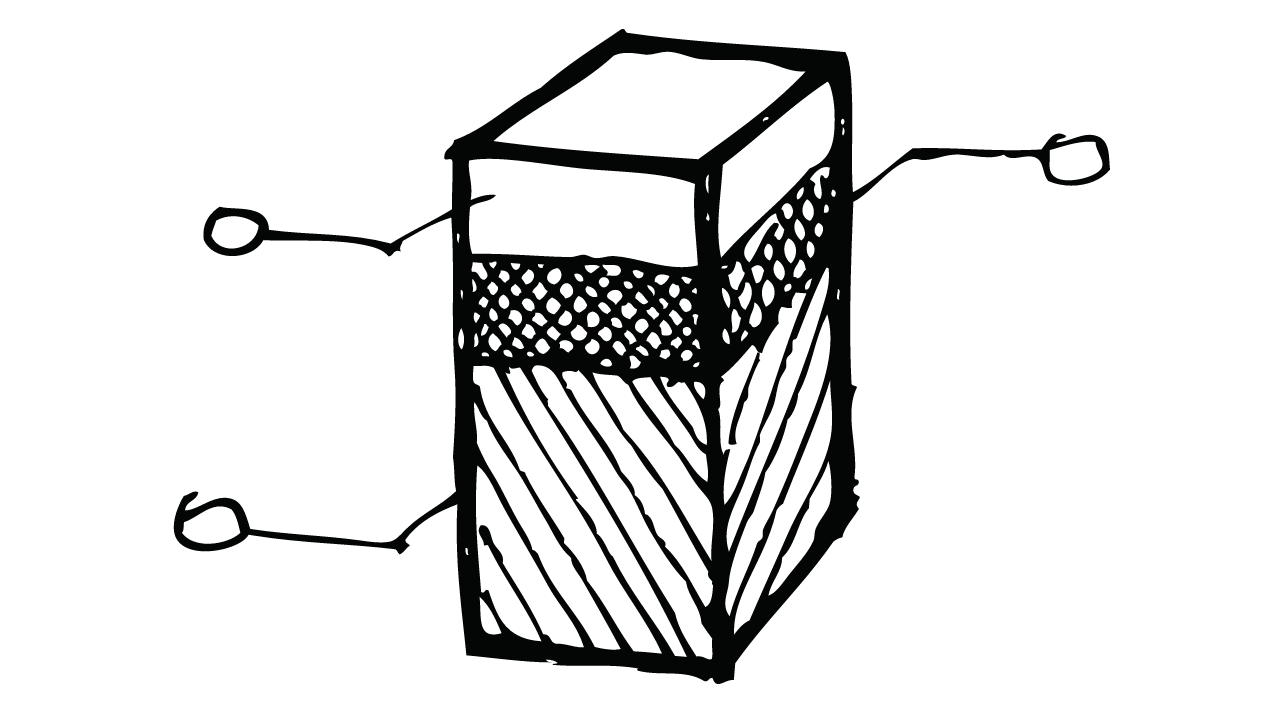

Modular Neural Network (Social Media Sentiment Analysis)

A modular neural network (MNN) is a type of artificial neural network that can be used for social media sentiment analysis. MNNs are made up of multiple smaller neural networks, called modules. Each module is responsible for learning a specific task, such as identifying sentiment in text or identifying patterns in data. The modules are then combined to form a single neural network that can perform multiple tasks. In the context of social media sentiment analysis, MNNs can be used to identify the sentiment of social media posts, such as tweets, Facebook posts, and Instagram stories. This information can then be used to filter out irrelevant or unwanted content, to identify trends in public opinion, and to target users with relevant advertising.Lasso Regression

Lasso regression, also known as L1 regularization, is a type of regression analysis that adds a penalty to the least squares objective function in order to reduce the variance of the estimates and to induce sparsity in the model. This is done by adding a term to the objective function that is proportional to the sum of the absolute values of the coefficients. The penalty term is called the "lasso" penalty, and it is controlled by a parameter called the "lasso constant". Lasso regression can be used to address the problem of multicollinearity in linear regression, as well as the problem of overfitting. Multicollinearity occurs when two or more independent variables are highly correlated. This can cause the standard errors of the coefficients to be large, and it can also cause the coefficients to be unstable. Overfitting occurs when a model is too closely fit to the training data, and as a result, it does not generalize well to new data.

For further technical information as per how our model work we invite you to visit the article below:

How do AC Investment Research machine learning (predictive) algorithms actually work?

DKL Stock Forecast (Buy or Sell) for 1 Year

Sample Set: Neural NetworkStock/Index: DKL Delek Logistics Partners L.P. Common Units representing Limited Partner Interests

Time series to forecast n: 17 Jun 2023 for 1 Year

According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

X axis: *Likelihood% (The higher the percentage value, the more likely the event will occur.)

Y axis: *Potential Impact% (The higher the percentage value, the more likely the price will deviate.)

Z axis (Grey to Black): *Technical Analysis%

IFRS Reconciliation Adjustments for Delek Logistics Partners L.P. Common Units representing Limited Partner Interests

- If, at the date of initial application, it is impracticable (as defined in IAS 8) for an entity to assess whether the fair value of a prepayment feature was insignificant in accordance with paragraph B4.1.12(c) on the basis of the facts and circumstances that existed at the initial recognition of the financial asset, an entity shall assess the contractual cash flow characteristics of that financial asset on the basis of the facts and circumstances that existed at the initial recognition of the financial asset without taking into account the exception for prepayment features in paragraph B4.1.12. (See also paragraph 42S of IFRS 7.)

- Expected credit losses are a probability-weighted estimate of credit losses (ie the present value of all cash shortfalls) over the expected life of the financial instrument. A cash shortfall is the difference between the cash flows that are due to an entity in accordance with the contract and the cash flows that the entity expects to receive. Because expected credit losses consider the amount and timing of payments, a credit loss arises even if the entity expects to be paid in full but later than when contractually due.

- If a financial asset contains a contractual term that could change the timing or amount of contractual cash flows (for example, if the asset can be prepaid before maturity or its term can be extended), the entity must determine whether the contractual cash flows that could arise over the life of the instrument due to that contractual term are solely payments of principal and interest on the principal amount outstanding. To make this determination, the entity must assess the contractual cash flows that could arise both before, and after, the change in contractual cash flows. The entity may also need to assess the nature of any contingent event (ie the trigger) that would change the timing or amount of the contractual cash flows. While the nature of the contingent event in itself is not a determinative factor in assessing whether the contractual cash flows are solely payments of principal and interest, it may be an indicator. For example, compare a financial instrument with an interest rate that is reset to a higher rate if the debtor misses a particular number of payments to a financial instrument with an interest rate that is reset to a higher rate if a specified equity index reaches a particular level. It is more likely in the former case that the contractual cash flows over the life of the instrument will be solely payments of principal and interest on the principal amount outstanding because of the relationship between missed payments and an increase in credit risk. (See also paragraph B4.1.18.)

- An entity may retain the right to a part of the interest payments on transferred assets as compensation for servicing those assets. The part of the interest payments that the entity would give up upon termination or transfer of the servicing contract is allocated to the servicing asset or servicing liability. The part of the interest payments that the entity would not give up is an interest-only strip receivable. For example, if the entity would not give up any interest upon termination or transfer of the servicing contract, the entire interest spread is an interest-only strip receivable. For the purposes of applying paragraph 3.2.13, the fair values of the servicing asset and interest-only strip receivable are used to allocate the carrying amount of the receivable between the part of the asset that is derecognised and the part that continues to be recognised. If there is no servicing fee specified or the fee to be received is not expected to compensate the entity adequately for performing the servicing, a liability for the servicing obligation is recognised at fair value.

*International Financial Reporting Standards (IFRS) adjustment process involves reviewing the company's financial statements and identifying any differences between the company's current accounting practices and the requirements of the IFRS. If there are any such differences, neural network makes adjustments to financial statements to bring them into compliance with the IFRS.

Conclusions

Delek Logistics Partners L.P. Common Units representing Limited Partner Interests is assigned short-term Ba1 & long-term Ba1 estimated rating. Delek Logistics Partners L.P. Common Units representing Limited Partner Interests prediction model is evaluated with Modular Neural Network (Social Media Sentiment Analysis) and Lasso Regression1,2,3,4 and it is concluded that the DKL stock is predictable in the short/long term. According to price forecasts for 1 Year period, the dominant strategy among neural network is: Sell

DKL Delek Logistics Partners L.P. Common Units representing Limited Partner Interests Financial Analysis*

| Rating | Short-Term | Long-Term Senior |

|---|---|---|

| Outlook* | Ba1 | Ba1 |

| Income Statement | B3 | B1 |

| Balance Sheet | C | Caa2 |

| Leverage Ratios | Ba3 | C |

| Cash Flow | B2 | Ba3 |

| Rates of Return and Profitability | B2 | Baa2 |

*Financial analysis is the process of evaluating a company's financial performance and position by neural network. It involves reviewing the company's financial statements, including the balance sheet, income statement, and cash flow statement, as well as other financial reports and documents.

How does neural network examine financial reports and understand financial state of the company?

Prediction Confidence Score

References

- Mullainathan S, Spiess J. 2017. Machine learning: an applied econometric approach. J. Econ. Perspect. 31:87–106

- Breusch, T. S. (1978), "Testing for autocorrelation in dynamic linear models," Australian Economic Papers, 17, 334–355.

- Byron, R. P. O. Ashenfelter (1995), "Predicting the quality of an unborn grange," Economic Record, 71, 40–53.

- Firth JR. 1957. A synopsis of linguistic theory 1930–1955. In Studies in Linguistic Analysis (Special Volume of the Philological Society), ed. JR Firth, pp. 1–32. Oxford, UK: Blackwell

- A. K. Agogino and K. Tumer. Analyzing and visualizing multiagent rewards in dynamic and stochastic environments. Journal of Autonomous Agents and Multi-Agent Systems, 17(2):320–338, 2008

- Andrews, D. W. K. (1993), "Tests for parameter instability and structural change with unknown change point," Econometrica, 61, 821–856.

- Çetinkaya, A., Zhang, Y.Z., Hao, Y.M. and Ma, X.Y., How do you decide buy or sell a stock?(SAIC Stock Forecast). AC Investment Research Journal, 101(3).

Frequently Asked Questions

Q: What is the prediction methodology for DKL stock?A: DKL stock prediction methodology: We evaluate the prediction models Modular Neural Network (Social Media Sentiment Analysis) and Lasso Regression

Q: Is DKL stock a buy or sell?

A: The dominant strategy among neural network is to Sell DKL Stock.

Q: Is Delek Logistics Partners L.P. Common Units representing Limited Partner Interests stock a good investment?

A: The consensus rating for Delek Logistics Partners L.P. Common Units representing Limited Partner Interests is Sell and is assigned short-term Ba1 & long-term Ba1 estimated rating.

Q: What is the consensus rating of DKL stock?

A: The consensus rating for DKL is Sell.

Q: What is the prediction period for DKL stock?

A: The prediction period for DKL is 1 Year